Will Small Auto Part Stores Survive Amazon?

The traditional brick-and-mortar auto part stores are in big trouble following Amazon.com Inc.’s (AMZN) entrance into the market. The e-commerce market leader has been expanding to different marketplaces in recent years including video streaming, green groceries, and auto parts among others.

Its entry into the auto parts business is seen as a direct rivalry to auto parts retailers that receive most of their business from residential do-it-yourself (DIY) customers. Amazon’s online Auto Parts store targets customers who prefer to fix their vehicles at home and as pointed out in several reports, this approach is also likely to affect listed auto part retailers like AutoZone Inc. (AZO), whose main revenues stream is DIY customers.

The company receives roughly 75% of its revenues from this group of customers and is likely to be the most affected. Its rivals Advance Auto Parts Inc. (AAP) and O’Reilly Automotive Inc. (ORLY), which have about 50% of their top lines coming from the same class of customers, are also affected by Amazon’s entry into the market but not to the same extent. However, when you look at the three companies’ performances over the last few years, it is quite clear that they have all suffered since Amazon announced its intent to disrupt the retail auto parts business.

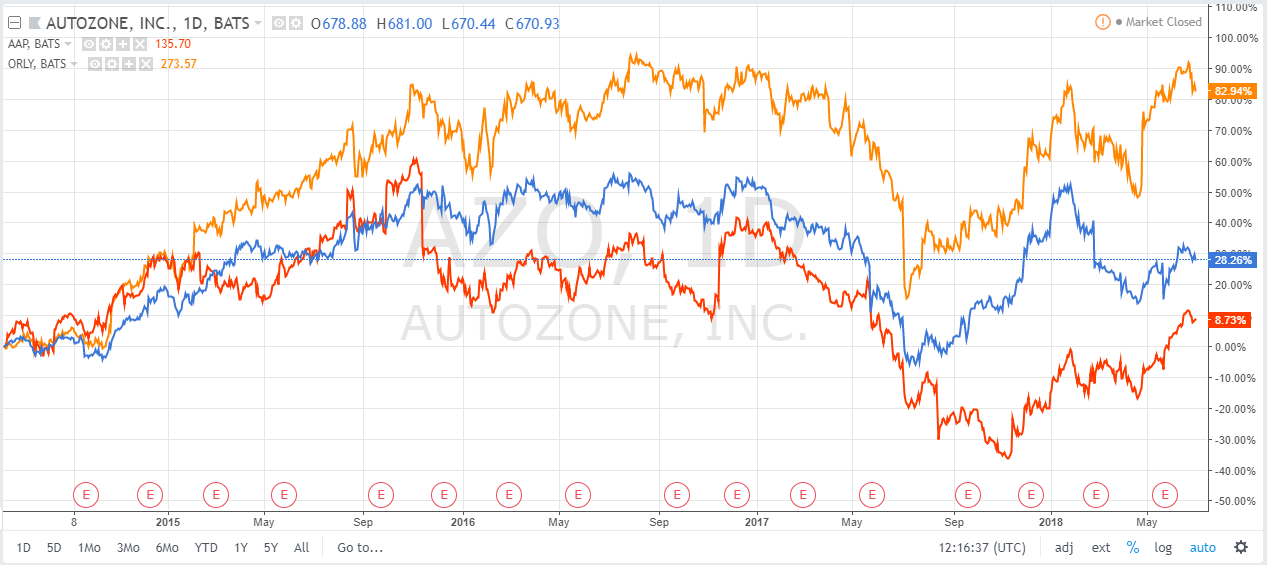

AutoZone, Advance Auto Parts, and O’Reilly plunged last year but have since recovered

Stock prices of the three companies plunged last year to hit new multi-year lows but have since recovered. However, it remains to be seen how long these recoveries can last especially given the choppy behavior the three stocks have demonstrated in the stock market since the start of the year. In addition, this space is also being disrupted by several online-based startups that have opened e-commerce stores and provide several educative guides like this infographic published by AutoDoc. These addon resources could play a huge part in developing customer loyalty as they help residential DIY customers to cut auto part-related costs.

Online retail has grown over the last two decades to play a crucial part in every business. In today’s market, survival is almost impossible for retailers that do not have an online store. This is part of the reason why even the likes of AutoZone, O’Reilly and Advance Auto Parts have launched their own e-commerce platforms in a bid to boosting their top lines in a market that has become very competitive over the last few years.

However, there is a huge challenge to this move. While these Auto Part stores have the financial power to easily launch an online store and even finance aggressive ad campaigns, they are unlikely to match the reach of Amazon, which has hundreds of millions of customers visiting its online platform. And on the lower end of things, they are also unlikely to match the flexibility and business-to-customer relationship that smaller online stores can offer.

This leaves the pure-play auto parts retailers at an interesting spot as they strive to remain competitive and convince shareholders to maintain optimism in their stocks.

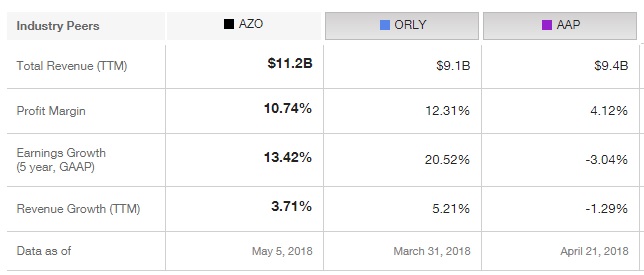

So, what exactly does this mean for the likes of AutoZone, Advance Auto Parts, and O’Reilly? Well, the three stocks are not doing bad currently and should at least continue to grow their bottom lines for the next few years. Their revenues have maintained steady growths and are projected to continue to do so through 2020 as should their earnings per share except for Advance Auto Parts.

Data via TD Ameritrade Research

AutoZone has a projected 5-year EPS growth of about 13.42% while O’Reilly, which is the biggest in terms of market capitalization, is expected to have a growth rate of about 20.52% over the next five years. Advance Auto Parts, on the other hand, which is the smallest of the three auto part retailers, is expected to experience a 5-year EPS decline of about 3%.

In summary, the auto parts business is becoming an interesting marketplace. Both the large and the small have recently demonstrated a clear intent to disrupt the market in diverse ways and traditional brick-and-mortar stores are likely to suffer from it. Some of the three stocks discussed here have already closed several stores as they seek to optimally augment their business activities by establishing a strong presence in the e-commerce space. Interesting times lie ahead.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more

With the exception of the cell phone, #Amazon has conquered every industry they've gotten into. I see no reason why it can't do that here as it already has tremendous related expertise and everything in place to outsell the existing leaders. $AAP, $AZO, $ORLY may very well follow in the footsteps of ToysRus. I'm very bullish on $AMZN.

Amazon has not slowed down other supermarkets. They are just better at what they do than Whole Foods. The same will happen with auto parts stores. They will continue to be better. Maybe Amazon will buy out a chain. Otherwise no serious threat. With groceries, Amazon bought out a chain that is not able to compete with the other major stores. Maybe they could find a better auto parts chain with which to compete.

Are you not concerned at all that Amazon is stretching itself too thin? They've made so many aggressive expansions lately - acquisition after acquisition to compete in such a diverse collection of industries: pharmaceuticals (PillPack), grocery stores (Whole Foods), video games (Twitch), Security (Ring), etc. That doesn't even include the record 10 acquisitions from 2017, or their creating their own delivery service. But now auto parts too? I'm starting to wonder if it's all just too much. Acqusitions that match it's core, like Audible, made sense. But this?

Interesting article indeed, but a bit un-nerving, since I am one of those DIY auto repair persons.

I wouldn't be too worried. Yes, Amazon may be able to sell the parts for less, but $AAP $AZO $ORLY can still have a competative edge for knowledge and will be able to charge a premium for that. Many aspiring DIY'ers lack the expertise to do it on there own and will need hte guidence from better trained staff. I guarantee that Amazon's customer support chat from India will not be able to lead Americans through a repair.

Interesting article. Auto parts is a money maker for sure. These stores may have to increase market share by cutting prices to mechanics.