Zigzag Structure In Russell Futures Nears Resolution Around 2300

Image Source: Unsplash

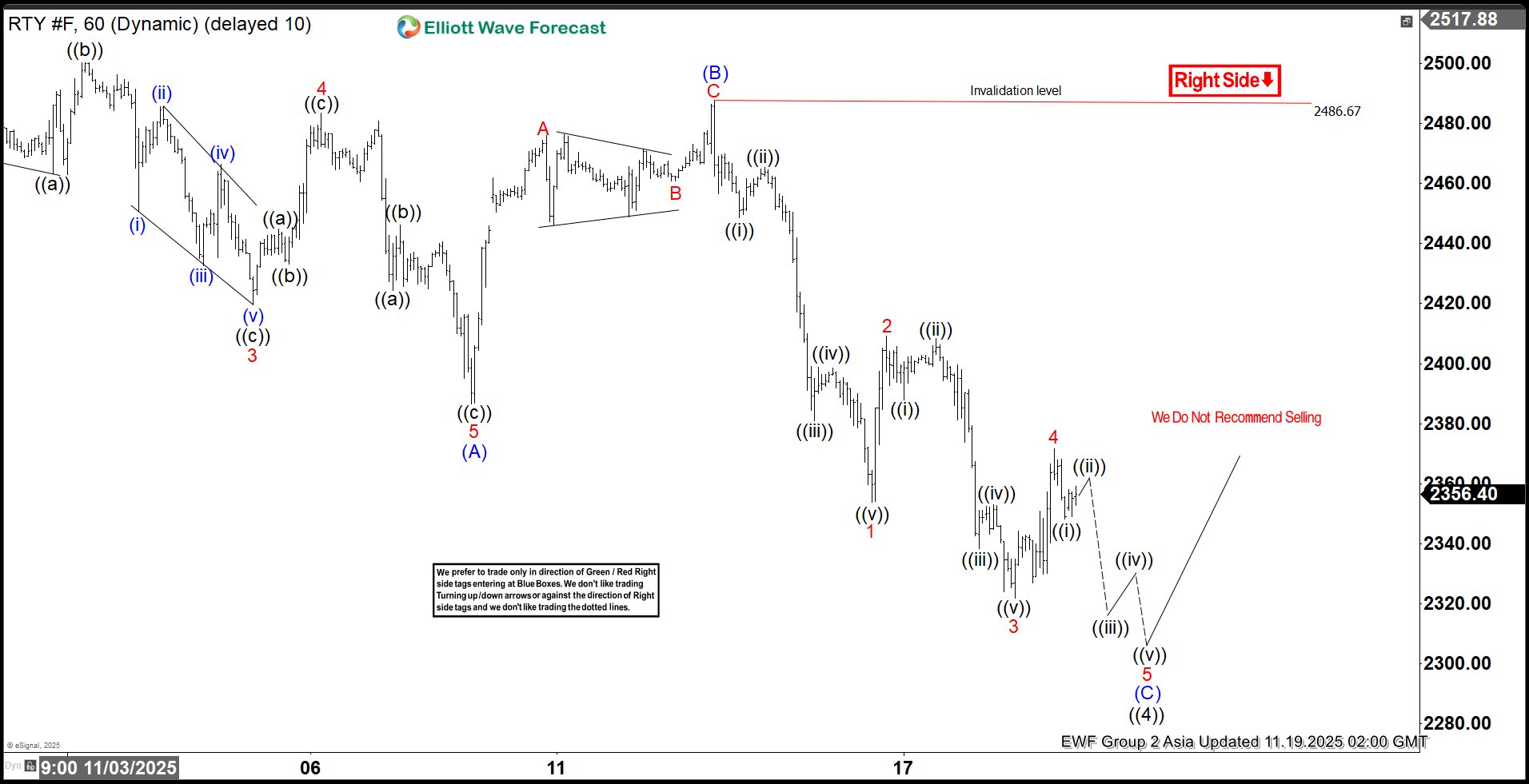

The short-term Elliott Wave outlook for the Russell 2000 Index (RTY) indicates that the decline from the October 25, 2025 peak is unfolding as a zigzag corrective structure. From that high, wave 1 concluded at 2473.9, followed by a corrective rally in wave 2 that terminated at 2517.2. The Index then extended lower in wave 3, reaching 2419.6. A brief recovery in wave 4 ended at 2483.4, while the final leg, wave 5, completed at 2386.6. This sequence marked the completion of wave (A) at a higher degree.

Subsequently, the Index corrected higher in wave (B), which concluded at 2486.67, as illustrated in the accompanying one-hour chart. From that point, the Index has resumed its descent in wave (C), which is unfolding internally as a five-wave diagonal. Within this structure, wave 1 ended at 2353.8, and the corrective rally in wave 2 peaked at 2409.1. Wave 3 then declined to 2321.9, followed by a modest rebound in wave 4 to 2371.6.

The Index is expected to extend lower in wave 5, thereby completing wave (C) of ((4)). The projected downside target lies within the 100%–161.8% Fibonacci extension range from the October 27 peak, spanning 2316.3 to 2307.4. In the near term, as long as the pivot high at 2486.6 remains intact, any rally is anticipated to fail in three, seven, or eleven swings, paving the way for further downside pressure.

Russell 2000 Futures (RTY) 60-Minute Elliott Wave Chart From 11.19.2025

RTY Elliott Wave Video

Video Length: 00:06:37

More By This Author:

Volatility Before Opportunity: AT&T Correction Sets Up RallyElliott Wave Analysis: Spot Silver Targeting Fresh All-Time Highs

Dow Futures Breaks Record : Five Waves Elliott Wave Impulse In Sight

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more