With VVIX In Full "Yikes" Mode, Negative Convexity "Accelerant Flows" Are Now In Play

The holiday-shortened trading day - or rather bloodbath - is almost over so time for a quick post-mortem from Nomura's Charlie McElligott who notes that the close the week with a hard “risk-off” on Nu Variant concerns laying into a super-illiquid post-holiday US market, which is hammering growth- and inflation- sensitives (Russell -4.4%, WTI Crude -10.7%, Copper -3.8%, 5Y Breakevens -13.3bps) and crypto (XBT -7.3%, ETH -9.7%) as a read on speculative sentiment, while front VIX fut is +8 vols and VVIX (vol of vol) skying through 138 in full “yikes” mode (largest 1d move VVIX since Jan 27th).

(Click on image to enlarge)

Meanwhile, Rates is even more of a calamity, because as McElligott puts it, "that’s what Rates trading is in 2021…PAIN; Funds positioned for bear-flattening after the recent run-up / pull-forward in Central Bank “accelerated taper to hasten hiking liftoff” trades…but now you’re getting a bull-steepening, as the market suddenly realizes that IF we were to get more border closures (on account of Nu) which hit growth and further contribute to supply-chain woes, you’re sure as hell not getting 2.5 / 3 Fed hikes in ’22 on account of perpetually scared of their own shadow CB’s and their asymmetric policy (at one point, belly / UST 5Y yields were -19bps today…WOW)"

So with regard to this downtrade’s impact or sentiment especially in light of Goldman's repeated calls for a year-end meltup, there is an obvious psychological impact: people who’ve been playing for the year-end seasonality surge for Equities— the Nomura quant included— are getting increasingly frustrated because after a rollicking bull-move in October, the S&P has gone absolutely nowhere since Nov 1, while late-comers have had their hands blown-off…which then further bleeds desire to put risk capital to work into the rest of the year end—i.e. buyside transitions into “protect year” mode, where “return of capital” > “return on capital.”

This is a problem since such a psychological revulsion goes for all trades with any crowding, i.e. “bearish fixed-income”/“flattener” expressions, which have had a heck of a run and could see hastened monetization in order to protect PNL into year-end—especially with Dealer balance-sheet and market illiquidity certain to get worse with every passing day which incentizes folks to tap-out on trades.

So, putting it all together, the Nomura strategist calls today a “reversal” type of day from the general halcyon of recent months for most assets, especially with the recent hawkishness in Rates reversing and seeing Bonds squeeze/rally massively today on the risk-off, which means completely opposite price-action in Equtiies “Value / Growth” dynamics of last week--ouch

Hence, what we are seeing according to the Nomura quant, are "shock outlier moves" in US stocks today in a mega “reversal of the reversal” seen last week, with “Bond / Duration proxies” exploding higher, while “Economically Sensitives” get smashed—see “1-Day Ret Z-Score (1yrRel)” column:

(Click on image to enlarge)

And with this broad momentum/trend reversal, McElligott warns that we must pay a lot of attention to “negative convexity” strategies that have again accumulated substantial exposures in recent weeks of low realized Volatility.

Meanwhile, an even larger risk here residing within systematic strategies is the volatility component as it relates to the de-leveraging or re-leveraging of positions because position sizing is set to be inversely proportional to the instrument’s volatility input—or as Charlie puts it, “Volatility is the exposure toggle.”

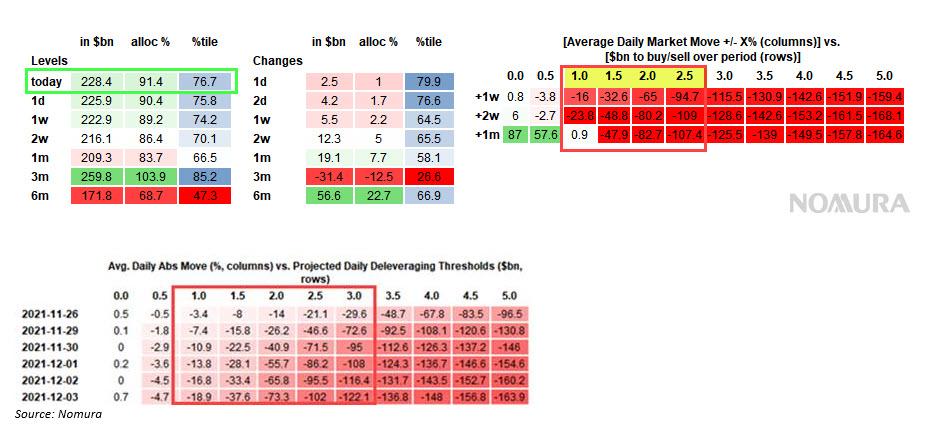

So looking at US Equities Vol Control, we see a more substantial “local” risk of selling—in other words, a 1.5% change in SPX today would be -$8.0B of de-allocation from US Equities; a 2.0% change would be -$14.0B; a 2.5% change would be -$21.1B of exposure to reduce, and so on (and mind you, Vol Control is now back up to $228.4B of US Eq Exposure, a solid 77%ile rank).

(Click on image to enlarge)

If this feels very deja vu, it's because it is - much like late August, we’ve seen a resumption of the same pattern in the equity vol space (which Goldman addressed just a few days ago) where we have ridiculously low realized Vol pinned by dispersion/low corr and options sellers (overwriters, strangle sellers) which have been stuffing Dealers full of Gamma which has stabilized us into pullbacks …yet despite so many other Vol metrics screaming "crash".

(Click on image to enlarge)

According to the Nomura strategist, the only way then to rinse this “imbalance” is to actually see a proper “shock down” and get that realized Volatility “true up” to implied Volatility; but as always, it will take more than just 1 day of vol spike…and require multiple days of follow-through of said “high rVol” to drag up trailing averages before getting that larger mechanical deleveraging…but today is a good head-start... unless of course, we get an all-clear from the authorities in the next few hours in which case the meltup will continue.

"Start buying. We are about to leak the all clear" pic.twitter.com/55HV35eon0

— zerohedge (@zerohedge) November 26, 2021

McElligott's punchline is similar to that from SpotGamma - namely that we are nearing max pain “short Gamma vs Spot” for Dealers in SPX / SPY options - below 4574 in spoos -with market slipping away from prior stabilizing “long Gamma” (as Vol runs higher) and nearing Dealer “short strikes” on client hedges, while already there “short Gamma vs Spot” in QQQ (Nasdaq) and EXTREMELY short in IWM (Russell)…so negative convexity “accelerant flows” are very much in-play.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more