Will Nvidia's Q4 Results Lift Markets Back To New Highs?

Image Source: Pixabay

Amid recent market volatility, investors are anxiously awaiting Nvidia’s (NVDA - Free Report) fourth-quarter results this week, with the chip giant set to release its Q4 report after-market hours on Wednesday, February 26.

Having a market cap of $3.29 trillion, Nvidia is the largest holding in the S&P 500 and Nasdaq outside of Apple (AAPL - Free Report). That said, Nvidia’s stock tends to have larger price fluctuations than Apple, and could heavily influence which direction the broader indexes go from here.

Image Source: Zacks Investment Research

Why Nvidia’s Q4 Results Are So Significant

Nvidia’s quarterly results are usually in the spotlight, however, Wall Street is especially on notice for its Q4 report to provide some insight into the current state of the artificial intelligence boom. This comes as Chinese enterprise DeepSeek has entered the global market as a potential disrupter, garnishing significant attention in recent months for its advanced AI models and applications.

DeekSeek’s AI capabilities are rumored to have equal or greater efficiency and performance than its U.S. counterparts, including a chatbot that rivals OpenAI’s ChatGPT among other large language models (LLMs). Furthermore, DeepSeek’s offerings/operations are significantly cheaper which has cast doubts on demand for Nvidia’s AI chips, and increased spending on artificial intelligence by other U.S. firms.

Making matters more significant to a broader base of investors (especially those in the U.S.), is that economic concerns have reemerged amid the Trump administration's tariff implementations. After reaching fresh all-time highs last Tuesday, the S&P 500 and Nasdaq have pulled back sharply in the last few trading sessions with market sentiment wayfaring.

Image Source: Zacks Investment Research

Nvidia’s Q4 Expectations

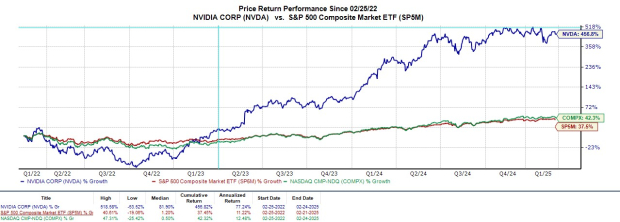

As shown in the price performance chart above, Nvidia’s stock has certainly lifted and often carried the broader indexes in recent years.

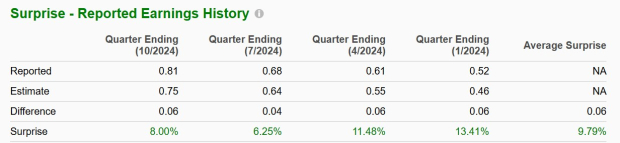

Optimistically, Nvidia’s Q4 sales are thought to have increased 70% to $37.72 billion compared to $22.1 billion in the comparative quarter. On the bottom line, Q4 earnings are projected at $0.84 per share, a 61% increase from EPS of $0.52 in the prior period. Nvidia has surpassed sales estimates for 23 consecutive quarters and has exceeded earnings expectations for eight straight quarters. Notably, Nvidia has posted an average EPS surprise of 9.79% in its last four quarterly reports.

Image Source: Zacks Investment Research

Tracking Nvidia’s Outlook

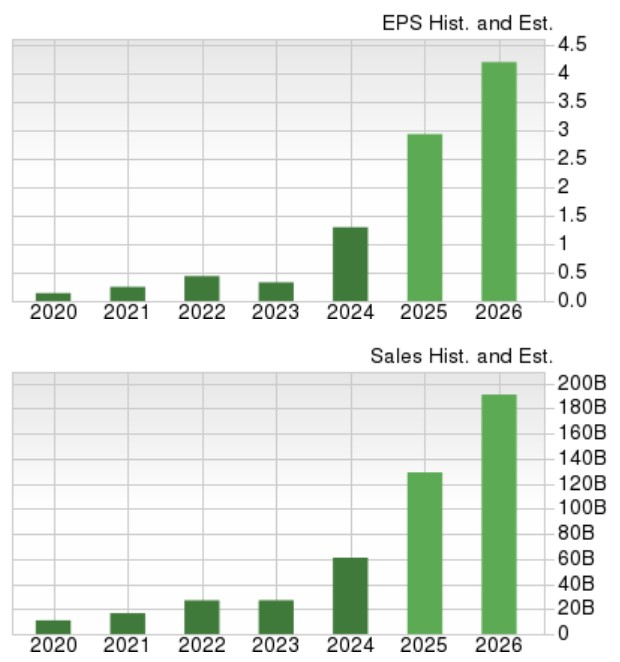

Rounding out its fiscal year 2025, Nvidia’s total sales are expected to soar 112% to $129.02 billion versus $60.92 billion in FY24. Even better, annual earnings are slated to skyrocket 126% to $2.94 per share from EPS of $1.30 in FY24.

Zacks projections call for Nvidia’s top line to expand another 48% in FY26 to $191.13 billion. Plus, 43% EPS growth is in the forecast for FY26 with projections at $4.21.

Image Source: Zacks Investment Research

Technical Analysis

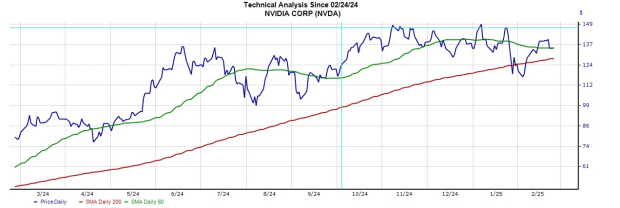

Interestingly enough, Nvidia’s stock has dipped below its 50-day simple moving average (SMA) of roughly $134 a share. Technical traders will be hoping NVDA can retake and rally above these levels, while a selloff below its 200-day SMA of $128 could signal more downside and perhaps a steeper decline among the S&P 500 and Nasdaq as well.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Ahead of its Q4 report, Nvidia stock sports a Zacks Rank #2 (Buy). To that point, it's noteworthy that FY25 and FY26 EPS estimates have remained higher with NVDA trading near its most reasonable P/E valuation in the last five years at 31.9X forward earnings.

While strong Q4 results from Nvidia could certainly help lift markets back toward their highs, investors will need to keep an eye on geopolitical tensions as it relates to Trump’s tariffs. It’s noteworthy that key inflationary data from Japan and Australia will also be on tap this week, and will provide insight into global economic stability.

More By This Author:

Buy Cheniere Energy Stock After Massive Q4 Earnings Beat?Walmart Vs. Target Stock: Which Is The Better Investment As Q4 Results Roll Out

Three Top Ranked Dividend Stocks: A Smarter Way To Boost Your Retirement Income

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more