Sustainable Finance: Paint It Green

![]()

Green is the colour! We expect sustainable finance issuance to grow in 2025, with fast-approaching interim decarbonisation targets and continuous standardisation driving global growth. This is despite headwinds from the changing political landscape.

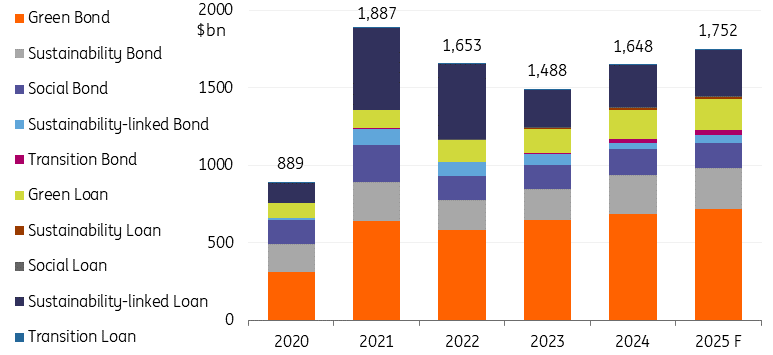

Growth in 2025 but still lower than 2021 levels

Sustainable finance issuance certainly saw some growth in 2024, with global issuance reaching US$1.657tr. This matches the volumes of 2022 and is an increase on 2023’s US$1.488tr. This was mostly driven by the record-breaking 1Q issuance and very decent 3Q issuance, despite slightly lower 2Q and 4Q levels. We expect sustainable issuance will continue on this growth path in 2025, likely ending the year above the 2024 levels but below the significant levels seen in 2021.

Global sustainable finance issuance per year

Source: ING, BNEF

Lots of paint - but be wary of paint peeler

Multiple drivers will sustain issuance volumes in 2025. Climate mitigation remains a primary focus, and the countdown to 2030 decarbonisation targets will drive investments in clean energy.

That said, companies are broadening their focus from climate mitigation to climate adaptation, as more frequent natural disasters weigh on business resiliency, and this shift could become more popular within sustainable finance. Moreover, sustainable issuance will continue to attract ESG-focused investors, potentially giving issuers access to more capital.

Finally, improved regulation and standardisation, as well as a bit more comfort regarding the ambition of sustainable targets, will also assist in issuance growth. The new European Green Bond Standard will likely act as a catalyst for more issuance.

At the same time, we see some headwinds too, namely the changing political nature in the US and less so in Europe. The policy environment under the current Trump administration is making companies cautious and could put a slight dampener on issuance volumes. Nevertheless, project-based green financing can still maintain positive momentum. Many states, local agencies, corporates, and financial institutions have their own sustainable targets that they will likely stick to, thus the effect is not expected to be too drastic.

In contrast, much of Asia, the UK and many EM segments are still very active and looking to grow their efforts in transition. Already in 2024, we have seen many transition bonds and loans coming out of Asia. Notably, transition debt issuance - not just within Asia but globally - was dominated by Japan because of its Climate Transition Bond Framework, and the country accounted for 86% of the total issuance in 2024. Transition debt can be a growth segment in the coming years in Asia, with issuances observed in China, Thailand, Vietnam, and South Korea last year. Nevertheless, absent a unified definition and framework, we see limited potential for transition debt issuance outside Asia.

Forecast breakdown of global sustainable finance issuance (US$)

Source: ING, BNEF

50 shades of green

Green bonds remain the largest portion of sustainable finance, with a record-breaking US$688bn in 2024. We expect this could reach US$700bn in 2025, for another record-breaking year.

Sustainability-linked loans accounted for a significant US$278bn of total issuance in 2024. This is still much lower than the significant levels seen in 2021 and 2022. While we continue to expect some growth in 2025, it is expected to fall short of those levels. Growth is driven by refinancing many deals closed in 2021/22, more interest across a broader range of geographies, and better ESG data available.

Sustainability-linked bond issuance was rather slow in 2024, coming in at only US$39bn, lower than even 2023. The SLB market could rebound slightly but we expect lower levels than in previous years.

Sustainability bonds and green loans both saw record-breaking levels in 2024 at US$252bn and US$192bn, respectively. Steady growth in these products is expected in 2025 driven by transition commitments (where products are not labelled transition debt).

More By This Author:

FX Daily: Refocus On Fiscal Proving Dollar SupportiveThe Commodities Feed: Mineral Deals And Tariffs

Rates Spark: The Glass Half Empty Trade

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more