Will Earnings Estimates Finally Come Down?

Key points:

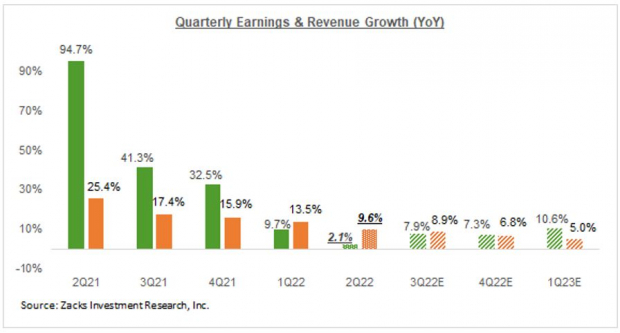

- For 2022 Q2, total S&P 500 earnings are expected to increase +2.1% from the same period last year on +9.6% higher revenues and net margin compression of 95 basis points.

- Excluding the hefty contribution from the Energy sector, total Q2 earnings for the rest of the S&P 500 index are expected to be down -5.2% on +7.4% higher revenues.

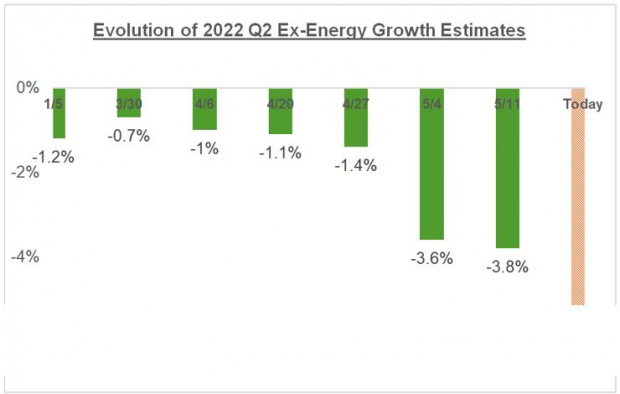

- Q2 Earnings estimates for the index as a whole are only modestly down since the start of the quarter, but they are down significantly on an ex-Energy basis.

- Looking at the calendar-year picture, total S&P 500 earnings are expected to be up +8.9% in 2022 and +9.0% in 2023. On an ex-Energy basis, total 2022 index earnings would be up +3.6% (instead of +8.9%, with Energy).

Part of the uncertainty in the market at present is related to how earnings estimates should evolve in an aggressive Fed tightening cycle. The market has a sense of what should happen to earnings estimates, but it isn’t seeing much of that just yet.

The natural order of things is that rising interest rates take the edge off of aggregate demand, causing the economy to start cooling off. Businesses start experiencing this changed ground reality in their normal operations, which shows up in their quarterly numbers and management’s guidance.

We have started seeing some of that already. For example, recent comments from homebuilder Lennar (LEN - Free Report) about the difficulty in providing its next-quarter outlook in a fast-evolving interest rate environment shows that this interest rate-sensitive part of the economy has already started to respond to Fed tightening.

We also heard recently from Microsoft (MSFT - Free Report) and Salesforce (CRM - Free Report) about the negative impact a strong U.S. dollar is having on their current quarter results. Earlier we saw a host of retailers, including Target (TGT - Free Report), Walmart (WMT - Free Report), and others come out with quarterly numbers that were weighed down by ongoing macroeconomic drivers like inflation, supply-chain issues, and moderating/shifting consumer spending trends.

It is way too early to tell how much estimates will eventually come down. As you can see in the chart below, estimates have hardly come down for Q2.

Image Source: Zacks Investment Research

A big reason for that ‘stability’ in the aggregate is what’s happening to Energy sector estimates, with rising earnings estimates for Energy companies offsetting declining estimates for others.

You can see that in the chart below which reproduces the aggregative revisions trend on an ex-Energy basis.

Image Source: Zacks Investment Research

We have a similar trend at play with estimates for the full year 2022.

Beyond Q2, the growth picture is expected to modestly improve, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

There is a rising degree of uncertainty about the outlook, reflecting a lack of macroeconomic visibility in a backdrop of Fed monetary policy tightening.

The Ukraine situation is exacerbating pre-existing supply-chain issues, which combined with its impact on oil prices, is weighing on the inflation situation in hard-to-predict ways. The evolving earnings revisions trend will reflect this macro backdrop.

Note: This is an excerpt from this week’s Earnings Trends report. You can ...

more