Yeti Could Get Chilled By Lockup Expiration

April 23, 2019, concludes the 180-day lockup period of Yeti Holdings, Inc. (YETI).

When the lockup period expires for Yeti Holdings, the company's pre-IPO shareholders and insiders will be able to sell more than 60 million currently-restricted shares. With just 16 million shares trading pursuant to the IPO, there is a potential for the secondary market to be flooded by significant sales of currently-restricted securities when the lockup expires.

(Click on image to enlarge)

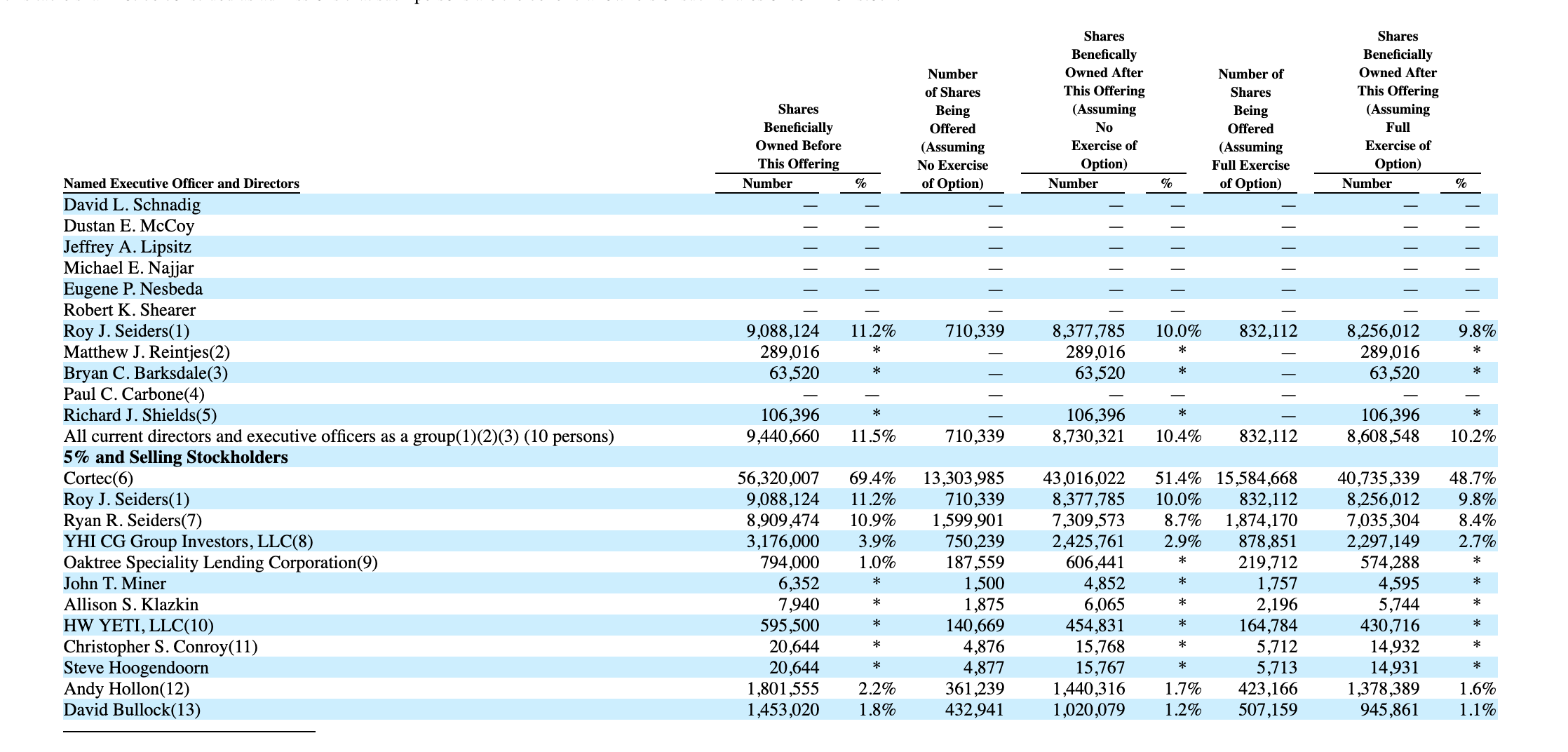

We expect that these pre-IPO shareholders and company insiders may be particularly interested in cashing in on some of their gains - YETI has a return from IPO of more than 75%. This group of pre-IPO shareholders and company insiders includes numerous directors and officers and twelve 5% shareholders.

(Click on image to enlarge)

Business Overview: Maker Of Outdoor Recreation Products

Yeti Holdings began as a maker of high-end coolers. The company now has an expanded product portfolio that includes branded hard and soft coolers, drinkware products, and outdoor living accessories. Yeti designs, makes and markets these products in the United States, Australia, Canada, and Japan under the Rambler and Yeti brands. Their products also include items such as dog bowls, shirts, and hats, sporting goods, hardware, and outdoor specialty items.

(Click on image to enlarge)

Yeti markets its products through a robust multi-channel strategy, which includes retailers, direct-to-consumer channels including YETI.com, Amazon Marketplace, and its flagship store based in Austin, Texas.

In its SEC filing, Yeti reported that net sales had leaped dramatically over the last several years, from $89.9 million in 2013 to an impressive $639.2 million in 2017. This is a compound annual growth rate of 63 percent. For the same four years, operating income grew at a CAGR of 43 percent, net income grew at a CAGR of 21 percent, adjusted operating income grew at a CAGR of 47 percent, adjusted net income grew at a CAGR of 30 percent, and adjusted EBITDA grew at a CAGR of 45 percent.

The company was founded by brothers Roy and Ryan Seiders in 2006. The Seiders are avid outdoorsmen who were determined to develop a sturdy ice chest. Currently, Yeti Holdings has approximately 565 employees and keeps its headquarters in Austin, Texas.

Company information sourced from the firm's S-1/A.

Financial Highlights

Yeti Holdings reported its fourth quarter financial highlights for the period ending December 31, 2018:

- Net sales grew to $241.2 million for an increase of 19 percent

- Gross margin grew to 53 percent for an increase of 690 basis points

- Net income grew to $25.2 million for an increase of 533 percent

- Adjusted net income increased to $32 million for an increase of 379 percent

- Adjusted EBITDA grew to $52.2 million for an increase of 58 percent

- Gross profit grew to $127.8 million for an increase of 37 percent

- Operating income grew to $37.6 million for an increase of 58 percent and 15.6 percent of net sales

Financial information sourced from the company's website.

Management

CEO and President Matthew Reintjes has served in his position since 2015. His previous experience comes from Vista Outdoor, ATK Sporting Group, Bushnell Outdoor Products, Hi-Tech Industrial Services, Danaher Corporation, and KaVo Equipment Group. Mr. Reintjes earned a Bachelor’s degree in economics from the University of Notre Dame and an MBA from the University of Virginia.

SVP and CFO Paul Carbone has served the company since June 2018. His previous experience comes from senior financial positions at Talbots, Dunkin’ Brands Group, Tween Brands, and Limited Brands. He holds a bachelor’s degree from the University of Massachusetts and an MBA from the University of Illinois.

Management information sourced from the company's website.

Competition: Coleman, Igloo, And Other Outdoor Gear Brands

Yeti faces competition from many makers of outdoor gear including Coleman, Igloo, Otterbox, Pelican, Columbia (COLM), Patagonia, North Face, MSR, Black Diamond, Hydro Flask, Marmot, and Mountain Hardware.

Early Market Performance

The underwriters priced the IPO at $18 per share. Its expected price range was originally $19 to $21. The stock closed its first day at $17 for a first-day return of -5.6%. The stock declined to reach a low of $12.51 on December 24. After that, the market performance improved. Shares climbed steadily to reach a high of $32.56 on March 27. Currently, shares trade around $31 to $32 for a return from IPO of 75.3%.

Conclusion

When the YETI IPO lockup expires on April 23rd, pre-IPO shareholders and company insiders will be able to sell more than 60 million previously-restricted shares for the first time. Any significant sales have the potential to flood the secondary market and cause a sharp, short-term downturn in share price.

Aggressive, risk-tolerant investors should consider shorting shares ahead of the April 23rd IPO lockup expiration. Interested investors should cover short positions during the April 24th trading session.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more

It will take many days to unload all the shares that they have based on the average daily volume.

And you can't get shares to short ahead of time, but after the 23rd they will be available. May is going to be bloody

Is it wrong that I like this company solely for their ticker symbol? :)

Go $YETI

For sure, creamed.