Stocks Near Record Highs As Xi Hope And Powell Hype Trump Global Economic Collapse

We hate to be the bearer of bad news, as stocks near record highs, bond yields hit record lows, and global macro collapses to cycle lows...BUT...

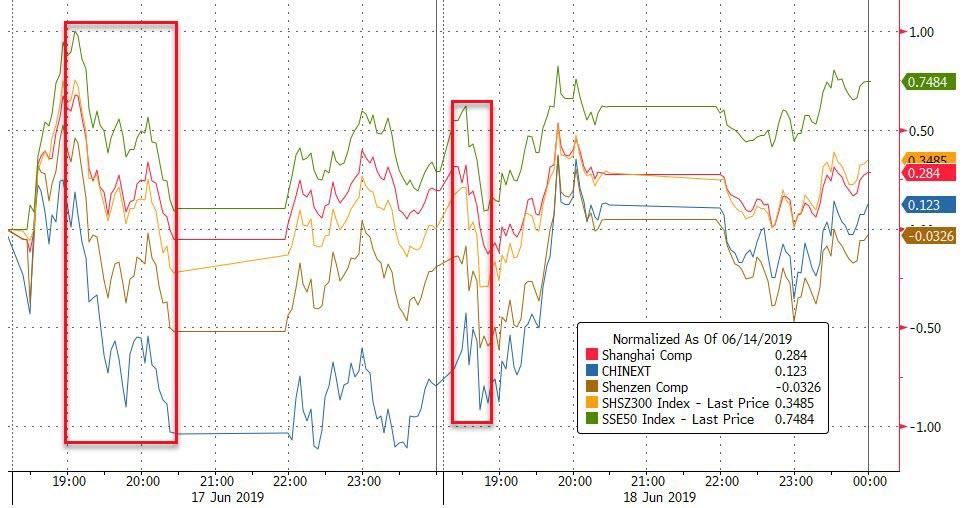

Chinese stocks missed out on today's fun (watch them catch up tonight) as they closed before Draghi rescued assets around the world and cornered Powell...

(Click on image to enlarge)

European stocks accelerated higher today after Draghi promised moarrrrr...

(Click on image to enlarge)

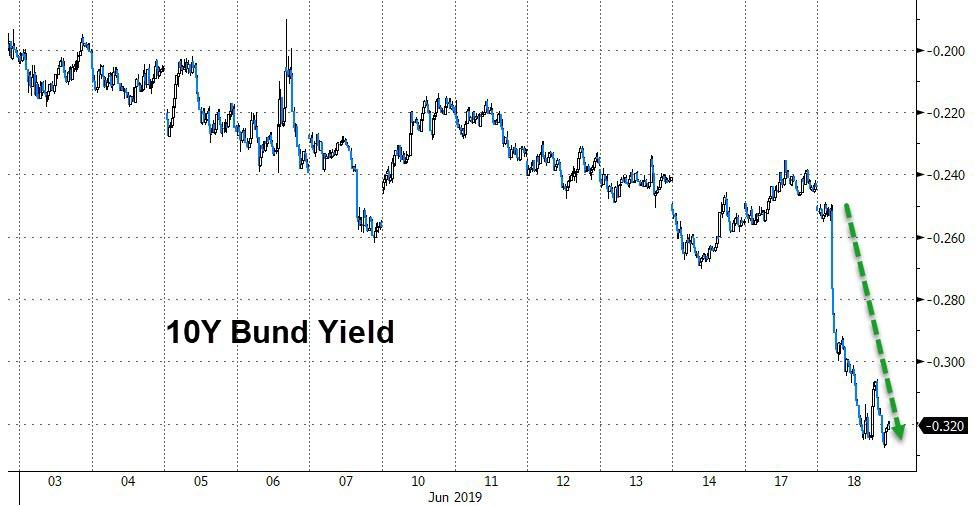

Sending Bund yields to new record lows...

(Click on image to enlarge)

And pushing yields on various European sovereign notes below 0 for the first time in history.

(Click on image to enlarge)

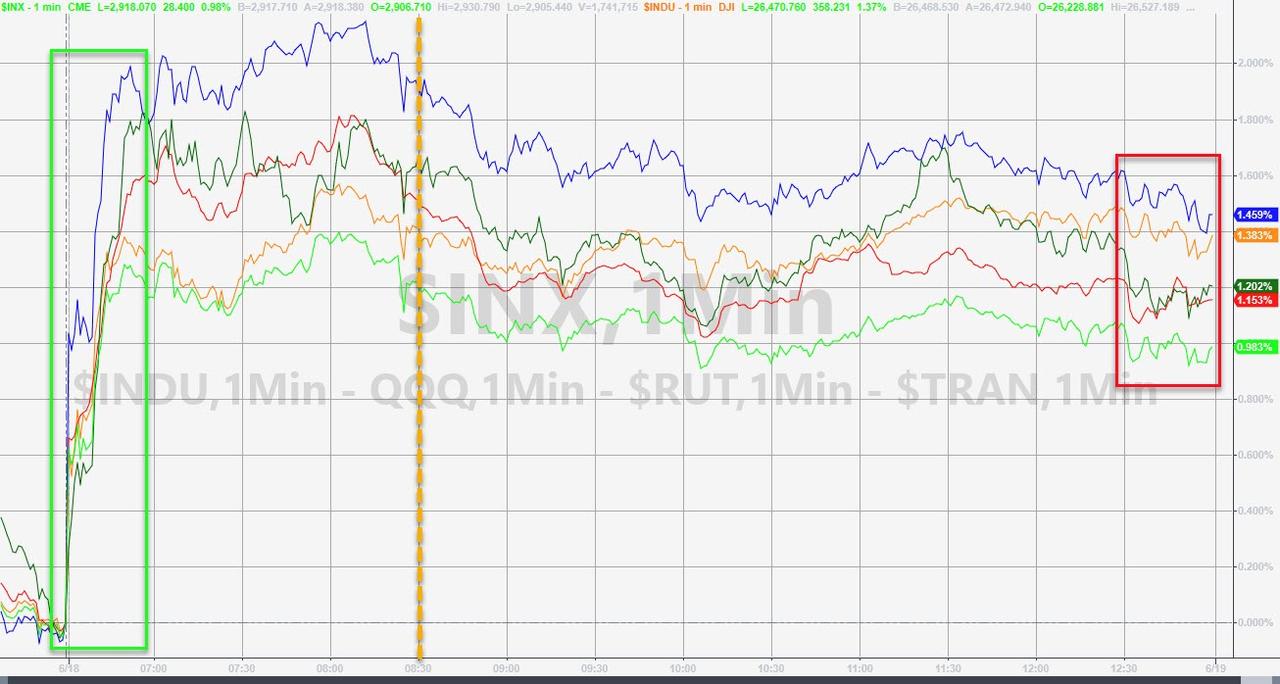

US equities surged in the pre-open on the Draghi and Trump-Xi comments...

(Click on image to enlarge)

But drifted lower after the European close with some weakness in the last 30 mins... Nasdaq was the best performer but the S&P 500 lagged...

(Click on image to enlarge)

Nevertheless, the S&P 500 is just 1.25% from its record highs, The Dow around 2% below its and Nasdaq around 3% below (with Small Caps and Trannies still down around 11% from their 52-week highs). China's Shanghai Composite is down around 12% from its 52-week highs.

BYND opened above $200, then plunged back into the red...

(Click on image to enlarge)

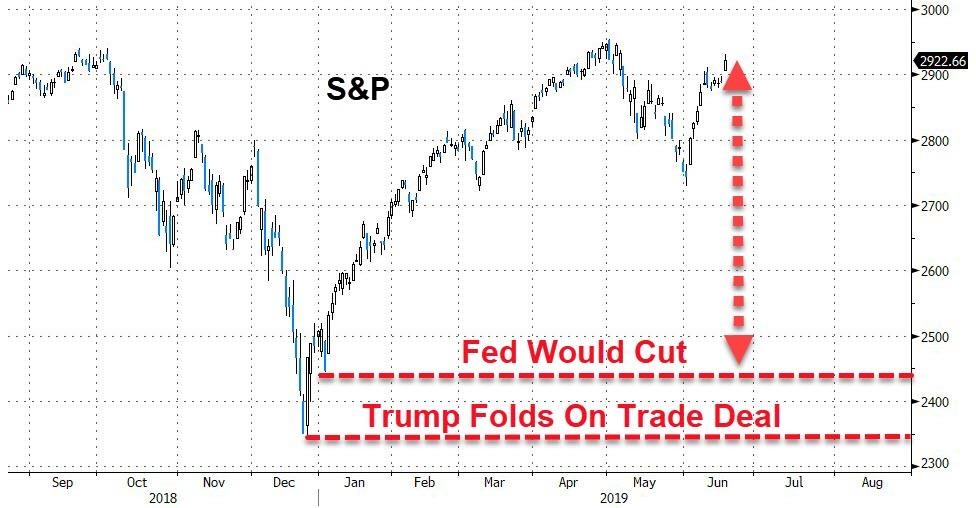

Notably, BofA's survey suggests market participants say that drop in the S&P to 2430 would prompt an immediate rate cut by The Fed and to 2350 would prompt Trump to do a trade deal no matter what...

(Click on image to enlarge)

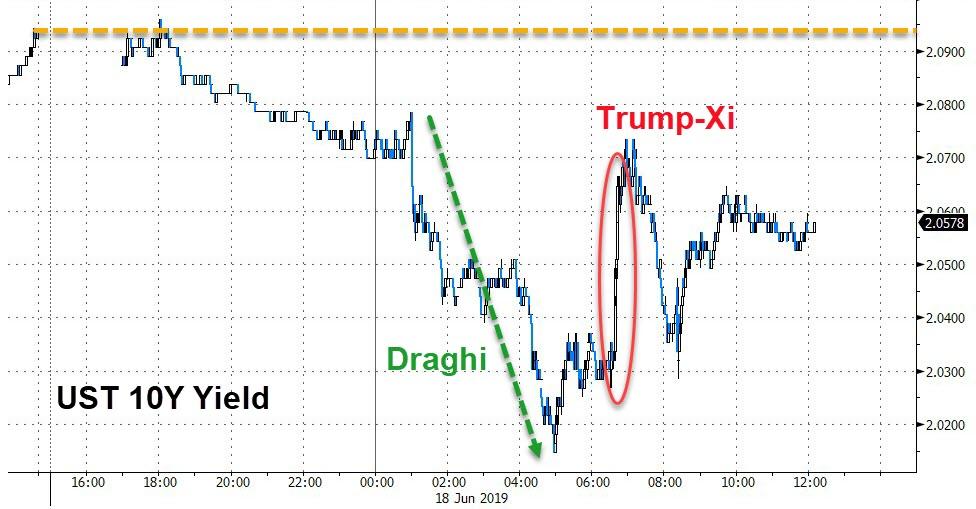

Treasury yields plunged on Draghi's comments and Trump's follow up, but as the day went on, rates recovered some of the drop (though the long-end notably outperformed)...

(Click on image to enlarge)

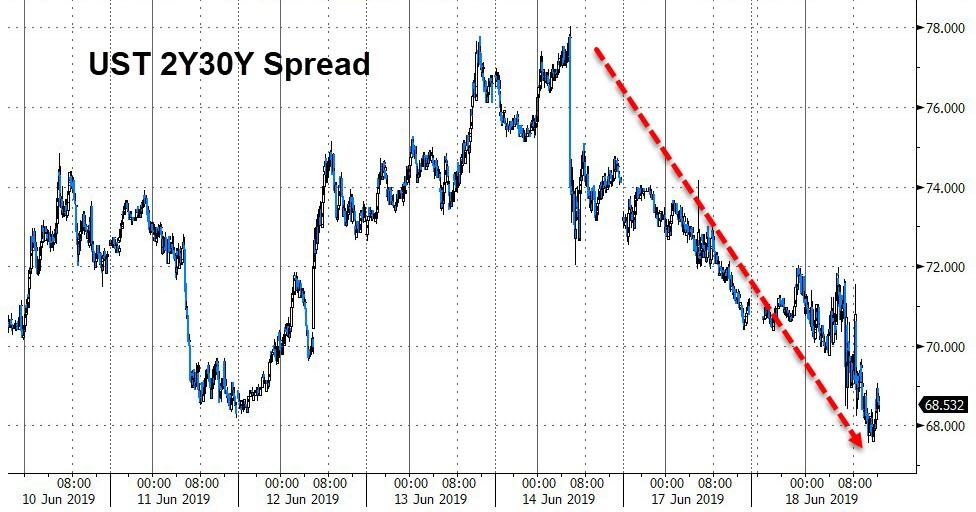

Dramatically flattening the yield curve...

(Click on image to enlarge)

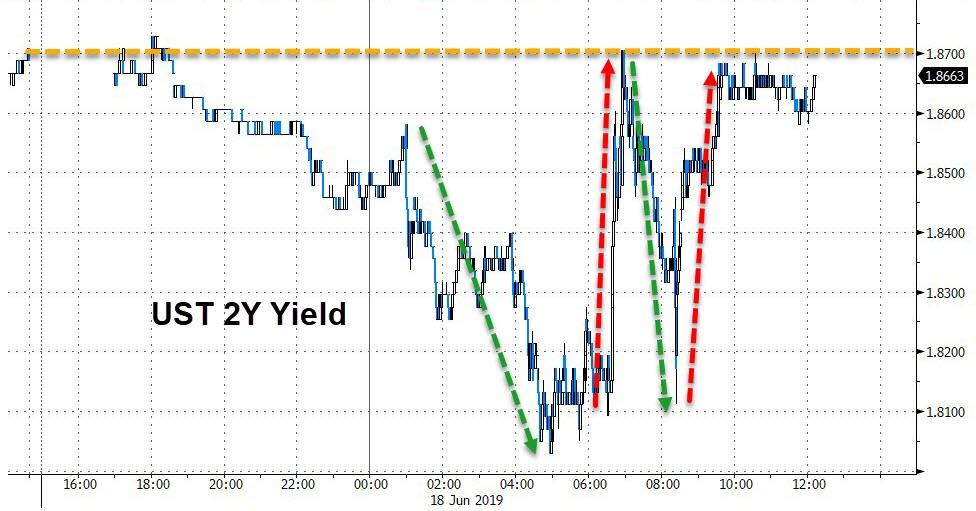

Bond yields were extremely volatile...

2Y roundtripped the entire plunge...

and 10Y traded like a penny stock after trading as low as 2.01%!!!

(Click on image to enlarge)

Breakevens continue to collapse...

(Click on image to enlarge)

European inflation forwards soared today - biggest spike since Feb 2012...

(Click on image to enlarge)

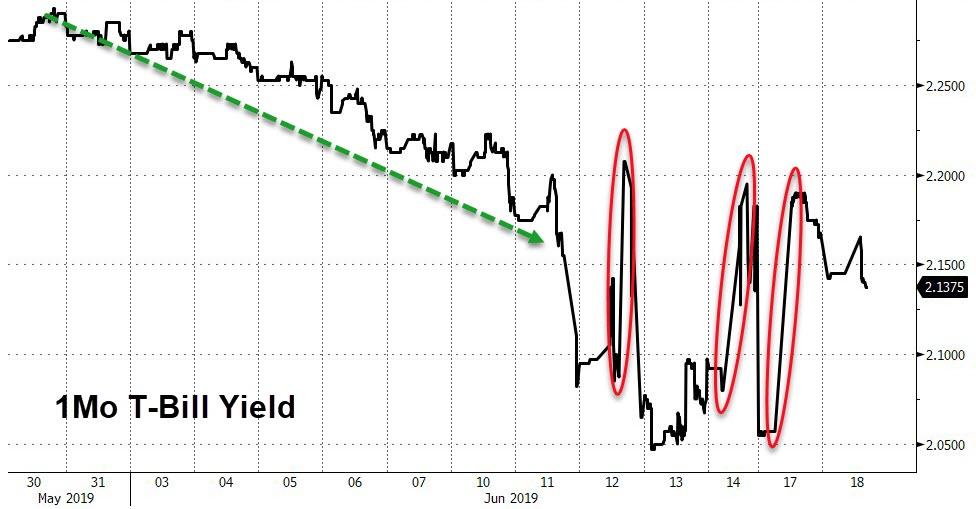

Short-dated Bills are extremely volatile - something or someone is in pain

(Click on image to enlarge)

Ahead of tomorrow's Fed statement, expectations for Fed rate cuts continue to be extremely dovish...

(Click on image to enlarge)

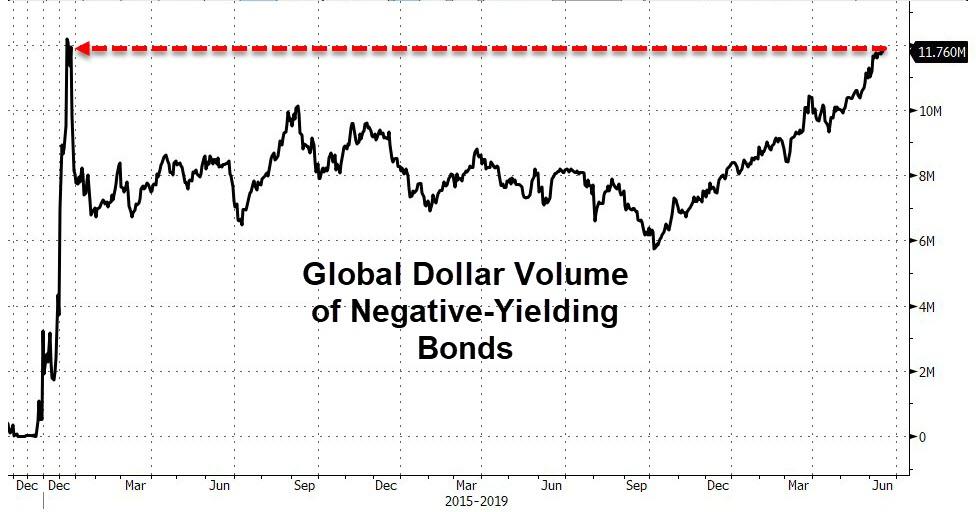

As the global negative debt pile is within inches of a record high...

(Click on image to enlarge)

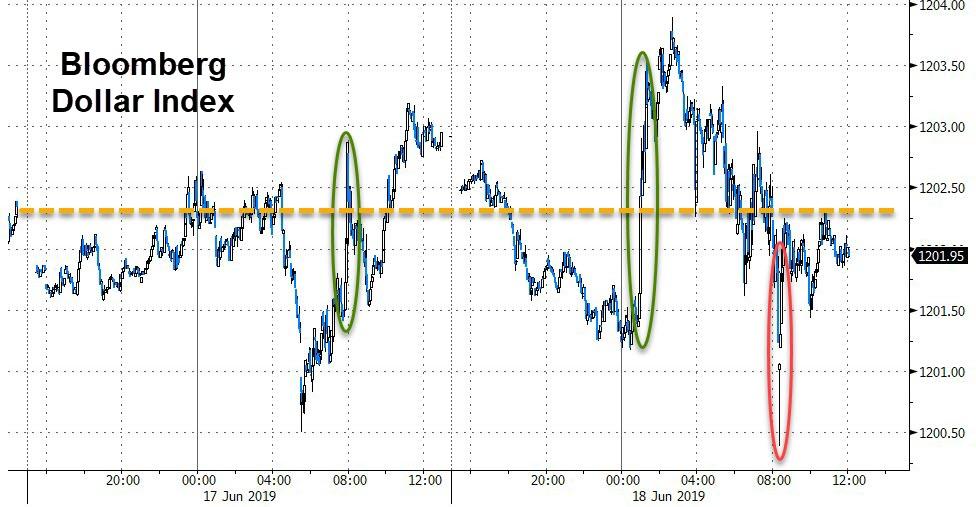

The Dollar spiked as Draghi's comments drove the euro lower but by the close, the dollar ended dovishly lower as Trump-Xi headlines hit...

(Click on image to enlarge)

EUR tumbled on the Draghi headlines...back below 1.1200...

(Click on image to enlarge)

Yuan spiked on the Trump-Xi call, hitting one-month highs against the dollar...

(Click on image to enlarge)

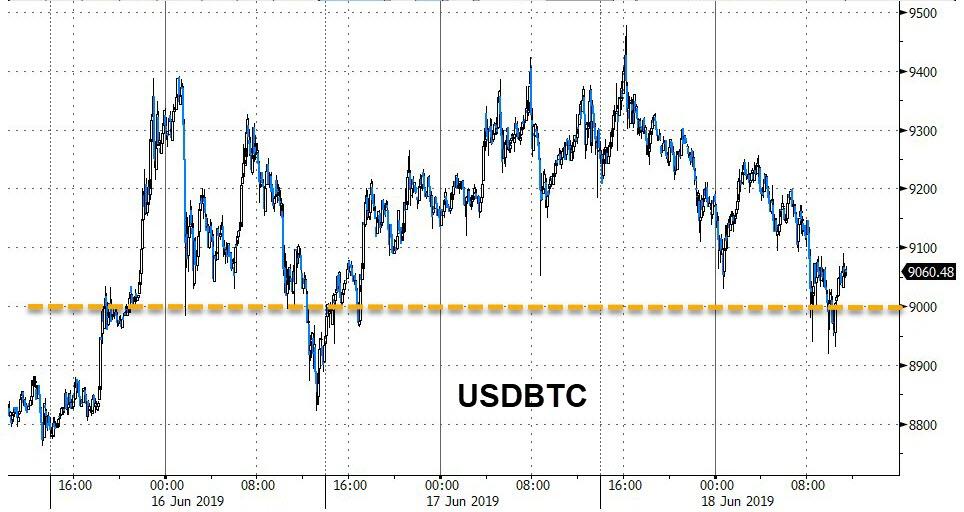

Cryptos slipped lower today, presumably as Facebook's Libra dominated headlines...Ripple was worst on the day

(Click on image to enlarge)

But Bitcoin held above $9000...

(Click on image to enlarge)

Commodities were all higher on the day, led by oil's gains...

(Click on image to enlarge)

Gold was slammed back below $1350 early on as the dollar spiked but rallied back into the green after Europe closed...

(Click on image to enlarge)

WTI soared today on the heels of China trade hopes...ripping off the $52 level once again.

(Click on image to enlarge)

Finally, we note that global macro data is double-dipping to cycle lows - and the longest period of negative surprises in history...

(Click on image to enlarge)

Who's right? Global Bonds, Global Stocks, or Global Macro?

(Click on image to enlarge)

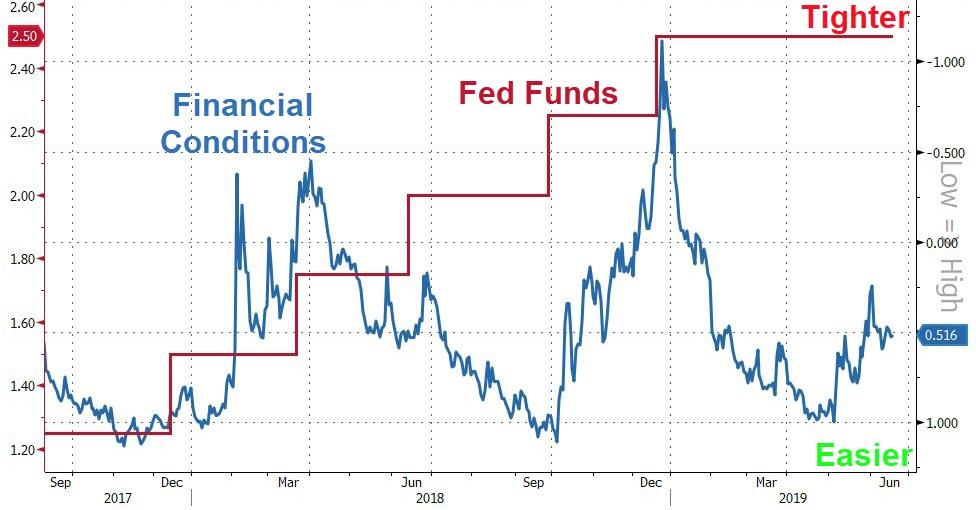

So, maybe The Fed should cut rates, right? Trouble is, the market already did, sending financial conditions to near record 'easy' levels...

(Click on image to enlarge)

Does The Fed really want to be easing with financial conditions already so easy? If you ask stocks, yep!!

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

moreComments

No Thumbs up yet!

No Thumbs up yet!