ZIM Integrated Shipping Establishing A Niche Market

One of the first things that might draw in investors who are considering an investment in ZIM Integrated Shipping (ZIM) is its sky-high dividend yield. The company paid its recent massive dividend of $17 last week to push its current yield north of 20%. This follows previous quarterly dividend payouts of $2.50 and $2 in December and August 2021, respectively.

ZIM Integrated Shipping is based in Israel and has been in business for more than 75 years but has only traded publicly for just over a year. The company priced its IPO in late January 2021 at $15, below an expected $16 to $19 range. The company offered 14.5 million shares and raised $217.5 million in its debut.

ZIM is a global, asset-light container liner shipping company, and it happens to be flushed with cash from a booming industry. This explains why the recent dividend yield will likely remain high over the next couple of years.

The company is establishing leadership positions in the markets where it currently operates (Israel, Turkey, and Northern Europe) and is also signing new charter agreements on eco-friendly vessels to expand its services. The two recent deals they have signed so far this year are designed for routes between Asia and Africa.

Unlike traditional shipping companies, ZIM charters virtually its entire fleet. The company operates roughly 100 vessels, most of which are chartered with lease durations of one year or less. The risk here is that because the company does not own the majority of its fleet, high charter rates could imply higher leasing expenses going forward.

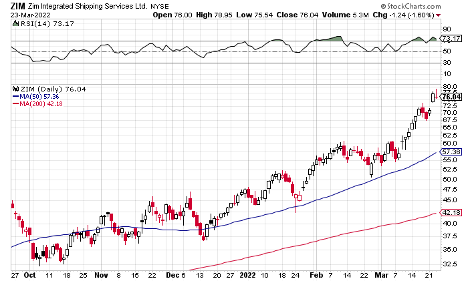

The chart shows shares have made a nice breakout above double-top resistance at $60 from earlier this month and are at an all-time high. Support is in the $72.50–$70 area.

(Click on image to enlarge)

High-yielding dividend stocks can be a red flag, but if record-high shipping rates remain in play, ZIM Integrated Shipping could continue to reward shareholders. The company has paid off most of its outstanding debt and continues to sign charters as it focuses on becoming a niche shipper.

Given the cash on hand and its dividend policy, investors could continue to see a dividend yield between 20%–30% from ZIM for the next couple of years.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more