Wiz Dogs: Do You Buy?

It's that most wonderful time of the investing year. Pundits offer tidbit tips to tempt traders to their tallies. These tempting trades I call "WizDogs" because Wall St. wizards wrought them.

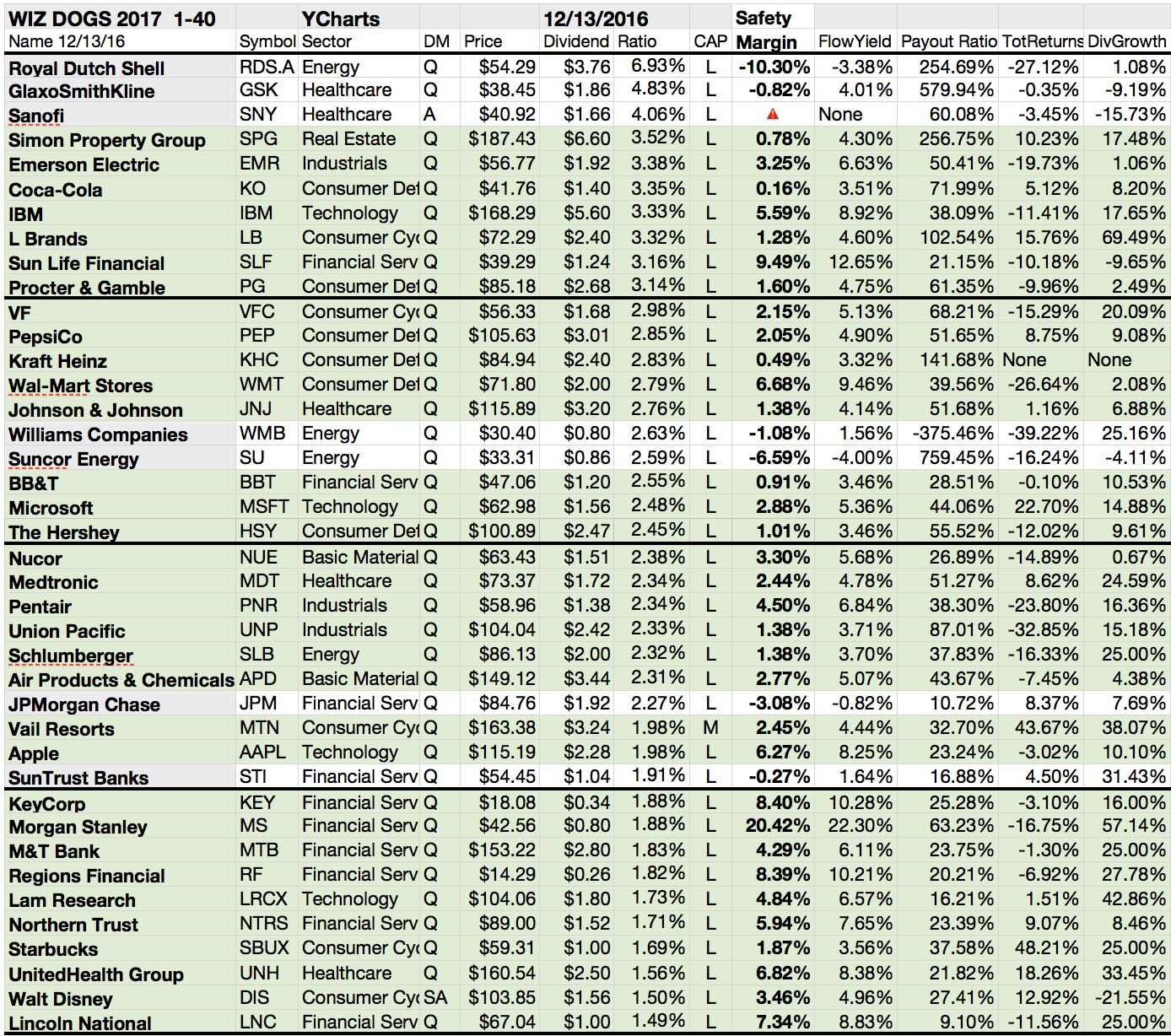

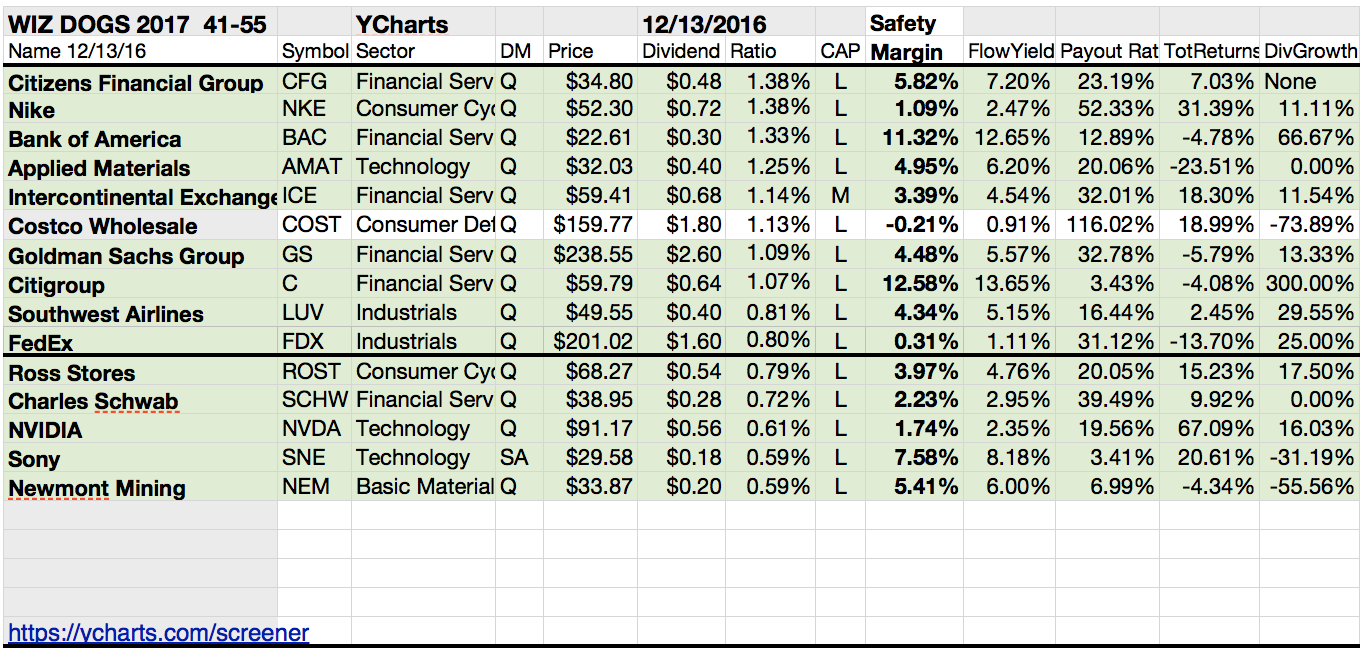

The Wiz list below reveals fifty-five of those pundit favorites.47 tinted greenish show "WizDogs" with free cash flow yield exceeding dividend yield (so their cash income margin covers anticipated dividends).

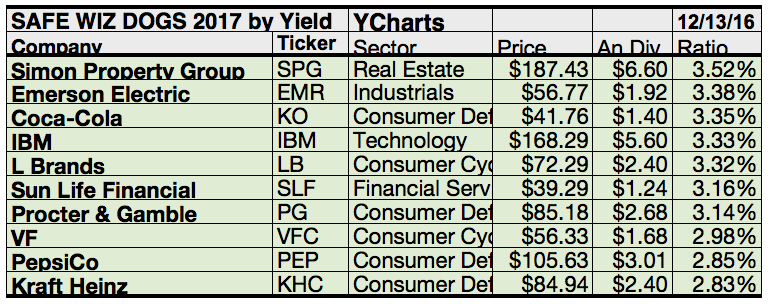

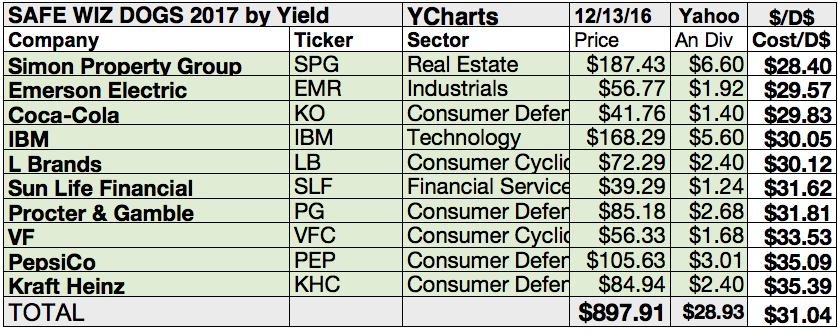

Top ten safe WizDogs, KHC, PEP, VFC, PG, SLF, LB, IBM, KO, EMR, & SPG dividend yields ranged 2.83%-3.52%. Cash yields ranged 3.32%-12.65%.

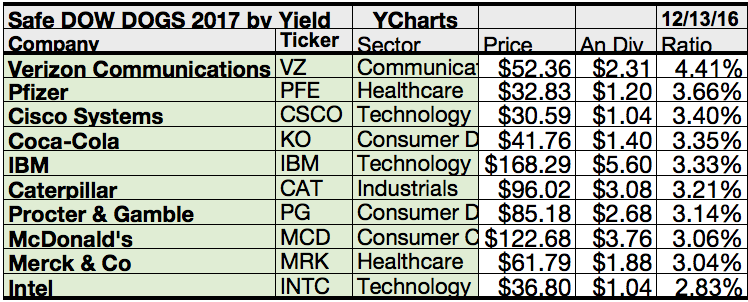

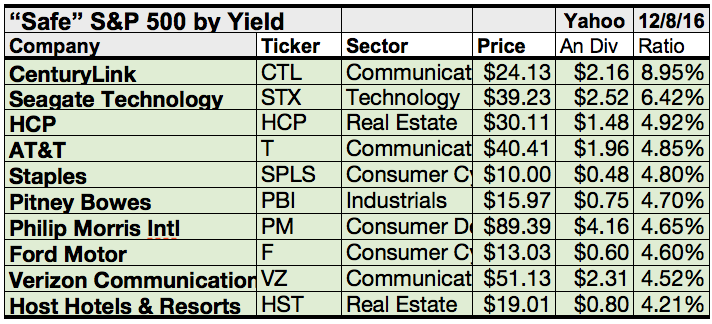

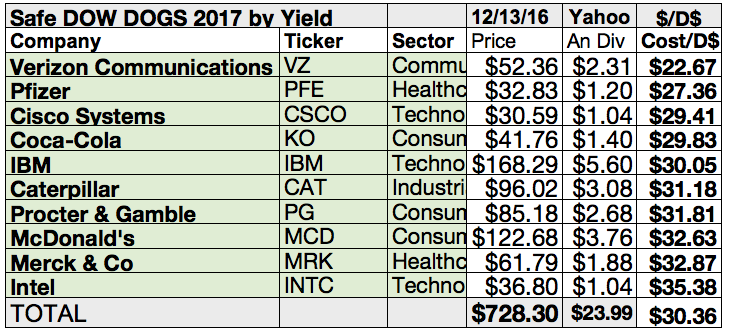

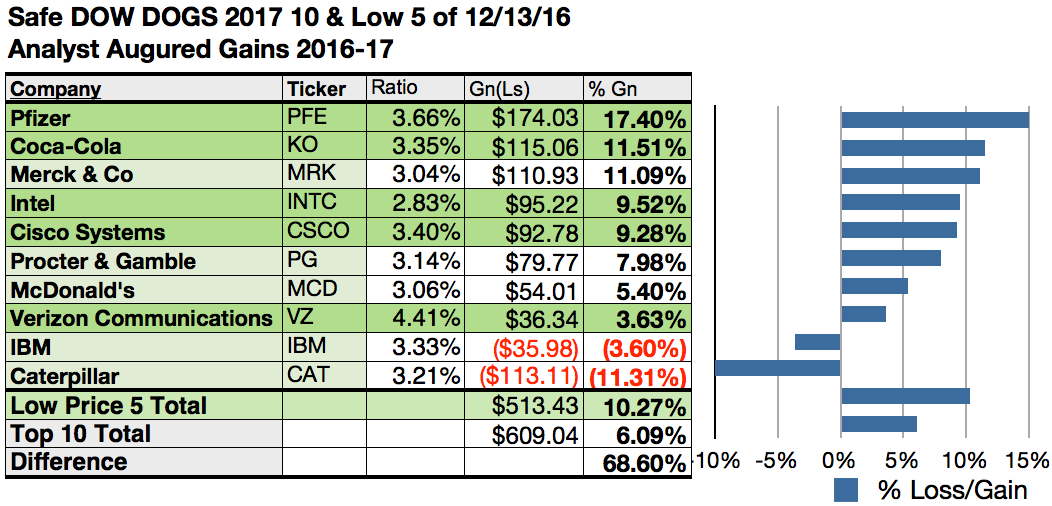

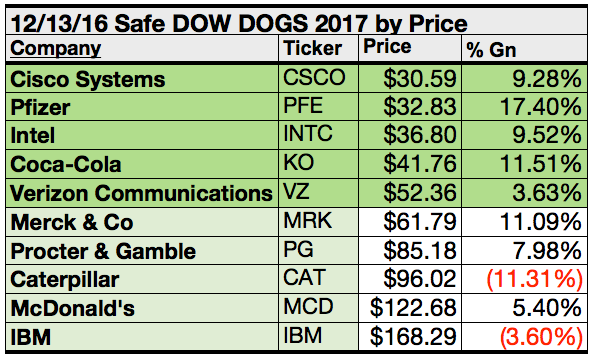

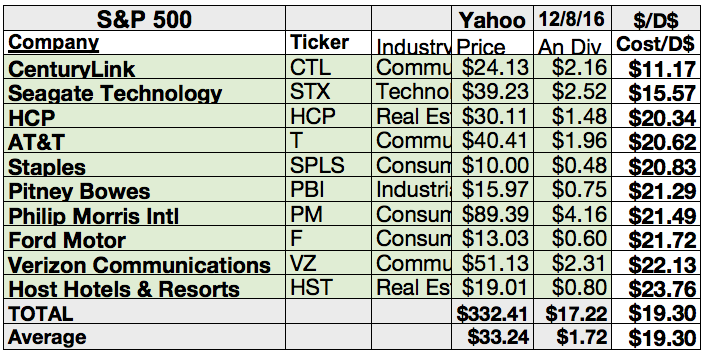

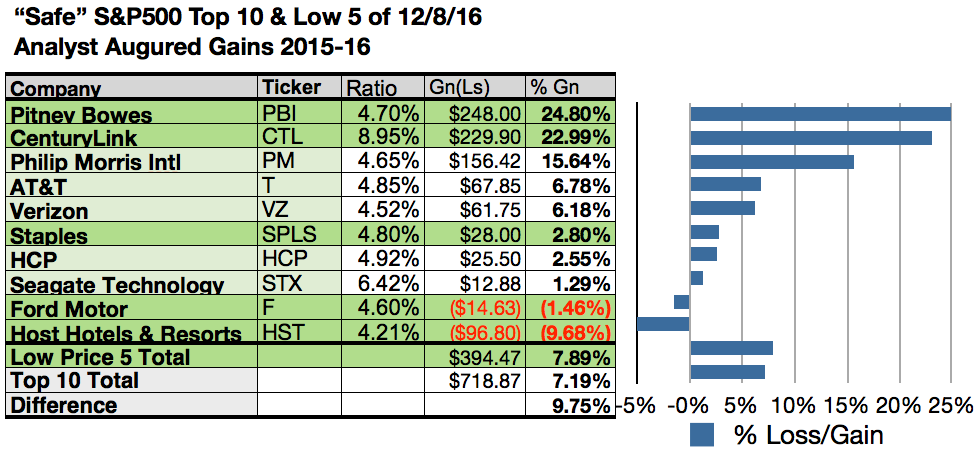

For comparison, top ten Dow Dogs and SPY (S&P500) Dogs were listed. Dow: INTC; MRK; MCD; PG; CAT; IBM; KO; CSCO; PFE; VZ. S&P500: HST; VZ; F; PM; PBI; SPLS; T; HCP; STX; CTL .

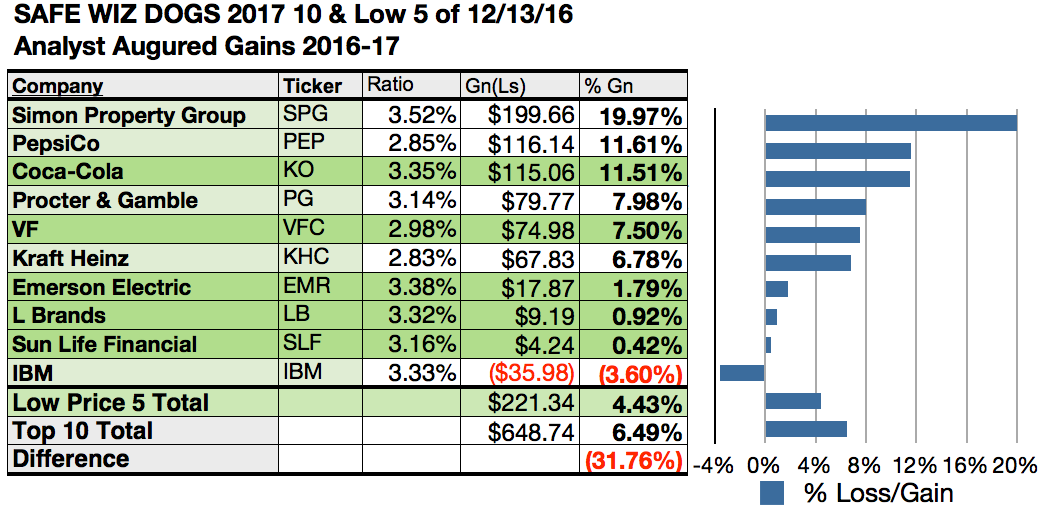

Wizards credited 5 top yield safe "WizDogs" with 31.76% LESS, Safe Dow dogs with 68.60% more, and safe SPY dogs with 9.75% more gains from $5k invested in the lowest-priced five than from $5K invested in ten.

The Dividend Dogs Rule

The "dog" moniker was earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as "dogs." More precisely, these are, in fact, "underdogs".

(Click on image to enlarge)

(Click on image to enlarge)

Do "WizDogs Cover All Sectors?

The top 30 of 47safe "WizDogs" came from 9 of 11 business sectors. These were: real estate (1); industrials (3); consumer defensive (6); technology (4); consumer cyclical (4); financial services (7); healthcare (2); basic materials (2); energy (1). Two sectors were not represented: communication services; utilities.

Safe WIZ, DOW, & SPY Dogs Have Cash Margins to Cover Dividends

Periodic Safety Check

Three previous articles discussed the attributes of these 30 WIZ, DOW, & SPY dividend dogs from which these "safest" were sorted. You see above the green tinted lists that passed the dividend "stress" test. These 30 WIZ, DOW, & SPY dogs report sufficient annual cash flow yield to cover their anticipated annual dividend yield.

Dog Metrics Looked For Small Dog Bargains

Dog Metrics Sorted "Safe" WIZ Stocks

Ten "Safest" top "WizDogs" displaying the biggest yields December 13 per YChart data ranked themselves by price of dividends. The "WizDogs" price of dividends showed the middle ground between Dow at the top and S&P lower average price per dollar of dividend.

Actionable Conclusion: Analysts Calculated Five Lowest Priced of "Safe" Ten Top Yield WIZ Dogs To Deliver 4.43% VS. (2) 6.49% Net Gainsfrom All Ten by December, 2017

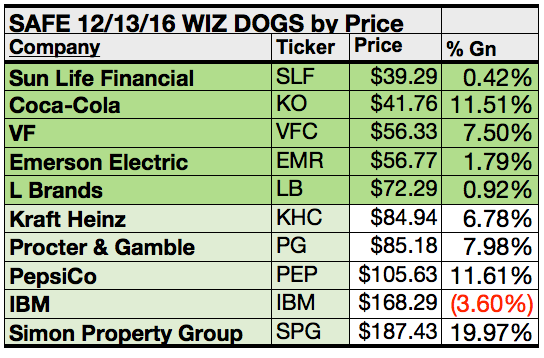

$5000 invested as $1k in each of the five lowest priced stocks in the 10 highest yield safe "WizDogs" dog kennel by yield were determined by analyst one-year targets to deliver 31.76% LESS net gain than $5,000 invested as $.5k in all ten. The highest priced "Wiz Dogs" "Safe" dog, Simon Property Group (SPG) showed the best net gain of 19.97% per analyst targets.

Lowest priced five "safe" "Wiz Dogs" as of December 13 were: Sun Life Financial (SLF), Coca-Cola Co. (KO), VF Corporation (VF), Emerson Electric (EMR), and L Brands (LB), whose prices ranged $39.29 to $72.29.

Higher priced five "safe" "Wiz Dogs" as of December 13 were: Kraft Heinz (KHC ), Procter & Gamble (PG), PepsiCo (PEP), International Business Machines (IBM), and Simon Property Group, whose prices ranged from $84.94 to $187.43.

Dog Metrics Rated "Safe" DOW Stocks

Ten "Safest" top Dow Dogs that displayed the biggest yields December 13 per YChart data ranked as the highest priced dividends of the three as follows:

Actionable Conclusion: Analysts Estimated Five Lowest Priced of "Safe" Ten Top Yield DOW Dogs To Deliver 10.27% VS. (2) 6.09% Net Gainsfrom All Ten by December, 2017

$5000 invested as $1k in each of the five lowest priced stocks in the 10 highest yield safe Dow Dog kennel by yield were determined by analyst one-year targets to deliver 68.60% more net gain than $5,000 invested as $.5k in all ten. The second lowest priced Dow Safe dog, Pfizer (PFE) showed the best net gain of 17.4% per analyst 1 yr. target prices.

Lowest priced five "safe" Dow Dogs as of December 13 were: Cisco Systems (CSCO), Pfizer (PFE), Intel (INTC), Coca-Cola (KO) and Verizon Communications (VZ), whose prices ranged $30.59 to $52.36.

Higher priced five Safe Dow dogs as of December 13 were: Merck & Co. (MRK),Procter & Gamble (PG), Caterpillar (CAT), McDonald's (MCD), and International Business Machines (IBM), whose prices ranged from $61.79 to $168.29.

Dog Metrics Selected "Safe" SPY Stocks

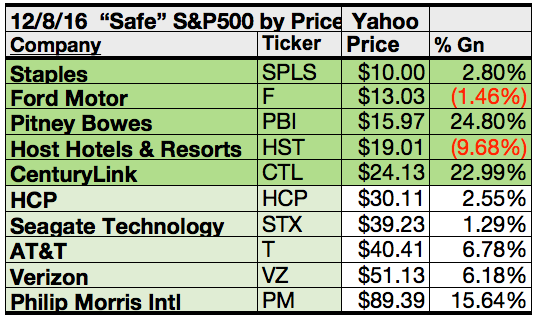

Ten "Safest" top S&P500 issues that showed the biggest yields December 8 per YCharts data ranked as the lowest priced dividends of the three as follows:

Actionable Conclusions: (1) Analysts Estimated Five Lowest Priced of "Safe" Ten Top Yield SPY Dogs To Deliver 7.89% VS. (2) 7.19% Net Gains from All Ten by December, 2017

(Click on image to enlarge)

$5000 invested as $1k in each of the five lowest priced stocks in the 10 highest yield safe S&P500 Dog kennel by yield were determined by analyst one-year targets to deliver 9.75% more net gain than $5,000 invested as $.5k in all ten. The third lowest priced S&P500 "Safe" dog, Pitney Bowes (PBI) showed the best net gain of 24.8% per analyst targets.

Lowest priced five "safe" S&P 500 Index dogs as of December 8 were: Staples (SPLS), Ford Motor (F), Pitney Bowes (PBI), Host Hotels & Resorts (HST), and CenturyLink (CTL), whose prices ranged $10.00 to $24.13.

Higher priced five Safe S&P 500 Aristocrats dogs as of December 8 were: HCP, Inc. (HCP),Seagate Technology (STX), AT&T (T), Verizon Communications (VZ), and Philip Morris Intl (PM), whose prices ranged from $30.11 to $89.39.

This distinction between five low priced dividend dogs and the general field of 10 reflects the "basic method" Michael B. O'Higgins employed for beating the Dow. The added scale of projected gains based on analyst targets contributed a unique element of "market sentiment" gauging upside potential. It provided a here and now equivalent of waiting a year to find out what might happen in the market. Its also the work analysts got paid big bucks to do.

Caution is advised, however, as analysts are historically 20% to 80% accurate on the direction of change and about 0% to 20% accurate on the degree of the change.

The overbought Dow Dogs are so inflated in price that they have ceased to be reliable dividend income generators. The "Wiz Dogs" are no better. Only the S&P500 (SPY) Dogs show more annual dividends produced from a $1k investment than the aggregate single share price of the stock.

Disclosure: The net gain estimates mentioned above did not factor in any foreign or domestic tax problems resulting ...

more

Thanks for sharing and merry christmas

Thanks fr sharing