Worried About Rising Rates? Then Turn To These Stocks

Image Source: Unsplash

It’s something we’ve been talking about since last Sunday, when I warned you very specifically about it, together with a downside test this week. Remember how the game is played. Highly leveraged traders – a.k.a. the big money – borrow boatloads of moola to magnify returns.

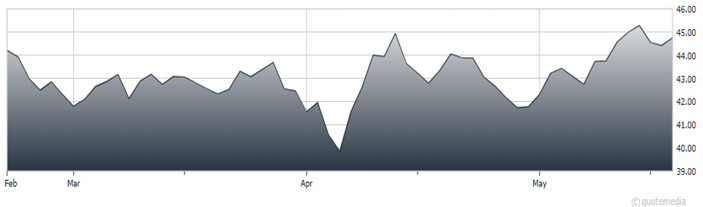

10-Year Treasury Note Index (^TNX)

When rates rise, the vigorish costs more, so they sell: A) To reduce the risk of institutional-size margin calls by reducing their VaR (Value at Risk), and B) Because every dollar they'd otherwise fork over in interest to pay for their leverage costs more while also becoming a performance drag. Both of those reduce bonus potential.

What to do? Funny you should ask. I recently sat down for a wide-ranging interview with my colleague, the fabulous Scott “The Cow Guy” Shellady. He wanted to know how and why the spike in Japanese government bonds would impact investors here.

It’s not something that’s widely talked about because most financial advisors, frankly, haven’t got a clue how international markets work. But they probably should, IMHO. This really IS a bigger deal than people think, which is why smart investors will pay attention.

My investing tip: Low-beta, high dividend stocks are going to be your best friend if there’s some volatility ahead, like I think might be the case. Hopefully, you’ve got your shopping list ready.

More By This Author:

DVS: A Silver Miner That Keeps Growing By AcquisitionInterest Rates: Budget Deficit, Borrowing Woes Worrying Bond Investors

Carnival Corp.: An Undervalued Consumer Play You Shouldn't Pass Up

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more