Will UK Stocks Benefit From Inflation And Rate Rises In 2022?

For the past decade or so, London’s blue-chip stock index the FTSE 100 has been out of favor with investors and has regularly underperformed the market.

The index’s reliance on much maligned industries such as banking, tobacco, mining and oil has seen it repeatedly shunned by investors, a fact only exacerbated by Brexit. Why invest in these old, tired stocks when on the other side of the Atlantic the exchanges are laden with exciting new technology stocks, such as Apple (AAPL), Tesla (TSLA) and Amazon (AMZN).

However, as we enter a year of uncertainty, where inflation is rampant and interest rates are expected to be raised to their highest levels in years, tech stocks have faltered and appear to have fallen out of favor.

The FTSE 100, on the other hand, has gained 2.8% thus far in 2022. Granted, that may not sound terribly remarkable at face value, but when you consider that the DAX 40, Euro Stoxx 50, S&P 500 and Nasdaq are all down by 3.03%, 3.74 %, 6.11% and 9.72% year-to-date (YTD), it becomes much more impressive.

So, why are tech stocks out? The combination of rising inflation and anticipated interest rate hikes are mainly to blame, both of which make expensive, risky tech stocks a less desirable investment. In such an environment, investors gravitate towards less risky stocks, which have the ability to pass price rises on to their customers, have reliable cash flows and which pay dividends.

Fortunately for the UK, the FTSE 100 is full of these types of stocks, which are less sensitive to interest rate rises and many of which are reliable dividend distributers. The index currently boasts a dividend yield of more than 3% compared to the S&P 500’s 1.2%.

Furthermore, several of the main industries in the FTSE 100 have solid prospects this year. Bank stocks are set to directly benefit from higher interest rates, oil companies are already reaping the rewards from soaring oil prices and mining stocks should benefit from a post-pandemic global economic recovery.

So, will 2022 be the UK’s benchmark index’s year? The current circumstances make the FTSE 100 tempting to investors right now, but if the last couple of years have taught us anything, it is to expect the unexpected. While the FTSE 100 has certainly started the year positively, future prospects will depend largely on how the economy reacts to interest rate rises and whether or not inflation is contained.

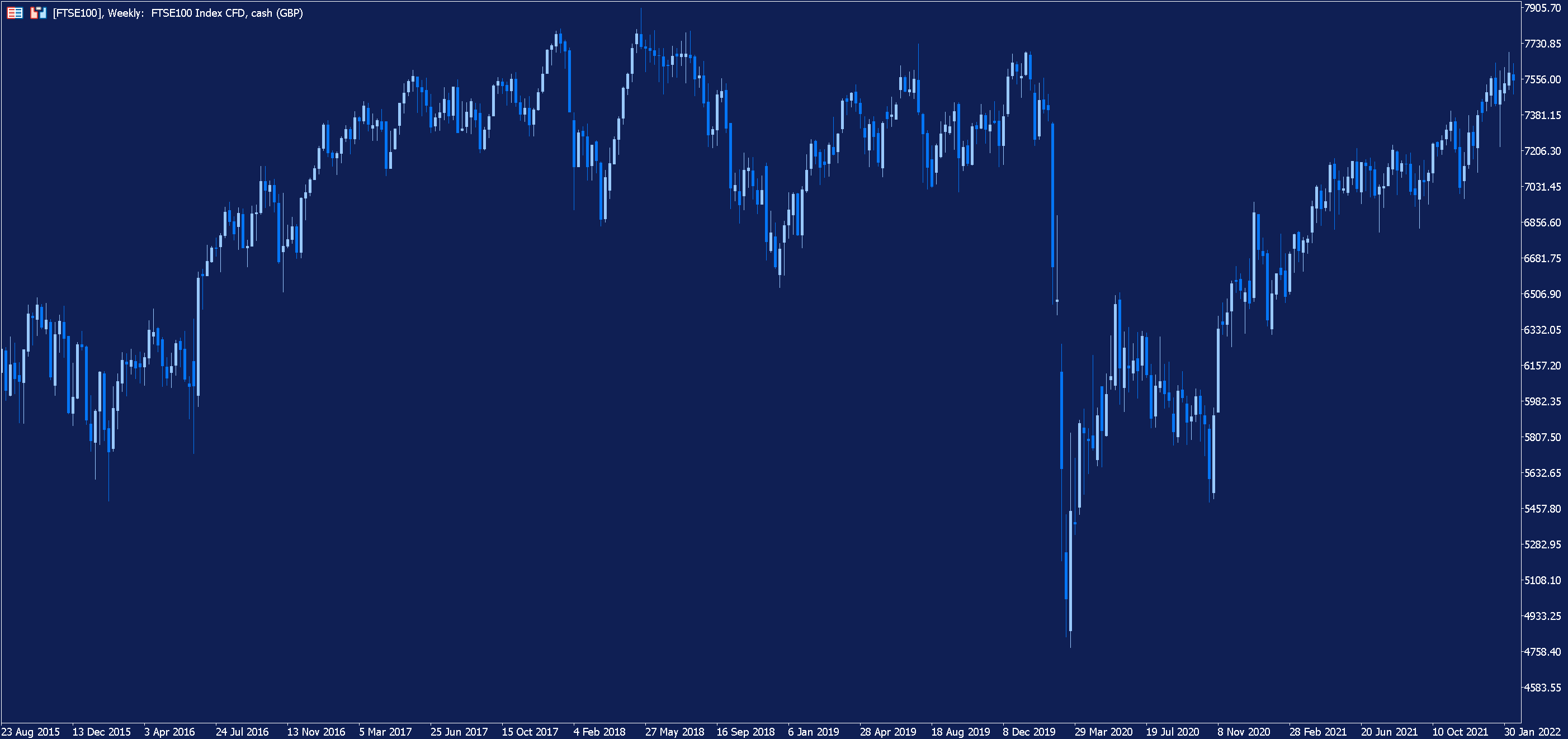

(Click on image to enlarge)

Depicted: Admirals MetaTrader 5 – FTSE 100 Weekly Chart. Date Range: 23 August 2015 – 17 February 2022. Date Captured: 17 February 2022. Past performance is not a reliable indicator of future results.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more