Will Netflix Stock Reach New Heights As Q3 Results Approach?

Image Source: Unsplash

Ten percent from its 52-week and all-time high of $1,341 a share, Netflix (NFLX - Free Report) stock is sitting on impressive gains of more than +30% this year.

Holding down the title of subscriber king ahead of Amazon’s (AMZN - Free Report) Prime Video and Disney’s (DIS - Free Report) Disney+, market sentiment has remained high for NFLX, with Netflix now boasting over 300 million paid subscribers worldwide.

Known for having sharp post-earnings swings in either direction, investors may wonder if Netflix stock is poised to reach new heights or if a selloff could be in the cards as its Q3 report approaches on Tuesday, October 21.

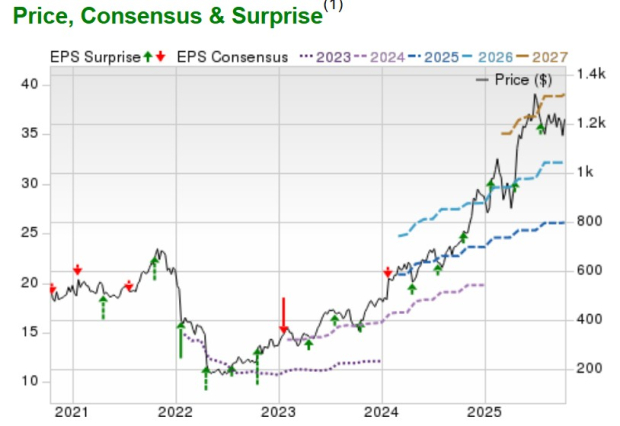

Image Source: Zacks Investment Research

Strategic Expansion & Blazing Ad Growth

Embarking on new monetization avenues, Netflix has continued to diversify its streaming services with live sports and advertising.

More intriguing, Netflix is making a push into the $100+ billion gaming market through interactive cloud gaming and TV integration. Turning its streaming service into a gaming console, Netflix now allows users to play games directly on their TV screens. Netflix’s initial gaming strategy includes party-style games designed to enhance social engagement through group play.

Ad-Tech: Investing heavily in generative AI to streamline and personalize game creation, Netflix has also modularized its AI ad formats, which has helped double its ad revenue while reducing reliance on price hikes. These immersive AI ads appear directly inside hit shows like Stranger Things and Wednesday with Netflix using gen AI to create deeper brand integration without traditional product placement.

Netflix’s more affordable ad-supported tier has grown to nearly 100 million subscribers and now accounts for 50% of its new subscriptions. Furthermore, Netflix’s ad revenue has already soared over 120% this year to more than $3 billion after more than doubling in 2024 as well.

International Audiences: Increasing its presence in Asia-Pacific and Europe, Netflix has built its cultural relevance by leveraging local storytelling to appeal to diverse audiences with regional hit shows like Tokyo Ghoul and Delhi Crime.

Netflix’s Q3 Expectations

Zacks' projections call for Netflix’s Q3 sales to be up 17% to $11.52 billion compared to $9.82 billion in the prior year quarter. Taking advantage of its top-line expansion, Netflix’s earnings are expected to climb 27% to $6.89 per share versus EPS of $5.40 in Q3 2024.

NFLX Price Target

Reflecting strong confidence in its growth trajectory, analysts have remained moderately bullish on Netflix stock, with the current Average Zacks Price Target of $1,338 suggesting 13% upside for NFLX. Notably, the street-high price target of $1,600 suggests 35% upside, while the low of $800 reflects 32% downside.

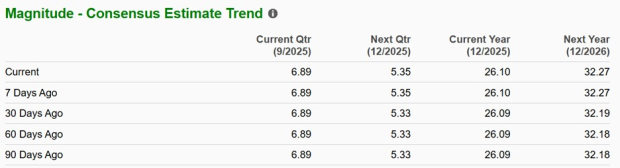

Image Source: Zacks Investment Research

What the Zacks Rank Suggests

Most influential to Zacks' proprietary ranking system is the trend of earnings estimate revisions (EPS), with NFLX currently landing a Zacks Rank #3 (Hold). Over the last quarter, EPS estimates for NFLX have remained positive, but the needle hasn’t moved much for fiscal 2025 or FY26 projections.

That said, Netflix’s annual earnings are now expected to soar 31% in FY25, with FY26 EPS projected to spike another 23% to $32.27.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Netflix’s massive earnings potential does justify its premium to the broader market at a forward P/E multiple of 45X. Although Netflix has continued to grow into what was a much loftier valuation, its Q3 report will need to reconfirm the company's enticing outlook.

Considering the YTD gains for NFLX and that it is now up nearly +400% in the last three years, a selloff could be spurred by any disappointment or profit taking if the results are not overwhelming. On the other hand, if Netflix wows with financial results, NFLX could certainly see a post-earnings rally and even hit new heights on promising guidance that reflects its compelling strategic expansion.

More By This Author:

What's Next For Gold ETFs: A Pullback Or Buying Opportunity?Buy The Surge In First Solar Stock Before It's Too Late?

Buy 3 Tech Stocks On The Dip To Strengthen Your Portfolio In Q4

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more