Store Credit Cards Hit 30% Interest Rates As Consumer Balances Rise

There has been a massive surge in credit card usage by US households, a troubling sign that could suggest that in lieu of disposable income, many consumers are forced to max out credit cards to survive the inflation storm.

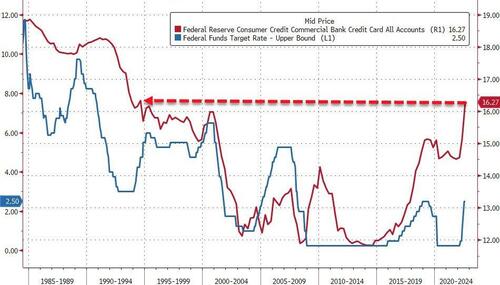

A major problem with inflation is that monthly balances keep rising as the cost of goods becomes more expensive, but the interest rates consumers pay on the debt are also rising because of the Federal Reserve's most aggressive tightening spree in a generation to quell inflation.

As consumer balance sheets become more saturated with credit card debt, it will become harder to pay off as rates rise. According to the Federal Reserve Bank of New York, the total US household debt swelled by $351 billion in the third quarter to $16.5 trillion. Credit card balances jumped 15%, the fastest annual rate in two decades.

(Click on image to enlarge)

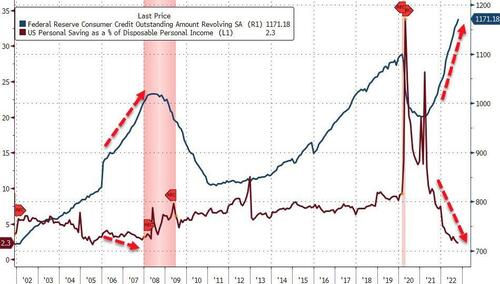

Households are taking on insurmountable credit card debts while rates are climbing -- as well as personal savings is collapsing.

(Click on image to enlarge)

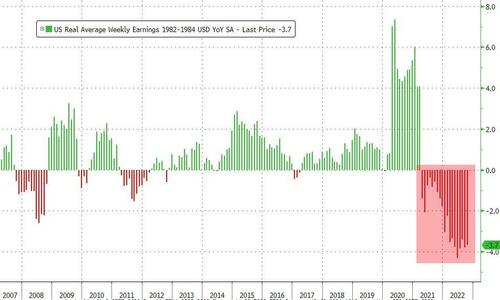

This couldn't come at the worst time for consumers who have endured 19 months of consecutive negative real wage growth.

(Click on image to enlarge)

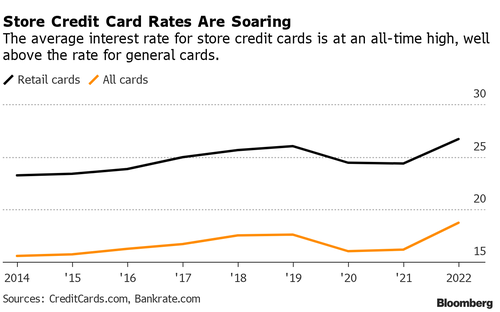

Bloomberg cited a new CreditCards.com report Thursday that outlined the average annual percentage rate for retailer-brand credit cards is now at a mindboggling record high of 26.72%, up from 24.35% in 2021. Meanwhile, the average APR for general-purpose cards is 22.66%.

(Click on image to enlarge)

In another report, store cards, including ones from Wayfair, Bloomingdale's, Macy's, Shell, Exxon Mobil, QVC, and the Home Shopping Network, with variable APRs, were reported to breach above 30% in some cases.

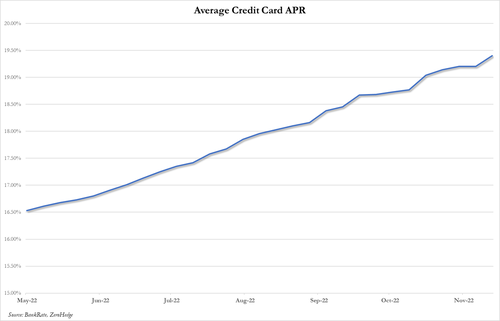

BankRate.com reports that the APR on the average US credit card just hot 19.40% - a new record high...

(Click on image to enlarge)

Matt Schulz, the chief credit analyst for LendingTree, was quoted by Bloomberg as saying some store cards that hit 30% were lowered soon after.

Consumers carrying hefty balances could see APRs rise through early next year but may top out around these levels as the Fed's hiking spree could hit a terminal rate of 5% before the summer of next year.

Depletion of savings by consumers and shifting to credit cards shows how many are quickly running out of lifelines.

Despite all of these pressures, delinquency rates remain low by historical standards but are rising, signaling if current conditions persist, then consumers could exhaust cash piles by mid-23, as per a warning via JPMorgan to clients.

More By This Author:

Microsoft Slides After FTC Blocks Activision Deal, Drags Market LowerFeds Probing Bankman-Fried's Manipulation Of Terra USD, Luna... Which Eventually Crushed FTX

China Confirms It Is "Mystery" Massive Gold Buyer With First Official Purchase In 3 Years

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more