Will The S&P 500 Set A New 2023 High This Week?

Last week, investors digested mixed inflation reports, hawkish comments from Fed Governor Wallace, weak retail sales, and robust bank earnings. Investors will focus on corporate earnings reports and forecasts this week. The S&P 500 can break out of its 2023 trading range to set a new high if 2023 earnings forecasts from the reporting companies exceed analysts’ expectations.

Investors reacted to inflation data last week with cautious optimism. The producer price index (PPI) unexpectedly declined, bringing some cheer. Inflation in the consumer price index (CPI) remained stubbornly high, offsetting some of the excitement from the PPI data.

The core PPI, which measures wholesale prices excluding food and energy components, gained 0.1% in March, lower than economists’ 0.3% forecast and the 0.2% increase in February. In the 12 months through March, the core PPI advanced by 3.6%, compared to 4.5% in February. The core CPI, which measures wholesale prices, rose 5.6% year over year in March compared to its 5.5% increase in February.

After the CPI and PPI inflation data came out, Fed Governor Waller said interest rate policy needs to be tightened further and remain tight for a substantial period since the Fed hasn’t made much progress on its inflation goal.

Total retail sales fell 1.0% month-over-month in March, marking their fourth decline in five months. Economists had forecasted retail sales to fall 0.5%. The weakness in consumer spending seen in most retail categories exacerbated concerns about an economic slowdown.

The first quarter earnings season began with the nation’s largest banks, JPMorgan Chase, Citigroup, and Wells Fargo, reporting earnings above analysts’ estimates despite recent turmoil in the banking sector. The results showed that customers moved deposits to larger and better-capitalized banks after the collapse of Silicon Valley Bank and Signature Bank.

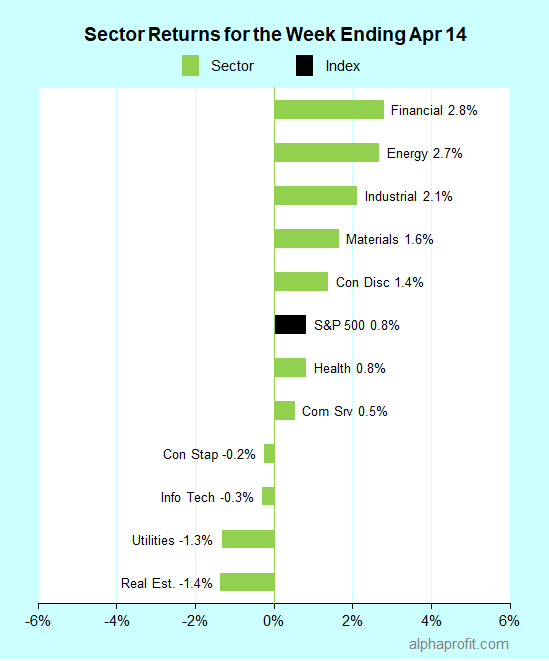

For the week ending April 14, the S&P 500 (SPY) rose 0.8%. Seven of the 11 sectors advanced. The financial sector (XLF) gained the most, while real estate (XLRE) lost the most.

(Click on image to enlarge)

Leading and lagging sectors for the week ending April 14, 2023.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Bio-Techne Corporation (TECH) +13% – The week’s top performer in the S&P 500.

2. Energy Sector

- Pioneer Natural Resources Company (PXD) +10%

3. Information Technology Sector

- Enphase Energy, Inc. (ENPH) +9%

4. Financial Sector

- JPMorgan Chase & Co. (JPM) +9%

- Citigroup Inc. (C) +8%

5. Consumer Discretionary Sector

- CarMax, Inc. (KMX) +8%

6. Materials Sector

- CF Industries Holdings, Inc. (CF) +8%

- The Mosaic Company (MOS) +8%

- Freeport-McMoRan Inc. (FCX) +7%

7. Consumer Staples Sector

- Molson Coors Beverage Company (TAP) +8%

Top ETFs for the week

The following ETF themes worked well: cryptocurrency, bitcoin, Latin America, Brazil, copper miners, and South Korea. The top ETFs for the week include:

- Bitwise 10 Crypto Index Fund (BITW) +9.1%

- iShares MSCI Brazil ETF (EWZ) +8.4%

- Global X Copper Miners ETF (COPX) +7.6%

- iShares Latin America 40 ETF (ILF) +7.0%

- iShares MSCI South Korea ETF (EWY) +5.7%

Will the S&P 500 Set a New 2023 High This Week?

* Last week’s rally pushed the S&P 500 to the top of its 2023 trading range. The index closed last week at 4,138, just 1% below its year-to-date closing high of 4,180 set in early February. The first-quarter earnings reporting season picks up pace this week. Investors will get earnings reports from some of the top S&P 500 index members. The roster of reporting companies includes Johnson & Johnson, Morgan Stanley, Netflix, Procter & Gamble, and Tesla. While companies may easily exceed analysts’ watered-down forecasts, their 2023 guidance amid a slowing economy could determine if the S&P 500 sets a new 2023 high this week.

* China reports its first-quarter gross domestic product data on Monday. Economists expect the world’s second-largest economy to grow 2.2% in the first quarter, or 4.0% year-over-year.

* The U.S. housing industry is in the spotlight. Data on existing home sales, housing starts, building permits, and homebuilder confidence are due.

* S&P Global provides the flash measures of U.S. manufacturing and services sector activities from the purchasing manager surveys. Economists surveyed by Dow Jones expect both measures to lose ground.

More By This Author:

Best ETFs, Funds, And Stocks Of Q1 2023; Preview Of Q2Best ETFs, Funds, and Stocks of 2022. A Preview to 2023.

Top Performing ETFs For November 2022

Disclaimer: Get two special reports Five Smart Ways of Using Fidelity Select Funds and Avoid Three Common Mistakes ETF Investors Make when you more