Will Markets End 2024 On A High Note?

The close of another eventful year in the financial markets approaches. Focus now shifts to a seasonal phenomenon that has intrigued investors for decades: the Santa Claus Rally. Known for its tendency to boost stock prices during the final trading days of December and the early days of January, this rally is once again in the spotlight.

With the S&P 500 delivering robust gains in 2024, the question remains: Will this year follow the pattern, or are we in for surprises?

There are clearly significant uncertainties ahead. On the one hand, under president-elect Trump’s incoming policies, the U.S. economy is expected to see tax cuts and deregulation, fuelling short-term growth, which could boost the S&P500. On the other hand, worsening global growth dynamics (particularly China’s slowdown as well as potential trade and tariff disputes with Europe) could create headwinds challenging the recent U.S. economic momentum. Also, the path of US interest rates will be pivotal. On December 18 the Federal Reserve will release their summary of economic projections; a lower path for interest rates for 2025 could boost the S&P500 into the year end.

So, there are compelling market uncertainties ahead that this seasonal trend will have to contend with. However, the Santa Claus Rally seasonal pattern has weathered periods of uncertainty before!

December: The Market’s Golden Month

Historically, December has been a standout month for markets, offering high average returns, steady gains, and low volatility—especially during election years.

This year, the S&P 500 rally is being fueled by a combination of positive seasonality, the possibility of Federal Reserve rate cuts, and resilient consumer spending.

The Santa Claus Rally starts in mid-December!

Starting around December 20 and typically ending on January 6 (highlighted in dark blue on the chart), this period has delivered some of the most impressive short-term returns in market history.

What is most astonishing is that over the last 96 years the Santa Claus Rally generated S&P500 an annualized return of 50.80%, delivered in only 11 trading days. By comparison, the average annualized return for the rest of the year is a modest 3.93%.

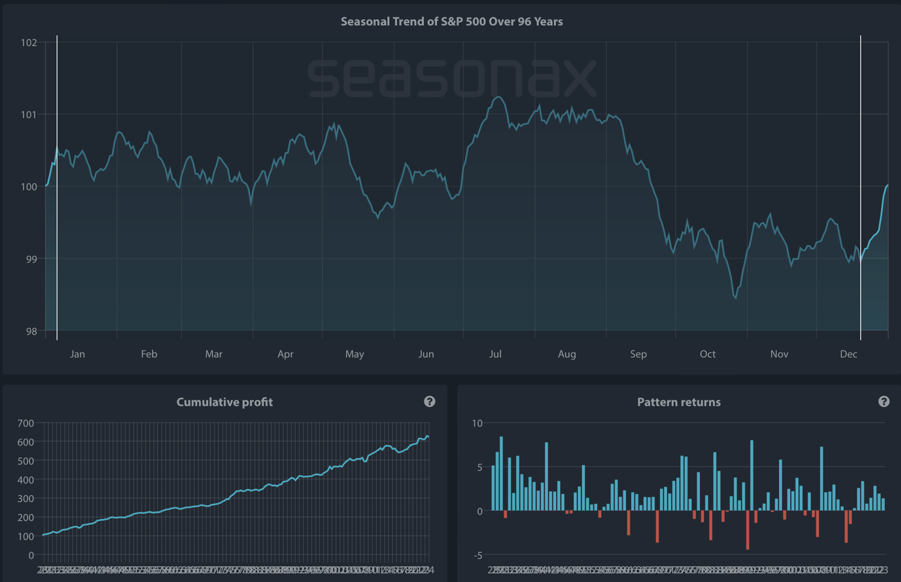

Seasonal Trend of S&P 500 over the past 96 years

(Click on image to enlarge)

Source: Seasonax

Unlike regular charts, a seasonal chart doesn’t display price over a set time, but shows the average trend over several years. The horizontal axis represents the time of the year, and the vertical axis shows the % change in price (indexed to 100). The prices reflect end of day prices and do not include daily price fluctuations.

In short, the seasonal rally around the Christmas holidays is quite extraordinary. Moreover, looking at the pattern returns of every single year since 1928, prices rose almost 80% of the time (meaning that only 19 years out of 96 brought losses during the highlighted period). As this detailed breakdown of the S&P500 illustrates, blue bars clearly dominate, both in frequency and extent.

Beyond the U.S.: Global Markets Join the Rally

The Santa Claus Rally isn’t limited to the U.S. markets. Germany’s DAX, one of Europe’s leading indices, also benefits from seasonal tailwinds during December and early January.

The rally in the DAX typically begins on December 14 and extends until January 6, offering a slightly longer window of opportunity compared to the S&P 500.

Over the past 44 years, the DAX has delivered an average return of 2.85% during the rally period. This trend has repeated itself in 34 out of 44 years, making it a consistent opportunity for investors in European markets.

Seasonal Trend of DAX over the past 44 years

(Click on image to enlarge)

Source: Seasonax

What Drives the Santa Claus Rally?

There are a few explanations that have been offered for this seasonal phenomenon.

Window dressing by investment funds is an often cited reason for the end-of-year stock market rally. In other words, investment funds are supporting prices at the year-end in order to embellish their results, with the (purely coincidental but undoubtedly welcome) side-effect of boosting bonus payments, which are often calculated at the turn of the year.

However, although less obvious, psychological reasons are probably more often an important factor. These include the fact that most people tend to take stock at the end of the year and position themselves for the new year. In addition, there is the statistically significant holiday effect, which demonstrably tends to lead to stock market rallies ahead of other holidays as well.

This is a reason we can all relate to, as Christmas shopping and good spirits appear to be spilling over into the stock market as well.

More By This Author:

“Presidential” Stocks In A Trump ComebackTop Halloween Stocks To Watch

The Next Big Move: September Fed Meeting

Seasonax, sign up here to access further analysis, 30 days for free.

Disclaimer: Past results and past seasonal patterns are no ...

more