Strategic Vs. Tactical: The Two Approaches To Portfolio Construction

Image Source: Pexels

A strategic portfolio is designed around an investor’s long-term goals—returns, risks, liquidity, time horizon, and taxes, for the most part. You would then mix your assets and the weight of those assets in your portfolio, based on your most important goals.

Here’s an example of a strategic portfolio’s asset allocation:

Cash = 10%

Bonds = 35%

Stocks = 45%

Commodities = 10%

By comparison, a tactical portfolio is simply taking your strategic allocation and adjusting it over a short period of time, according to market and economic factors, to maximize returns. By its nature, a tactical portfolio is not really a trading portfolio, but a nudge in the assets to take advantage of shorter-term changes—basically shifting percentages of the current holdings while keeping the original asset mix.

In a tactical portfolio, the asset mix and weights would change, depending on what you thought the economy or markets might do in the near future. For example, if you think a bull market is on the horizon, you may shift to a higher percentage of stocks. And if you thought small-cap stocks were on the rise (which looks to be the case currently), you may allocate a higher percentage to small-cap stocks.

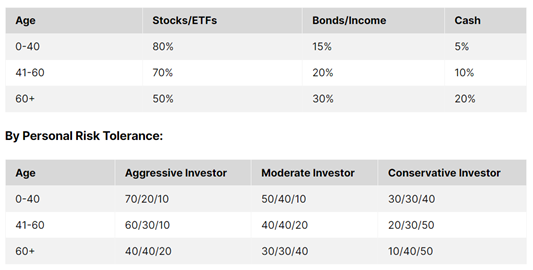

Source: Cabot Money Club

Most financial planners recommend that investors tailor their portfolios around their age and risk tolerance, such as the ones I included in my recent Cabot Stock of the Month newsletter shown above.

More By This Author:

Tech Stocks: Sharp Decline? Yes; Out Of The Ordinary? No

AFK: An Africa ETF To Consider As Money Shifts To "The Rest Of The Market"

Tech Stocks: Sharp Decline? Yes. Out Of The Ordinary? No.

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more