ZYNE: Nano-Cap Company That Is Focused On Treatments For Neuropsychiatric Disorders

TM Editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

This article looks at what Zynerba Pharmaceuticals, Inc. (ZYNE) is focused on, its clinical trial progress to date, its latest quarterly financials, and the investment risks associated with such an investment.

About Zynerba

ZYNE:

- has a market capitalization of $28M;

- is the leader in pharmaceutically-produced transdermal cannabinoid therapies for neuropsychiatric disorders such as Fragile X syndrome (FSX), 22q11.2 deletion syndrome (q22), and autism spectrum disorder (ASD);

- has put together an experienced management team with proven development and commercialization track records and extensive experience in transdermal delivery, orphan diseases, neurology, and psychiatry led by Armando Anido, Chairman and Chief Executive Officer, who has more than 30 years of executive, operational and commercial leadership experience in the biopharmaceutical industry.

About Fragile X Syndrome (FSX)

FSX:

- is a rare genetic developmental disability that is the leading known cause of both inherited intellectual disability and ASD;

- affects 1 in 3,600 - 4,000 males and 1 in 4,000 - 6,000 females;

- affects approximately 78,000 people in the U.S. and approximately 121,000 in the EU and U.K.;

- is the most common inherited intellectual disability in males and a significant cause of intellectual disability in females, and the leading genetic cause of ASD;

- results in a spectrum of intellectual disabilities and behavioral symptoms, such as: anxiety, aggression toward others, irritability, temper tantrums, shyness, and a preference for solitary activities; and

- has not received any regulatory approvals for treatment despite decades of preclinical research and interventional clinical trials.

About 22q11.2 Deletion Syndrome (22q)

DiGeorge syndrome, more accurately known by the broader term "22q11.2 deletion syndrome",

- is the second most common chromosomal disorder after Down syndrome;

- is caused by a small missing piece of the 22nd chromosome near the middle of the chromosome at a location designated q11.2;

- is estimated to occur in every 3,000 to 6,000 live births, suggesting that there are approximately 83,000 people with 22q in the U.S.;

- is linked to poorer adaptive behaviors for children such as self-care and communication skills that affect daily life; and

- has not received any regulatory approvals for treatment despite decades of preclinical research and interventional clinical trials.

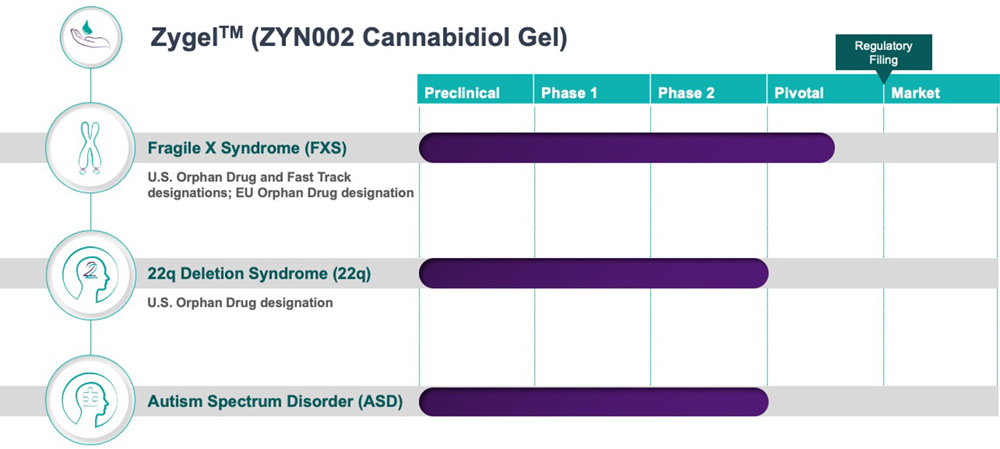

About Zygel

Zygel, also known as ZYN002:

- is a pharmaceutically-manufactured cannabidiol clear gel formulation designed to provide controlled delivery into the bloodstream through the skin for the potential treatment of behavioral symptoms associated with FXS, 22q and ASD;

- is designed to help regulate neuronal development and cognitive functions;

- has been issued a patent for the “Treatment of 22q11.2 Deletion Syndrome With Cannabidiol,” by the U.S. Patent and Trademark Office;

- has received orphan drug designation for cannabidiol, the active ingredient in Zygel, from the FDA and the European Commission for the treatment of FXS and by the FDA for the treatment of 22q; and

- has been designated a Fast Track development program for the treatment of behavioral symptoms of FXS.

Clinical Trials

A Phase 2 clinical study on the efficacy, safety, and impact of Zygel by administering the transdermal gel to children and adolescents with FSX and 22q and found that:

- 75% of patients showed clinically meaningful improvements at week 14 compared to the baseline;

- it was well tolerated; and

- its safety profile was consistent with previously released data from other Zygel clinical trials.

While the data from the Company’s ASD clinical development program had been progressing well, the Company has decided:

- to defer the start of the Phase 3 development program in ASD until the first half of 2024, and

- to prioritize its resources on FXS and 22q.

Clinical Pipeline & Expected Milestones

Plans For Future Growth

In 2023/24, Zynerba expects:

- to have concluded its confirmatory Pivotal Phase 3 trial results in the first half of 2024 for FXS and

- to finalize the regulatory pathway with the FDA in 2023 and then initiate Phase 3 soon after receipt of expected positive RECONNECT topline results enabling it to satisfy requirements for an NDA submission in the U.S. and a marketing authorization application in the EU.

By 2026, Zynerba intends:

- to launch Zygel for FXS into a $1.9B+ U.S. market opportunity,

- to establish a fully integrated organization with a U.S. commercial presence,

- to prepare for EU approval in FXS and

- to advance the 22q Ph3 program towards completion.

Beyond 2026, Zynerba plans:

- to launch Zygel in FXS via strategic partners in the EU elsewhere,

- to launch Zygel into the additional multi-billion dollar market of 22q,

- to optimize Zygel growth with additional synergistic indication and

- to accelerate further growth through complementary asset licensing and acquisition.

3Q 2022 Financial Results

The Company is still in the product research and development of novel compounds and, as such, has no products and has no revenue, and requires a great deal of money to fund its R&D expenses. For a detailed look at all the financial metrics related to Zynerba in the last quarter and for every year going back to 2018 go here.

Stock Price History and Forecast

Zynerba's stock price declined 80% in 2022 compared to the 70% decline experienced by the 6 major clinical-stage psychedelic stocks in the munKNEE Psychedelic Drug Stocks Index (see details here). Based on 3 analyst ratings (see here), however, the stock is forecast to jump by 2015% to $11.00 by the end of 2023 from its $0.52 close on February 17th, 2023.

Investment Risks

The company reports that its cash position of US$55 million is sufficient to advance the company through its key value-creating clinical milestones without the need to raise additional financing over the next 1.5 years. That being said, however,

- were Zynerba to experience a number of setbacks in its various research studies,

- that might cause investors to lose confidence in the eventual success of the company and such negative sentiment could negatively impact its stock price;

- were another company to develop a treatment for FXS, 22q or ASD before Zynerba,

- that would most likely negatively impact the stock price, as well and, even more so, if such a competitor were to take the treatment for one of those diseases to market; and

- were senior management to depart, especially the CEO,

- that might cause the company to lose focus which would slow down the progress of its research and development.

- that might cause the company to lose focus which would slow down the progress of its research and development.

Conclusions

Given the above review and extremely optimistic analyst stock price forecasts, Zynerba appears to be an excellent buy-and-hold investment consideration. In addition, were the Company to commercialize one of its products or be acquired by a major pharmaceutical company, that would likely cause its stock price to surge.

More By This Author:

Ammo Inc. Update: Company Split-Up Cancelled; Financials Should Improve In Q4

As Of This Week, Only One Cannabis Category Is Down (Slightly) YTD

12 Largest American Cannabis MSOs Now Up 4.3% YTD

Disclosure: The opinions stated here are my own and I was not compensated in any way for this article.

Visit more