Zoom Video Q3 Earnings: Can Shares Find New Life?

Image: Shutterstock

A handful of stocks massively benefited from the stay-at-home orders during the pandemic, going on unbelievable runs. Now that the party has come to an abrupt halt, many reside deep in the red in 2022. One of these companies was Zoom Video Communications (ZM - Free Report), which is slated to unveil Q3 earnings on Nov. 21, after the market close.

Zoom Video Communications’ cloud-native unified communications platform, which combines video, audio, phone, screen sharing, and chat functionalities, makes remote working and collaboration easy.

Currently, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a C. How does everything else shape up for the company? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, ZM shares have undergone adverse price action, down more than 50% and coming nowhere near the general market’s performance.

Image Source: Zacks Investment Research

Over the last month, however, the picture has visibly changed. ZM shares have tacked on roughly 7% in value, marginally outperforming the S&P 500.

Image Source: Zacks Investment Research

The company’s valuation multiples have fallen extensively in 2022; ZM’s current forward P/S ratio of 5.6X is a fraction of its 29.7X median since its IPO in 2019. ZM carries a Style Score of a C for Value.

Image Source: Zacks Investment Research

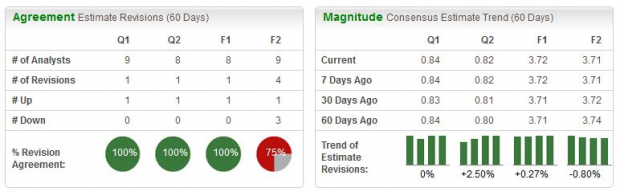

Quarterly Estimates

A singular analyst has upped their earnings outlook for the quarter to be reported over the last several months, with the Zacks Consensus EPS Estimate of $0.84 indicating a 24% year-over-year drop in quarterly earnings.

Image Source: Zacks Investment Research

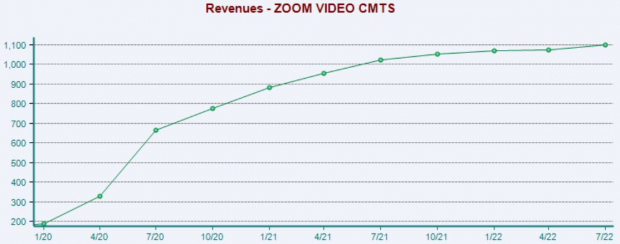

The company’s top-line is in better health; the Zacks Consensus Sales Estimate of $1.1 billion suggests an improvement of more than 4% year-over-year.

Quarterly Performance

ZM is on an impressive earnings streak, exceeding the Zacks Consensus EPS Estimate in 13 consecutive quarters. In its latest print, the company registered a 14% EPS beat.

Sales results have consistently been strong as well, with Zoom beating revenue estimates in 13 of its last 14 quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

ZM shares reside deep in the red year-to-date, but they have modestly outperformed the S&P 500 over the last month. The company’s forward price-to-sales ratio is well beneath its median since IPO, but it does remain on the higher end of the spectrum.

One analyst has upped their earnings outlook for the quarter to be reported, with estimates indicating a year-over-year decline in earnings but an uptick in revenue. ZM has consistently exceeded quarterly estimates, stringing together a long streak of positive EPS surprises.

Heading into the release, Zoom Video Communications (ZM - Free Report) carries a Zacks Rank #3 (Hold) paired with an Earnings ESP score of 0.3%.

More By This Author:

Dell Technologies To Post Q3 Earnings: What's In Store?Foot Locker Beats Q3 Earnings And Revenue Estimates

Zoom Video To Report Q3 Earnings: What's In Store?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more