Will Lyft Ever Pay A Dividend?

Lyft, Inc. (LYFT) made its widely-expected initial public offering, or IPO, in late March at a price of $72. Since then, the stock has lost 18% and has disappointed its investors because of its underperformance.

However, the company is only in the very early phases of a multi-year growth trajectory and is growing its revenues at a high rate. And it still has promising growth prospects up ahead. Nevertheless, it is natural for income-oriented investors to wonder whether Lyft will ever pay a dividend.

Lyft does not currently pay a dividend, which is fairly common among growth stocks, particularly those in the technology sector. Of the 500 stocks that comprise the S&P 500 Index, nearly 90 do not currently pay a dividend to shareholders. You can see the entire list of all S&P 500 stocks here.

Investors interested in buying shares of Lyft may also be interested to know whether the company will pay a dividend anytime soon. While there is always a chance a company could initiate a dividend down the road, Lyft still has a ways to go on its journey before a dividend is a real possibility.

Business Overview

Lyft operates a marketplace for on-demand ridesharing in the U.S. and Canada. The company was founded in 2012. Today, it has over 20 million riders and 2 million drivers.

In early May, Lyft reported financial results for the first quarter of the year. The company grew its revenues by 95% over last year’s first quarter, and improved its EBITDA margin significantly, from -60% in last year’s quarter to -28%.

(Click on image to enlarge)

Source: Investor Presentation

The improved performance was driven by two factors. First of all, the company rolled out its matching platform, on which it had been working for more than a year. The matching platform handles every single driver and passenger and produces good matches, thus resulting in fewer cancellations and better overall performance. Lyft continuously tries to improve its service. For instance, it now offers its riders the option to walk a few blocks and meet with another rider in order to facilitate drivers.

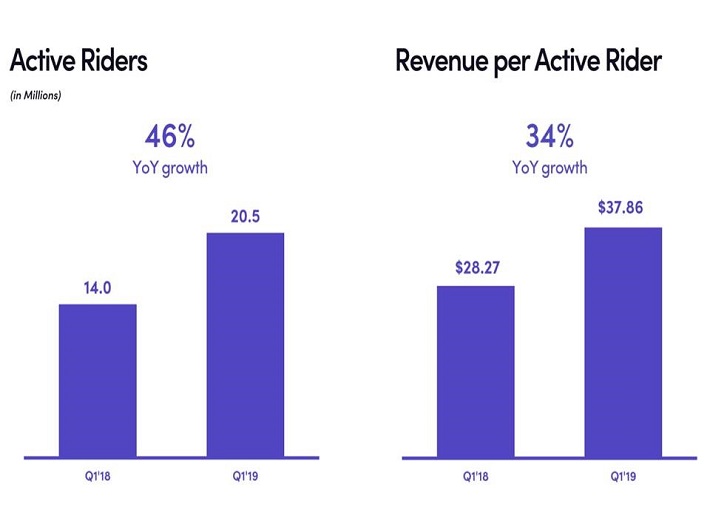

The second factor behind the impressive revenue growth of Lyft is the strong secular trend, which supports the business model of the company. The world is at the very early stages of shifting away from car ownership towards transportation-as-a-service. About 35% of Lyft users do not own a car. The company also estimates that about 300,000 people got rid of their cars because of Lyft. Thus, active riders grew 46% in the first quarter and revenue per active rider increased 34% over last year’s quarter.

(Click on image to enlarge)

Source: Investor Presentation

It is also remarkable that Lyft has never had a down quarter in the number of active riders. Moreover, according to Certify’s Five Star Customer Rating System, Lyft has been the top-rated ride-hailing service for five quarters in a row, with an average rating of 4.9 stars. This has helped the company grow its rider base at an impressive pace.

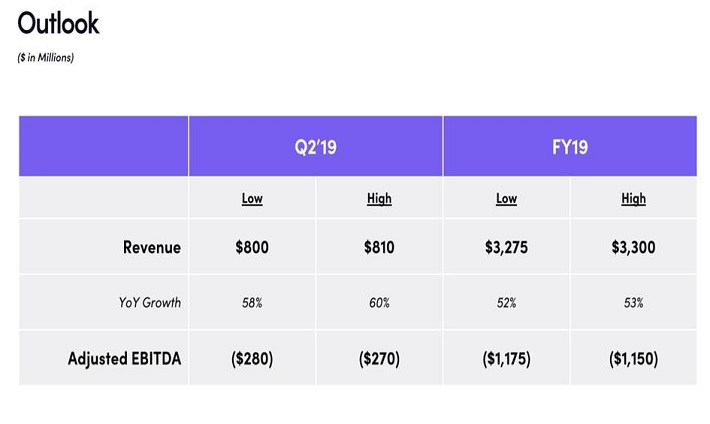

With that said, Lyft seems to be far from making a profit anytime soon. Its losses widened from $688 million in 2017 to $911 million in 2018. Moreover, management has provided guidance for negative EBITDA around $1.150-$1.175 billion this year.

(Click on image to enlarge)

Source: Investor Presentation

In fact, management expects 2019 to be the year of peak losses, with some improvement starting next year. The consumer transportation market is a $1.2 trillion market, with over $1.0 trillion spent on car ownership. Given the strong momentum of Lyft in terms of its number of riders and drivers, it is evident that the company has high growth potential.

On the other hand, no one can predict when the company will manage to make a meaningful profit. Lyft management has not provided any guidance in this respect.

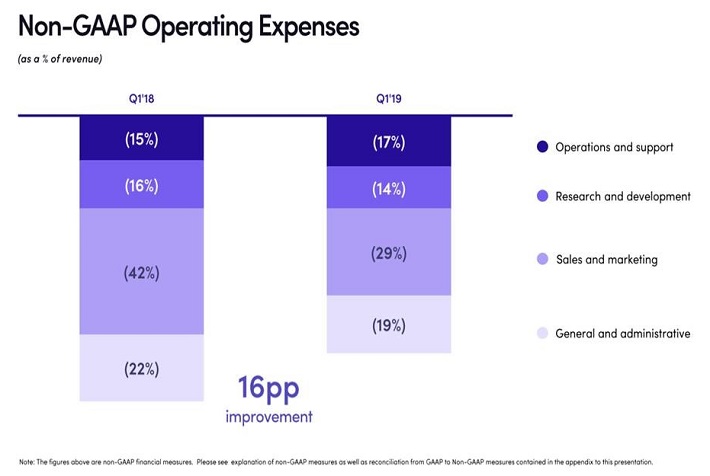

Lyft spent 14% of its revenues on R&D expenses in the first quarter. It thus improved this metric from the 16% spent in last year’s quarter but still, the company spends a great portion of its revenues on R&D expenses, which are required for the expansion of the company. Moreover, the company spent 29% of its revenues on sales and marketing expenses.

(Click on image to enlarge)

Source: Investor Presentation

It is thus evident that Lyft needs to spend excessive amounts to grow its business. As long as R&D and marketing expenses remain elevated, cash flow will suffer, and as a result, will likely prevent Lyft from paying a dividend for the foreseeable future. We expect the company to keep posting negative free cash flows in the upcoming years.

Even if Lyft achieves positive free cash flows in a few years, it will almost certainly prefer to reinvest its excess cash, given that its business will remain in high-growth mode for several more years. When a company expands its revenue base at such a fast rate, a dividend is typically the last thing that management has in mind.

Will Lyft Ever Pay A Dividend?

Until Lyft becomes profitable, investors should not expect a dividend from the company. And even when the company becomes profitable, investors should not expect a dividend right away. As Lyft is still a high-growth company, its stock will be trading at excessive price-to-earnings ratios when it does become profitable.

Consequently, even if the company considers distributing a portion of its earnings in dividends, those dividends will be negligible for the shareholders. For instance, if Lyft trades at a price-to-earnings ratio of 50 and decides to distribute 25% of its earnings in the form of dividends, it will offer a 0.5% dividend yield to its shareholders. Such a yield will be negligible for the shareholders of a high-growth stock.

Moreover, a dividend is a long-term commitment. Once a company initiates a dividend, its shareholders expect to receive a regular dividend each quarter. In fact, they expect to receive a growing dividend year after year. Therefore, a company needs to achieve reliable earnings for many years before it initiates a dividend. As Lyft is very far from posting consistent profits for years, investors should realize that the company is very far from initiating a dividend.

As dividends are paramount for income-oriented investors, most investors in this category will likely avoid the stock. However, the rest of the investors should not dismiss the stock solely for the absence of a dividend. When a business has tremendous growth potential, management should focus exclusively on investing in the business in the best possible way and not be distracted with a meaningless dividend.

There are many examples of companies that have rewarded their shareholders with exceptional returns even though they have never paid a dividend. Amazon (AMZN), Google (GOOG) and Netflix (NFLX) have offered life-changing returns without paying a dividend to their shareholders. In fact, if they ever initiate a dividend, these stocks will plunge, as investors will conclude that the high-growth phase is coming to an end in such a case.

Of course, Lyft still has a long way to go to produce impressive returns, as the company is not likely to achieve positive free cash flows anytime soon. This separates Lyft from other free cash flow positive tech giants such as Amazon and Google, neither of which pays a dividend.

Final Thoughts

Lyft is growing its revenue at a tremendous pace and has exciting growth potential ahead. However, the company has a long way to go to achieve a meaningful profit, let alone consistent profits for years. Even if it achieves earnings for some years, it will probably need to continue investing hefty amounts in its business in order to keep growing.

Moreover, its stock will probably be trading at an excessive price-to-earnings ratio and as a result, would not be able to offer a meaningful dividend yield to its shareholders. As a result, Lyft is not likely to offer a dividend for the next several years at least.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more