Yext Could Fall On Lockup Expiration

Summary

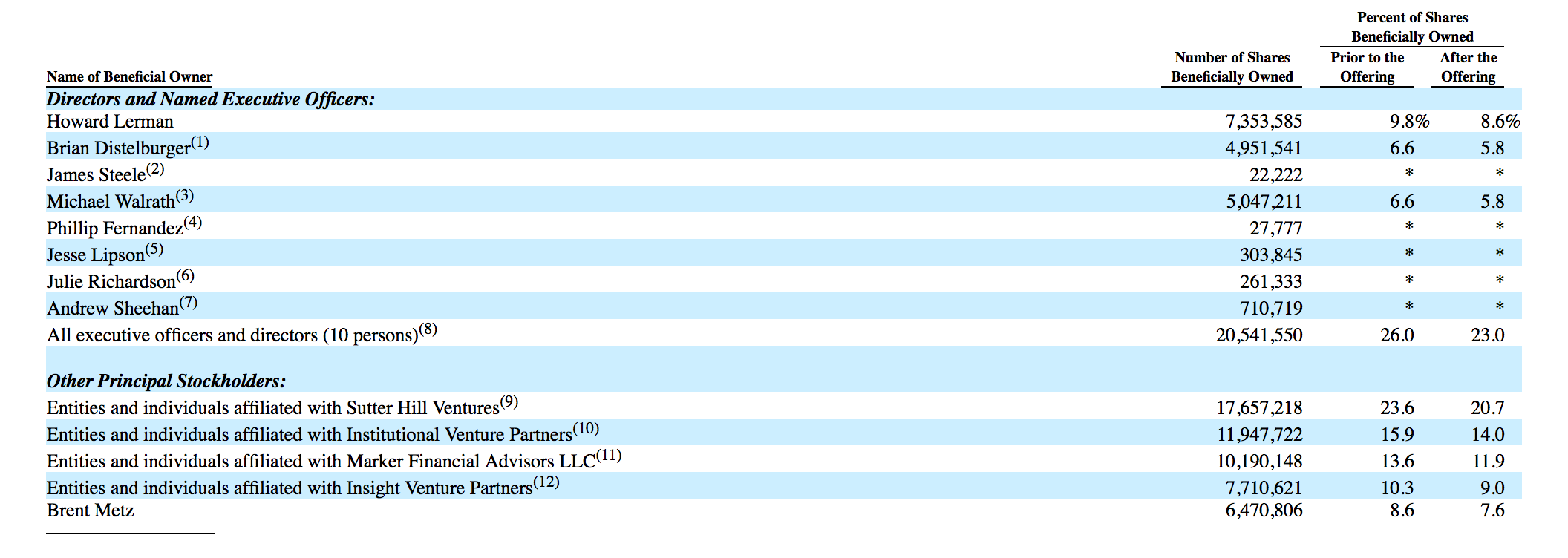

October 10, 2017, concludes the 180-day lockup period on Yext, Inc. (NYSE:YEXT). When the lockup period ends for Yext, the company’s pre-IPO shareholders, directors and executives will have the chance to sell their 74.15 million shares. The potential for a sudden increase in stock available in the open market may cause a significant decrease in the price of YEXT shares.

(Click on image to enlarge)

![]()

There are 10 individuals and four corporate entities that own a large number of restricted Yext shares. With less than 13% of total shares outstanding currently trading, if even a fraction of these individuals unload shares and take profits, investors could see a short-term dip.

(Click on image to enlarge)

Currently, Yext in the $13 to $13.50 range, above its IPO price of $11, and in the same range as its first day closing price of $13.41 on April 13, 2017.

Business Overview: Provider of Knowledge Engine Platform

Yext provides a proprietary knowledge engine platform that enables organizations to manage their digital data in the cloud. The company offers its solutions within North America and Europe. Their solutions include the Yext Knowledge Engine, which is a cloud-based global platform giving organizations the capability to control and manage their digital data and make it available through its PowerListings Network of close to 100 third-party apps, maps, social networks, vertical directories, digital assistants, intelligent GPS systems, and search engines. The company also offers its global Knowledge Engine that powers its listings, reviews, and pages features. Yext serves the technology, manufacturing, financial services, retail, pharmaceuticals, and healthcare industries.

The Yext platform produces intelligent searches, which are based upon digital data that integrates intent and context. For instance, searches that return with maps attached are increasingly popular, so when a user searches for a category such as Chinese restaurants or a specific brand such as Nike, the search will show maps showing locations of the search results. One of the highlights of the platform is the patented, proprietary Match & Lock process that ensures a client’s digital data is in sync across the PowerListings Network. It also enables clients to have control of their digital knowledge instead of third-party providers.

Financial Highlights

For the second quarter of fiscal 2018 ended July 31, Okta reported the following financial highlights:

-

Revenue was $40.8 million, a 38 percent increase versus $29.6 million for the same period last year. The company notes the increase was due primarily to the expansion of their client base and higher revenue from existing clients.

-

Gross profit was $30.2 million, a 48 percent increase versus $20.5 million for the same period last year. Gross margin was 74.1 percent compared to 69.3 percent over last year.

-

Net loss was $16.4 million, up from $9.0 million for the same period last year. The company notes this is due primarily from increased operating expenses and costs to acquire new customers.

Yext announced expectations for the full fiscal year of 2018:

-

Revenue is projected to be $169.5 million to $170.5 million, an increase from the company’s previous expectation of $169.0 million to $170.0 million.

-

Non-GAAP net loss per share is projected to be $0.50 to $0.52, which assumes 90.5 million non-GAAP common shares outstanding.

Management Team

Co-founder and CEO Howard Lerman is a five-time entrepreneur. His previous ventures include Felix and Confide. Mr. Lerman is a graduate of Thomas Jefferson High School for Science and Technology and holds a B.A. in History from Duke University.

President and Chief Revenue Officer James Steele has been in his position since January 2017. His previous experience comes from InsideSales.com, salesforce.com, Ariba, and IBM. Mr. Steele holds B.S. in Civil Engineering from Bucknell University.

Competition: Oracle, Microsoft, VMWare

Because this technology is relatively new, Yext faces competition primarily from providers of knowledge management in other forms, such as manual, paper, or spreadsheet-based systems. Morningstar lists the company’s peers as Microsoft (MSFT), Oracle (ORCL), VMware (VMW), Cielo, Citrix (CTXS), Wirecard, Worldplay, and others.

|

Market Cap (mil) |

Net Income (mil) |

P/B |

P/E |

|

|

Yext |

$1,168.0 |

($57.0) |

12.6 |

n/a |

|

Microsoft |

$581,051.0 |

$21,204.0 |

8.0 |

27.8 |

|

Oracle |

$200,473.0 |

$9,713.0 |

3.6 |

20.9 |

|

VMWare |

$44,853.0 |

$1,186.0 |

5.2 |

39.5 |

|

Industry Average |

$8,672.0 |

$237.0 |

5.8 |

27.1 |

Early Market Performance

Yext’s IPO priced at $11 per share, higher than its expected price range of $8 to $10. The stock closed on the first day of trading at $13.41. It reached a high of $14.84 on April 28 and a low of $12.29 on September 8. Currently, the stock trades between $13 and $13.50.

Conclusion: Sell or Short Shares

With the IPO lock-up for currently restricted shares quickly approaching, we recommend investors consider selling and shorting shares ahead of the October 10.

We anticipate that the company insiders will be eager to sell shares once restrictions are lifted, leading to a price dip surrounding the event.

When the 74.15 million currently restricted shares are eligible for trading, they could flood the marketplace.

Disclosure: I am/we are short YEXT.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more