Tariffs Can Be Deflationary

Tariffs are generally assumed to have an inflationary effect on the economy. I imagine that’s true in most cases, say a developing country with a newly elected populist government. But is it always true?

In my (still underrated) book on the Great Depression, I explained how the Smoot-Hawley tariff had a deflationary impact on the US economy. Stock and commodity prices fell sharply in April-June 1930, as the bill moved toward passage. The biggest stock market crash of 1930 occurred right after Hoover announced that he would sign the bill.

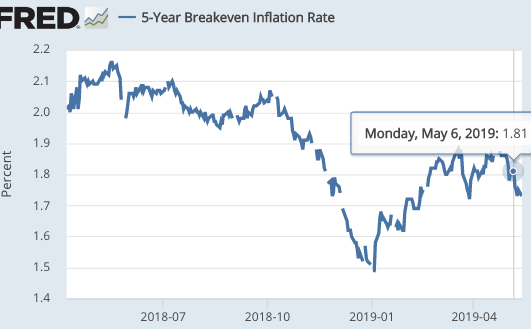

The same appears to be true of the recent trade war with China, which triggered a narrowing of the 5-year TIPS spread, down .08% to 1.73%:

In both 1930 and today, the Fed could have prevented a contractionary impact by an aggressive easing of policy. But in both cases, they were reluctant to ease too rapidly, as that would make their previous rate increases look mistaken. (I’ve discussed this problem in previous posts, which is why I prefer daily rate adjustments, to the nearest basis point.)

I suppose that one could also point to the Fed being reluctant to look like they were being bullied by Trump, although that’s highly speculative.

The Fed funds futures now show one rate cut by year-end, and another by mid-2020. That does not mean that money is currently too tight, as rates should move up and down with changes in economic growth. A better argument for money being too tight is that the newest Philly Fed forecast for 2020 inflation has dropped to 1.9%, and I suspect even that’s a bit too high, as market indicators suggest even lower inflation.

That doesn’t mean that everything is gloom and doom; the economy will probably do fine if inflation runs at 1.7% over the next 5 years. But if the Fed is going to have a 2% inflation target, it is better than they actually hit their target—if only to put them further from the zero bound.

Trump is arguing that the Fed needs to cut rates because of the trade war with China. Is Trump correct? The 5-year TIPS spread suggests that a rate cut would indeed be appropriate. But given my severe case of TDS, I’m reluctant to give him any credit. I hope readers won’t be offended if I point out that his argument makes no sense. Trump insists tariffs have an expansionary impact on the US economy. If that actually were the case (it isn’t), then Trump would be wrong in arguing that the trade war provides a rationale for the Fed to cut rates.

Trump is probably of two minds. His primitive understanding of trade theory leads him to view tariffs as expansionary, whereas the strongly negative view of stock investors toward tariff news triggers fear in the reptilian part of his brain. (And really, is there any other part?) And that fear leads him to call for the Fed to assist him in the trade war.

PS. Slightly off topic, but this David Beckworth tweet gets to the heart of the problem with monetary policy:

Here is my real critique: the Fed can get all the new tools in the world–neg rates, yield curve control, auto QE, etc.–but with a low inflation target regime they probably won’t matter much. IMHO, the past decade has shown us it is the monetary regime not the tools that is key.

I worry that the profession is focused too heavily on technical gimmicks, and is missing the bigger picture.

Trump so believes that tariffs are expansionary. But as this author nails it, POTUS fears that maybe it is not so expansionary and seeks the aid of the Fed. Perhaps the Fed will first show Trump that tariffs will not expand the economy before acting.