Will PLTR Ever Pay A Dividend?

While dividends are our primary focus, we understand that focusing solely on this strategy naturally excludes a large section of the investment world due to a lack of a dividend. We understand that even the staunchest supporter of dividend growth investing might be tempted to look at stocks for their growth potential, even if the security isn’t yet paying a dividend.

With that in mind, we wanted to highlight Palantir Technologies (PLTR), one of the most recent initial public offerings to take place. Investors interested in the company may want to know if Palantir will ever pay a dividend to shareholders. This article will attempt to answer that question.

Business Overview

Palantir had its initial public offering on September 30, 2020. The first day of trading was slightly disappointing. The stock opened up at $10 before finishing the day at $9.50. However, the stock has performed quite well in the ensuing months, and shares of the company are up more than 172% from the opening price. Currently, Palantir has a market capitalization of almost $49 billion.

The company may have had its IPO recently, but Palantir was founded in 2003, in part by well-known venture capitalist Peter Thiel. Thiel has been the brains, money or both behind some of the technology sectors most successful endeavors, including Facebook (FB) and PayPal (PYPL).

Palantir is one of the leading providers of software platforms for the intelligence community. The company has two main projects. The Palantir Gotham platform can identify patterns hidden in datasets, which range from signals intelligence sources to reports with confidential informants. Gotham is used by counter-terrorism analysts within the U.S. Intelligence Community and U.S. Department of Defense. Palantir Foundry creates a central operating system for a company’s data which allows users to integrate and analyze data needed in one centrally located place.

Growth Prospects

The company’s platform can be used to address a wide variety of industries, ranging from defense to health care to food to energy. This doesn’t limit Palantir ability to attract customers to just a few areas of the economy. With a deep pool of potential customers, Palantir is no niche business.

The need for businesses and organizations to be able to safely secure its data in a central location is also a necessity and Palantir is able to scale their platform to meet their needs.

Palantir has already translated these growth prospects into results.

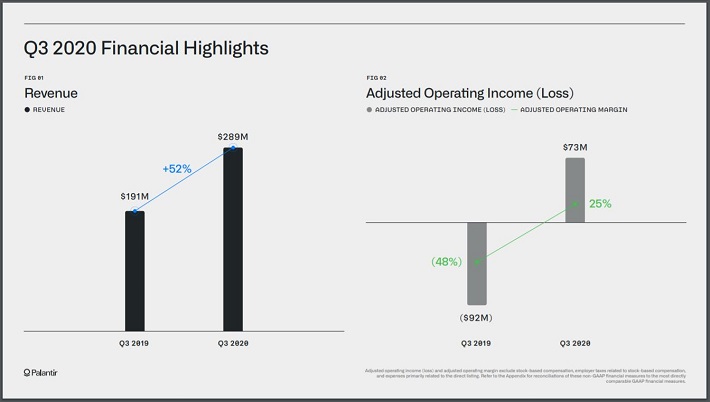

Source: Investor Presentation

Unlike a lot of companies that go public, Palantir is already showing positive earnings results. The company produced earnings-per-share of $0.06 in its first ever quarter with revenue growing 52% compared to the previous year. Both results came in ahead of what the analyst community had expected. When adjusted for stock-based compensation following the direct listing, income from operations was $73.1 million. The company also expects to grow revenue 44% to $1.071 billion in 2020.

The company has also been busy winning business since going public. Palantir closed on fifteen separate deals in its first quarter, all with a value of at least $5 million. These contracts included a contract renewal with a large aerospace company that could be worth as much as $300 million over the course of the five-year deal.

Palantir is also beginning to find more of an international presence, most recently in Japan. The company can continue to grow its business by expanding its area of operations.

Competitive Advantages

Palantir has several advantages that sets it apart from the competition. First, Palantir’s sophisticated platform can help companies optimize their business and find ways to remove costs from the system. This can help improve operating performance while reducing expenses.

The company’s products are also in high demand among military customers. While somewhat controversial amongst certain investors, the company’s platforms have been proven to work in these areas which makes them a popular choice amongst the intelligence and defense communities. Once trust has been gained, there could be switching costs associated with these agencies choosing another vendor.

Palantir also has the benefit of growing revenue generated per customer metric while also reducing in reliance on just a few customers.

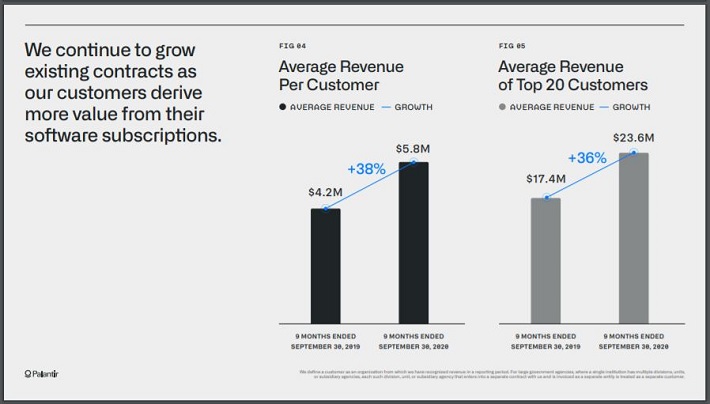

Source: Investor Presentation

For the first nine months of the year, revenue generated per customer has surged 38% to $5.8 million compared to the same period a year ago.

The company is also lowering its over-reliance on its largest clients. The top twenty customers contributed 61% of revenue through the end of September, but this is a decline of 68% from the previous year. The company still sees the bulk of revenues concentrated in its top 20 accounts, but it is an improvement compared to last year. This is a solid result given that the average revenue from Palantir’s top 20 clients grew 36% to $23.6 million.

What this means is that Palantir is simultaneously seeing a high growth rate among its largest clients while decreasing the overall percentage that these accounts contribute to revenue. This is not easy to do unless the entire business is posting an incredibly high growth rate.

Palantir is also blessed with significant cash reserves. As of the end of its most recent quarter, Palantir had a total of $1.8 billion of cash and cash equivalents on its balance sheet. Very few young public companies have such a vast sum of cash available.

Lastly, and perhaps most importantly, Palantir is still run by the same leadership as when the company was founded. Thiel remains chairman and his handpicked CEO Alex Karp has been in place since 2004. In addition, Thiel, Karp, and fellow founder President Stephen Cohen together account for at least 49.99% of voting rights through the various stock structures. This likely ensures that they will maintain control of the company as long as the three have the same interest aligned. Other shareholders won’t be able easily shift the company in a new direction should they wish to do so.

Will Palantir Ever Pay A Dividend?

Palantir is the rare newly public company that shows positive earnings results and has an abundance of cash on its balance sheet. Companies looking to pay a dividend need to be profitable and flush with cash in order to distribute a dividend.

However, Palantir continues to invest the vast majority of its proceeds back into the business. Total operating expenses were almost $988 million, nearly triple what they were in the previous quarter. The first three quarters of the year saw operating expenses more than doubled. This was due to the company increasing its sales and market, research and development and general and administrative budgets to a more reasonable level for a growing and expanding company.

With high expenses comes a low level of profits, which impacts any possible dividend desire Palantir may have. Even though the company was profitable in its first quarter, Palantir is only expected to earn $0.08 this year. Earnings-per-share are expected to grow by 50% next year to $0.12. If the company wanted to allocate half of next year’s earnings-per-share to a dividend, then shareholders might receive a quarterly dividend of $0.015. This equates to a yield of just 0.2% at the current price, which likely wouldn’t fund much appeal among those looking for income.

At the same time, investors aren’t flocking to Palantir because of its ability to throw off income. The young company is already profitable and seeing an incredible growth rate. Any use of capital to pay a paltry dividend would be capital that couldn’t be spent elsewhere.

Palantir is much better off preserving capital to reinvest in its business. The cash on the balance sheet can always be used to make an acquisition or help grow the business in some other way. Therefore, we believe it could be at least five to 10 years before Palantir is in a position where initiating a dividend makes sense.

Final Thoughts

After a slow start, there is no doubting Palantir has been an excellent investment following its IPO. The stock has rocketed higher in the short time its been available to the public.

The company produced actual profits in its first quarter and showed that revenue growth remains very high. Palantir also has a lot of growth in front of it and has multiple competitive advantages that should propel it higher.

Investors looking for a growth stock, and don’t mind the controversies regarding the company’s platforms, could do well owning shares of Palantir. What they likely won’t see is a dividend anytime soon. For shareholders of Palantir, they are probably more excited about the total return possibilities than a small dividend.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more