Will Chamath Finally Do A Deal For His IPOF SPAC? (19 Months Later)

Image Source: Unsplash

Much of the info I am going to write about is common and widely known:

Chamath Palihapitiya is recognized as a highly-successful entrepreneur and venture capitalist in the San Francisco Bay area. Palihapitiya, founded Social Capital in 2011 to invest in companies in health, financial services, and education.

Palihapitiya raised money so far for six special purpose acquisition companies known as SPAC's in 2020, SPCE with Virgin Galactic founder Richard Branson as well as RE firm OPEN Opendoor, Fintech SOFI, and CLOV Clover Health

Prior to founding Social Capital, Palihapitiya served on Facebook's (now Meta) vice president of operations in several capacities. He also is part owner of the NBA team The Golden State Warriors

Here is a link that explains how SPAC's work, how they raise money, and all the details I don't want to bore you with right now: Here

Now that you know some background, let me say this: In MY opinion, Chamath may be ready to announce a deal for either the 4th vehicle he has $ in IPOD or the 6th IPOF (All of his former deals have had similar monikers before they eventually change to the acquired companies name) IPOA IPOB IPOC and IPOE

These 2 SPAC's were formed in Oct 2020 and were designed to "do a deal" within 2 years or dissolve and return the capital they raised back to investors. With over $500 Million in IPOD and over a Billion in IPOF it is getting closer to the point where if they don't do a deal or announce an extension to the timeframe, then those dollars will be lost as an opportunity for Chamath to get another deal done. Again, in My POV, that just won't happen.

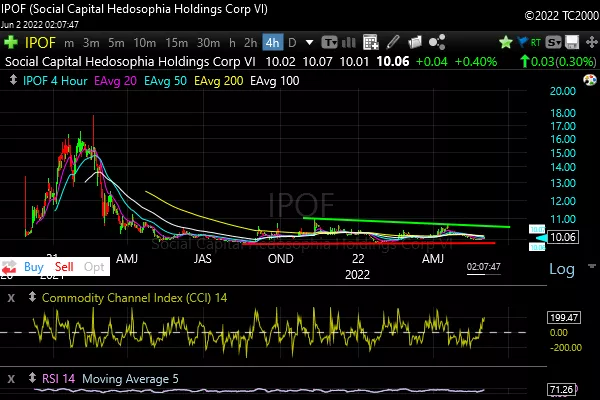

So many rumors of the kinds of deals that Chamath is working on have been floated on the internet, from him working with Elon Musk on Starlink or the Boring company, to Equinox fitness, to Impossible Foods to even Epic Games. I do NOT know IF any of these are workable because of the size of some of those targets or the reality that any deal is being worked on but what has made me write this article Now is the extreme volume that has come in on IPOF the past week. On Friday, May 27th over 14 Million shares traded, the 2nd highest ever and most in over a year, today, huge blocks going off again, and now over 12.5 million traded.

(Click on image to enlarge)

Normally, when rampant speculation starts, it is because of rumors or the reality that a timing issue may be at play with volume surges and large amounts of options volume, and heightened volatility readings. So far, the volume is there, the enhanced volatility is creeping up but I haven't (yet) seen extreme options volumes being traded. 5-7k volume is nice on a few strikes, but at prices of say $.10 an option that is Not a high $ value, and IMO it "doesn't count" as rampant spec with "real money". I'd like to see 30-50k options volume in Many strikes and over varied timeframes like the July and August periods as well.

There are also warrants for IPOF that are starting to rise (Now $.70 up $.10 today) and that is another way to play this.

So with IPOF at $10.06 right now I am already in the June 17th $10 calls at $.06 they are bid $.07 to $.08 which gives you the rights to all gains ABOVE $10 between now and June 17th

SO, IF and it is an "IF" there is a deal announced for IPOF and if the market deems it Good, it will push the price up. How high I do NOT know, but we have seen many SPAC deals that are well received in the market pop very nicely.

IF IPOF pops to say $14 as an example only, then these options I am in that are $.08 each now (means actually $8 each) will be a MINIMUM of $4.00 (which means $400)

$8 to $400 is what will happen to EACH option IF I'm right. We have 15 days for this to happen and if not, we may lose ALL or part or maybe the stock pops a little and this doubles, who knows.

For those who want more time for this to "possibly" play out, the July 15th $10 calls with 43 days of life left are now offered at $.14 and offer the same upside over $10 IF a deal is reached AND IF the market likes it.

Donald Trumps Truth Social merged with SPAC DWAC a few months ago and in TWO days went from around $10.50 to way over $100, so when I use $14 as a target, well, anything good can also happen. OR, anything bad can happen and nothing occurs and both of these options I have laid out, can lay an egg and lose ALL. Consider that before making any decision for your own account.

Those who know me, know that I DO hit grand slams once in a while, and here IMO is an opportunity for you to participate.

If anyone wants to see/read my trading ideas on twitter my handle there is: www.twitter.com/prosperousguy. The name of my feed is We Trade Setups.

I don't use Twitter. Do you plan to post more ideas here?

A plea deal?

Plea deal? Explain please.

Interesting stuff. I'm still not sure why SPACs are considered legit investment vehicles, and you posit that Palihapitiya will do a deal because he cannot afford not to for fear of losing his legitamacy and reputation. Perhaps...

Yes, "perhaps" as I do not know, only speculating on what he may do with my "risk" $.

Good read, thanks.

You're welcome, best of luck.

Before I jump on this, what are some of your other "grand slams" that you've profited on?

Remember, Grand Slams also come with strikeouts with the bases loaded. For me to list them all would be to tout that this one will be one of them. That said, for the helluvit the one I loved the most was $AIMT. They had a peanut allergy drug that the FDA approved and the stock was around $31-35 the day it happened. Nestle stepped up and bought 20% of the Co. for $31 in early 2020. Covid hit and many stocks got crushed and stayed there. Later in August the EU put out a report on how good the drug was as well as earlier in the Summer the FDA struck down a competitors drug attempt at peanut allergies. I said to myself "Here is $AIMT at $12.90 (Fri Aug 28th) and with no more potential competition as well as EU "loving" this drug, Nestle has got to step up and buy the rest of this Co." and I bought the Sep $15 calls for $.25 That Monday Nestle bought them out for $32.40 or so and I sold those calls for $19.10 roughly 71:1 payoff. I was shocked that I bought these calls on a Fri on a whim and the next trading day $AIMT was the #1 stock in the world for % gain. True story. I have MANY stories of the opposite as well, where I lost All, so these things do NOT happen often. Best of luck.

Makes sense, thanks for the reply.

This is good advice.

Speculative for sure, but you have to be in them Before a deal is announced, IF a deal will be announced.

Have any other tips?

Yes, I also like the SPAC $VYGG, story coming over the weekend. VERY speculative though..