Will Intel Stock Keep Soaring As Q4 Earnings Approach?

Image Source: Pexels

Even though Intel (INTC - Free Report) was once the world’s largest semiconductor company, the chip giant is on the cusp of an improbable turnaround.

Notably, Wall Street’s tone has flipped from “Intel is dying” to “Intel is back”.

Correlating with such, analyst upgrades and bullish commentary have piled up ahead of Intel’s Q4 results on Thursday, January 22.

This has pushed Intel stock to a two-year high of $50 a share, after trading at just $17 last April, its lowest point in over a decade.

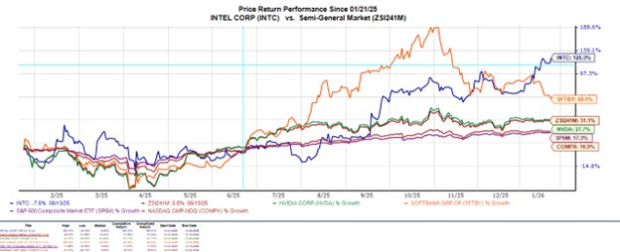

Intel’s revival has been led by major investments from the US government and even its long-time rival Nvidia (NVDA - Free Report), along with SoftBank (SFTBY - Free Report). Providing a lifeline, these investments and partnerships have helped stabilize Intel’s finances and validate its long-term strategy.

That said, the dramatic rebound in Intel stock is spurring the conversation of whether it’s time to buy into the latest rally, fade it, or hold INTC in the portfolio.

Image Source: Zacks Investment Research

Intel’s Q4 Expectations

Based on Zacks estimates, Intel’s Q4 sales are thought to have dipped 6% to $13.38 billion versus $14.26 billion in the prior year quarter. On the bottom line, Q4 EPS is expected to dip to $0.08 compared to $0.13 per share a year ago.

Despite the anticipated contraction, the excitement for Intel stock has been lifted by stronger-than-expected financial results. In its last four quarterly reports, Intel has posted an average sales surprise of 4.69% and a very impressive average earnings surprise of 577%. Intel most recently reported Q3 EPS of $0.23 in October, crushing expectations of $0.01.

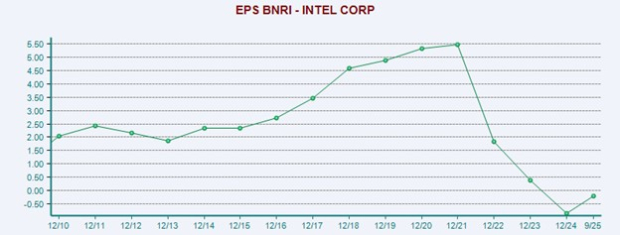

After posting a $18.8 billion loss in 2024 or -$0.13 per share, Intel is expected to round out fiscal 2025 with EPS at $0.34 despite annual sales being projected to decline 1% to $52.56 billion.

Image Source: Zacks Investment Research

Key Drivers to Intel’s Rebound

1. Strong Product Momentum

Intel’s launch of its Panther Lake PC platform is being treated as its most important product in years. Analysts see it as a sign that Intel’s multi-year technology delays are finally ending.

Panther Lake is a next-generation mobile PC architecture that is capable of complex on-device AI workloads and is built on Intel’s 18A process, the company’s most advanced manufacturing node to date.

2. Foundry Progress

With nodes being the manufacturing technology that helps build chips, Intel’s 18A nodes are at the center of its comeback narrative.

Intel’s 18A yields have surpassed 60%, a major milestone for a leading-edge node.

18A is drawing potential external customers outside of Nvidia, including reports that Apple (AAPL - Free Report) will use Intel Foundry to build chips starting in 2027.

Gaining Apple’s business would position Intel as a viable competitor to Taiwan Semiconductor (TSM - Free Report), which aligns with its goal of becoming the world’s second-largest circuit foundry provider by 2030.

3. Demand for Service CPUs

Intel is nearly sold out of server CPUs (Central Processing Units), a reversal from the oversupply issues that caused its stock to crash in 2023 and 2024.

Average selling prices for these CPUs could rise 10-15% due to demand outstripping supply for data center servers, with Intel seeing an increase in demand for consumer and laptop CPUs as well.

Analyst Upgrades

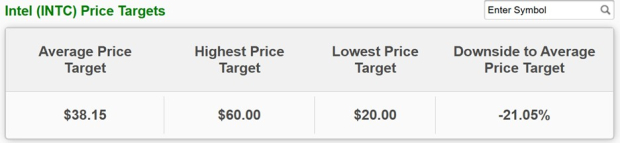

While Intel has blown past its current Average Zacks Price Target of $39.15, several analysts have recently upgraded their ratings and price tags for INTC.

This includes analysts at Citigroup, KeyBanc, TD Cowen, HSBC, and Seaport Research Partners. It’s noteworthy that Seaport has upgraded Intel stock from a hold to a strong buy, raising its price target for INTC to $65 on Tuesday. Seaport’s price tag would be the new street-high, with the firm citing PC recovery, manufacturing progress, and momentum in Intel’s foundry business.

Image Source: Zacks Investment Research

Monitoring Intel’s Valuation

The price-to-sales ratio (P/S) may still be the best way to track Intel's fundamental value to investors at the moment, rather than the P/E ratio. Keeping this in mind, INTC has drifted further above the often-preferred level of less than 2X forward sales, but is still beneath the S&P 500‘s 5.8X and the hefty P/S premiums that many chip producers can command.

Image Source: Zacks Investment Research

Regarding Intel’s earning potential, its multi-year EPS peak was $5.47 in 2021. At around $50 a share, an overly optimistic epiphany would value INTC at an attractive forward earnings multiple of less than 10X if it came near this pinnacle instead of current levels of 80X.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Intel appears to be making good on the $11 billion investment from the federal government, its largest shareholder. The United States' plan to secure and boost domestic chip manufacturing has made it enticing to keep Intel stock in the portfolio.

However, better buying opportunities could be ahead after such an exhilarating rally unless the chipmaker has blowout Q4 results and issues very promising guidance. For now, Intel stock lands a Zacks Rank #3 (Hold).

More By This Author:

Buy Netflix Stock For A Rebound As Q4 Earnings Approach?Buy Stock In The Top Investment Management Firms After Strong Q4 Results?

Is Capital One Stock Worth Owning Ahead Of Q4 Earnings?

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more