Stocks, Bonds, Gold, & Crypto Soar As Markets Call Fed's Bluff

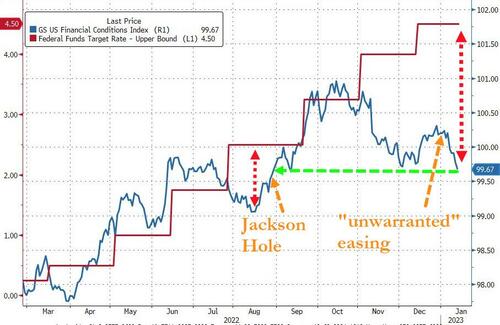

The world and his pet rabbit appear to believe that a 'soft landing' is imminent and 'peak inflation = peak Fed tightening' and so this week saw financial conditions loosen dramatically. This is very much not what Powell and his pals want to see, and specifically warned against "unwarranted easing" in the Fed's Minutes...

(Click on image to enlarge)

Source: Bloomberg

The last five days have seen one of the largest 'easings' in financial conditions on record.

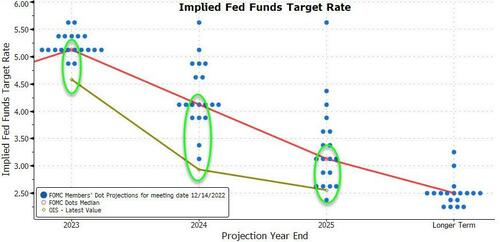

Simply put, the market is calling The Fed's bluff...

(Click on image to enlarge)

Source: Bloomberg

But, as Goldman's Chris Hussey noted, just like in Legoland, this 'Everything is awesome!' environment may still be riddled with risks.

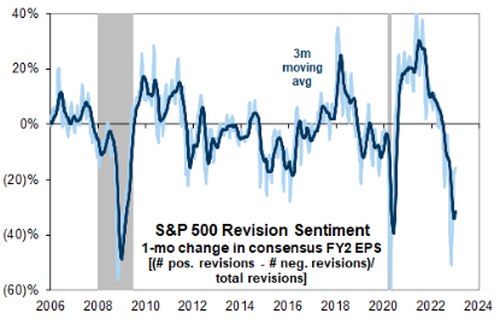

While stocks are pricing in a 'soft landing', Goldman's Jan Hatzius warns the biggest red flag: downward earnings revisions have been extreme and have only looked like this in past recessions (2000 and 2008). We are hesitant to look through this dependable market indicator and believe prudent portfolio managers should at least consider the implications if a hard landing transpires.

(Click on image to enlarge)

Additionally, Congress will need to raise the debt limit and renew government spending authority this year, but rule changes, the extremely thin margins of control in the House, and a divided Congress all raise the risk that the path is not smooth.

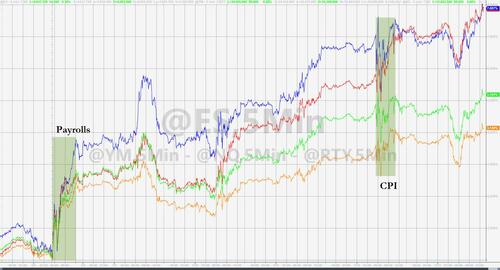

But hey, for now, it's all good... "Goldilocks" and all that shit... so BTFD!!! All the US Majors were higher on the week, extending the gains from Friday's payrolls print with Small Caps and Nasdaq leading the charge up 8% (S&P up over 5% and Dow up over 4%)...

(Click on image to enlarge)

The S&P 500 closed at 3999, just above its 200DMA. The Nasdaq closed a tick or two above its 100DMA...

(Click on image to enlarge)

The last six days have been one giant short-squeeze with 'most shorted' stocks up over 18% in an almost unbroken buying panic...

(Click on image to enlarge)

Source: Bloomberg

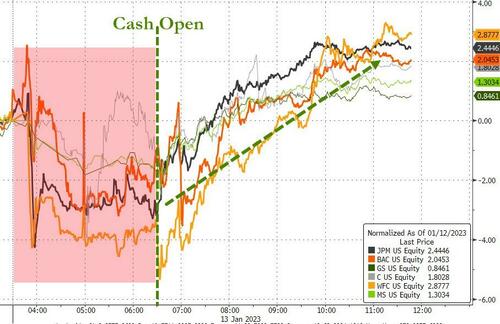

Banks stocks were all ugly in the pre-market after somewhat disappointing earnings, and most notably loss provisions, but as soon as the cash markets opened, they went bid and ramped into the green...

(Click on image to enlarge)

Source: Bloomberg

Wondering why we suddenly ripped this week... Fed reserve balances surged...

(Click on image to enlarge)

Source: Bloomberg

VIX has been clubbed like a baby seal since the start of the year, now at its lowest level since January 2022...

(Click on image to enlarge)

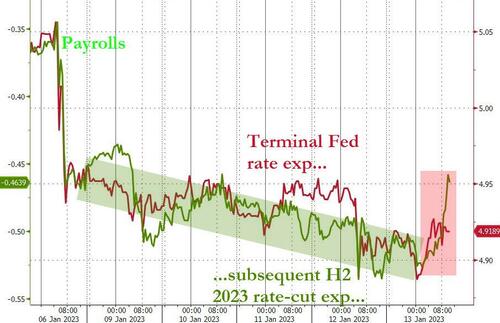

Bonds were bid this week, also extending their gains from the payrolls print last Friday, with the belly outperforming (5Y -31bps since before the jobs data). The long-end lagged the rest of the curve but yields were still down over 18bps since payrolls...

(Click on image to enlarge)

Source: Bloomberg

The yield curve (3m10Y) has done nothing but flatten (invert more deeply) since the start of the year as recession fears grow. This is - by far - the deepest inversion of this key recession indicator... ever...

(Click on image to enlarge)

Source: Bloomberg

But at the short-end, we note that while Fed rate trajectory expectations drifted dovishly most of the week, since the payrolls print sent them down hard, Friday saw a hawkish shift...

(Click on image to enlarge)

Source: Bloomberg

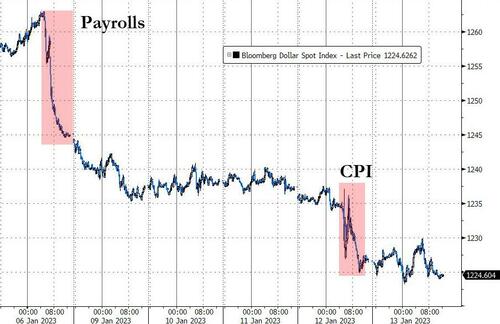

The dollar suffered its worst week in 2 months, falling to its weakest since June (and triggered a 'death cross'). The USD Index is down over 3% since the payrolls print last Friday...

(Click on image to enlarge)

Source: Bloomberg

Bitcoin is up 10 straight days (and 12 of last 13), topping $19,000 today (with its best run since Oct 2021)...

(Click on image to enlarge)

Source: Bloomberg

For some context, BTC is trading just below its 200DMA...

(Click on image to enlarge)

Source: Bloomberg

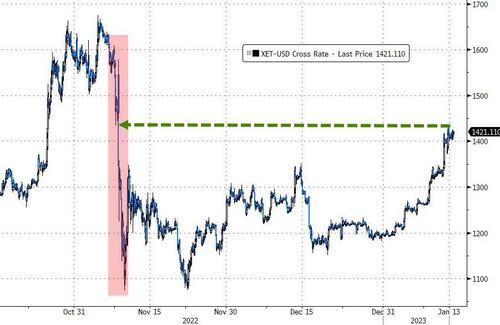

Ethereum also surged this week, topping $1400 for the first time since the FTX debacle collapse...

(Click on image to enlarge)

Source: Bloomberg

Gold surged above $1925 today (up six straight days, +5% since payrolls), now at its highest since April 2022...

(Click on image to enlarge)

Gold's gains triggered a 'Golden Cross' this week (50DMA crossed above the 200DMA)...

(Click on image to enlarge)

Source: Bloomberg

Oil prices are up for the 7th straight day, the longest streak of gains since Dec 2021, with WTI ending just shy of $80 (best week for WTI since Oct)...

(Click on image to enlarge)

Finally, bear in mind 2023's exuberant equity performance has been one big "dash for trash"...

(Click on image to enlarge)

Source: Nomura

So, is "everything" really "awesome" after all?

More By This Author:

Most Expensive And Cheapest Appliances To Use By RegionHow Europe Reduced Its Natural Gas Consumption

China Still Dominates The Rare Earth Market

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more