Will T-Mobile Ever Pay A Dividend?

Among companies in the wireless telecommunication services industry, two are extremely popular with dividend growth investors. AT&T Inc. (T) and Verizon Communications (VZ) are two of the most followed stocks by dividend growth investors.

Both stocks have high yields and long histories of growing dividends, especially AT&T, which is a Dividend Aristocrat.

Both of these companies are fairly mature, which means that they can deploy a large percentage of their capital in the form of dividends. This is what income investors find so attractive about AT&T and Verizon.

The flip side of owning these companies is that investors might miss out on a fast-growing company in the same industry simply because it does not pay a dividend.

Over the last five years, shares of T-Mobile US, Inc. (TMUS) have returned 273% compared to the 75% gain for the S&P 500. For comparison purposes, Verizon’s stock has gained 34% while AT&T is down nearly 15% over this same period of time. Adding the dividend yields to the return of these two stocks doesn’t even begin to bridge the gap between their returns and that of T-Mobile.

Dividend growth investors interested in the company will likely want to know if and when T-Mobile might pay a dividend. This article will examine the company’s business model, growth prospects, and its competitive advantages to see if a dividend is feasible in the near future.

Business Overview

Through its subsidiaries, T-Mobile provides wireless services for branded postpaid and prepaid and wholesale customers. The company has operations in the U.S., Puerto Rico, and the U.S. Virgin Islands. T-Mobile offers voice, messaging, and data services.

The company’s product offerings include wireless devices, such as smartphones, tablets and wearables, as well as accessories and wireline services.

T-Mobile was founded in 1994 and has a market capitalization of more than $165 billion today. The company produced revenue of $45 billion last year.

However, T-Mobile is on pace to generate more than $60 billion of revenue this year on account of its completed merger with Sprint in April of this year. T-Mobile crossed over the 100 million wireless customer mark in the most recent quarter. As a result, T-Mobile is now the second-largest wireless network in the U.S., trailing just Verizon.

Growth Prospects

T-Mobile’s best prospect for future growth is its merger with Sprint. Customer migrations have already begun, with 15% of Sprint’s postpaid traffic has now been transferred over to the T-Mobile network. The company stated that 85% of Sprint’s postpaid customers have handsets that are compatible with T-Mobile’s network today.

This has helped drive total postpaid accounts for the company. Leadership stated that merger synergies are already ahead of schedule, with the expectations for $1.2 billion in synergies this year.

T-Mobile was also showing strong growth rates prior to combing with Sprint. For example, the company has led the entire wireless telecommunications industry in net additions for several quarters in a row leading up to the merger with Sprint.

5G should also be a boost to T-Mobile’s business. The company’s 5G network is incredibly large, covering 270 million people and the geographic coverage is more than AT&T and Verizon combined. T-Mobile’s 5G network is available in all 50 states and Puerto Rico.

Mid-band 5G covers 30 million people, with a goal of covering 100 million by the end of this year. T-Mobile expects mid-band 5G to be nationwide by the end of 2021.

T-Mobile’s earnings-per-share have compounded at an annual rate of more than 37% from 2015 through 2019, which helps explain the stock’s impressive returns over this period of time. T-Mobile was already in high growth mode prior to merging with Sprint, but this transaction will only help fuel future gains as well.

Competitive Advantages

One of the primary advantages that T-Mobile has is that is been adding new customers at a very high rate.

Source: Investor Presentation

In the third quarter, T-Mobile had more than two million net additions, a company record. In fact, this was nearly as much as the rest of the wireless industry combined. The company also had nearly two million postpaid net additions, which was also a record, and included 689K postpaid phone net additions. Both marks were industry-leading.

The merger with Sprint has sent total postpaid accounts soaring. T-Mobile had 25.6 million postpaid accounts at the end of the quarter, a nearly 11 million increase from the third quarter of 2019. Average revenue per account grew 1.4% year-over-year.

The increase in revenue per accounts is due to higher revenues from each individual user. The average revenue per user has climbed each quarter in 2020. T-Mobile generated $48.55 of revenue per user in the third quarter, a 5% increase from the same quarter a year ago and 6% growth from the start of 2020.

T-Mobile’s churn ratio did increase 1 basis point year-over-year and 10 basis points sequentially but remains very low at 0.90%. The sequential increase in churn rate was attributed to higher switching activity due to fewer social distancing restrictions related to the COVID-19 pandemic compared to the second quarter.

The company’s most recent earnings results showed that it is leveraging all of its competitive advantages to its benefit. The company’s GAAP earnings-per-share increased 17% to $1.18 while revenue grew 74% to $19.3 billion. On the other hand, AT&T’s earnings-per-share were lower by 19% while revenue decreased 4%. Earnings-per-share were flat for Verizon while revenue fell more than 4%.

Will T-Mobile Ever Pay A Dividend?

T-Mobile has already shown that it is a high profitable company. The company has the other important ingredient needed to fund a dividend: positive cash flows.

T-Mobile’s cash from operating activities is quite strong. In the most recent quarter, cash from operating activities improved 56% to $1.75 billion. Sequentially, the improvement was even greater as net income was higher by a significant amount. Cash from operating activities is projected to be $5.1 billion to $6.1 billion for the last half of the year, a $500 million increase at the midpoint.

Though the company does invest a lot of capital into its business, $6.7 billion expected in the second half of 2020 alone, it does produce solid free cash flow as well.

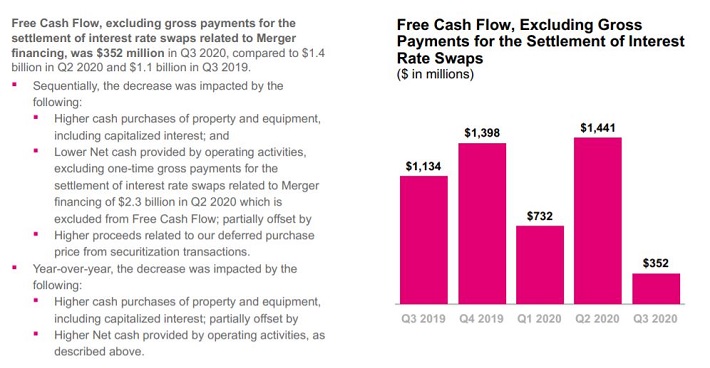

Source: Investor Presentation

Free cash flow declined in the third quarter compared to the previous year, but this was due to higher cash purchases of property and equipment related to the build-out of 5G. T-Mobile raised its free cash flow estimate to $700 to $900 million for the second half of 2020, $400 million higher than previously expected at the midpoint.

Were it to pay a dividend, T-Mobile would need to use its free cash flow. Let’s assume that the company chose to allocate 50% of its free cash flow towards dividend payments. Using the company’s revised guidance, T-Mobile’s free cash flow totaled should be almost $3 billion in 2020. Therefore, T-Mobile could use $1.5 billion to pay each of its 1.24 billion shares outstanding an annual dividend of $1.21.Based on the current share price of ~$132, T-Mobile’s dividend yield would be 0.92%.

This is below the average dividend yield of 1.6% for the S&P 500 and pales in comparison to AT&T’s yield of 7.2% and Verizon’s yield of 4.1%.

Current shareholders of T-Mobile might rebel against the idea of a dividend, especially one that results in a very low yield when that capital could be better spent on growing the business.

There is a case to be made that T-Mobile could offer a higher dividend growth rate than its peers just based on its ability to grow earnings-per-share at a higher rate than either AT&T or Verizon. It is our belief that it isn’t likely that shareholders of the company’s peers would find that growth attractive enough to switch to the stock.

Due to the need to build out its business, we believe that T-Mobile is likely at least a few years away from offering its shareholders a dividend.

Final Thoughts

T-Mobile has left its competition far behind in terms of share price returns over the last five years. The company continues to set records for net additions that are superior to that of its peers. Add in the merger with Sprint and the most 5G coverage and T-Mobile’s future looks especially bright.

T-Mobile doesn’t pay a dividend today, but that could change in the future. Investors with a long-term view could find the stock an attractive total return option with the possibility of a dividend at some later date.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more

No, I doubt $TMUS ever will.