Why We're Still Bearish On Ballard Power Systems

A) Introduction

It's been three months since the publication of our initial bear thesis on Ballard Power Systems Inc. (NASDAQ:BLDP), and it's time to review the risk-reward nature of the position now that the stock has fallen over 38% and hit new 52-week lows:

(click to enlarge)

B) Quick Review of Initial Thesis

The core thesis of the initial article rested on the fact that Ballard sports an extremely expensive relative valuation while remaining unprofitable and dependent on external financing for survival. The company's quarterly earnings releases had consistently been a disaster as well, with three straight misses on analyst consensus EPS estimates and two straight topline misses. Lastly, 'smart money' investors (i.e. institutional investors and short sellers) had been dumping stock. Overall, we concluded that the company was likely to underperform the overall market by 24.3% over the following 12 months. Recommended it as a strong short candidate.

C) Since Publication

On June 8th, Ballard's stock price briefly gapped up to $2.50 after Ballard announced a $10 million deal to deploy their technology in 33 buses in China. The euphoria surrounding the deal faded quickly as the stock price drifted lower in the weeks afterward before falling more than 30% after the company announced a secondary offering. The offering was for 8,125,000 million common shares at a price of $1.60. This offering price was more than 20% below the stock price at announcement time, and the dilution accordingly led to a steep fall in stock price.

D) Thesis Moving Forward

Moving forward, we still see significant downside in Ballard's stock price due to the same worries expressed in the previous report. First off, the company still has an extremely expensive relative valuation even though it has fallen over 40% in price. This is illustrated in the analytical table below, which ranks Ballard on five important valuation metrics relative to the market. Some may question using the market as a relative benchmark, but it's crucial to do so to avoid industry group bias. That bias can result in justifying the valuation of an expensive stock based on the frothiness of its peer competitors.

(click to enlarge)

With trailing twelve-month (TTM) sales of $64 million and a market cap of $186 million, Ballard currently sports a sales yield of 34.4%. This is well below the median sales yield of 56% and puts it in the bottom third of the market. Ballard's earnings yield is even grimmer at -10.15%, representing a TTM net income loss of $18.7 million. At the very least, the collapse in stock price has made Ballard's valuation relatively tolerable from a book value basis.

The same can't be said for Ballard's horrible free cash flow (FCF) yield of -8%, which is even worse than its previous FCF yield of -6% three months ago. This drop in FCF yield reflects the accelerating deterioration in Ballard's cash flow. Historical back testing shows that stocks ranked in the bottom 10% of the market by FCF yield have historically underperformed by over 5% a year.

On average, relatively cheap stocks have historically generated excess returns over relatively expensive stocks. Ballard is still a relatively expensive stock, ranking in the tenth percentile of all stocks according to our proprietary ranking system. Overall, our algorithms would expect an average stock with Ballard's relative value profile to underperform the market by 7.62% a year on average.

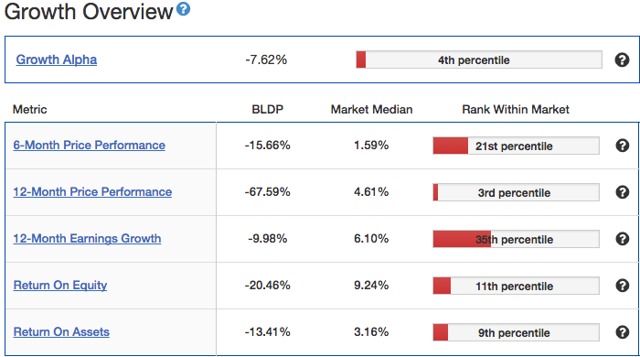

Next, we'll analyze Ballard's growth profile, concentrating on price momentum, earnings growth, and profitability:

(click to enlarge)

Ballard's price momentum remains horrible, as the stock remains in a firm downtrend. This is a bad sign for Ballard, as price momentum has historically been a strong predictive signal of future returns. The stock price has fallen 15.7% over the last six months, and 67.6% over the last twelve. During this same period, the average stock in the market gained 1.6% and 4.6%, respectively. Earnings growth remains a sore point as well, with TTM earnings 10% below earnings during the same period last year. Ballard remains extremely unprofitable, returning -20.5% on equity and -13.4% on assets. Both return rates fall right near the bottom of the market. Overall, our algorithms would expect an average stock with Ballard's relative growth profile to underperform the market by 7.62% a year on average. That puts it in the 4th percentile (bottom 4%) of the over 3,000 US listed equities our web application covers.

Next, we'll analyze Ballard's sentiment profile, concentrating on the recent activity of short sellers and institutions. Both of these are considered "smart money" investors that have an informational advantage over the average investor:

(click to enlarge)

Short selling currently makes up 6.5% of Ballard's total float, which is right in line with where it was during our initial article. This puts it in the 29th percentile of all stocks in the market based on level of short interest. While some may argue that this is a bullish signal and that the stock is susceptible to a potential short squeeze, history has shown short interest to be indicative of negative future returns. Short sellers tend to be much more sophisticated than the average market participant, and when a stock is as heavily shorted as Ballard it is a sign that the 'smart money' is betting on a collapse in price. Given Ballard's historical and recent performance, it looks like the short sellers are onto something. It is also noteworthy to note the 1.76% decrease in institutional ownership, which is also right near the bottom of the market.

The few remaining institutional investors left are also selling Ballard stock. It seems the 'smart money' investors are continuing to sell the stock. Overall, our algorithms would expect an average stock with Ballard's relative sentiment profile to underperform the market by 3.91% a year on average. That puts it in the 14th percentile (bottom 14%) of the over 3,000 US listed equities our web software covers.

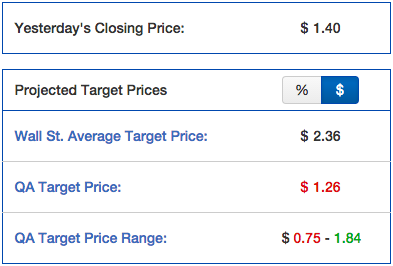

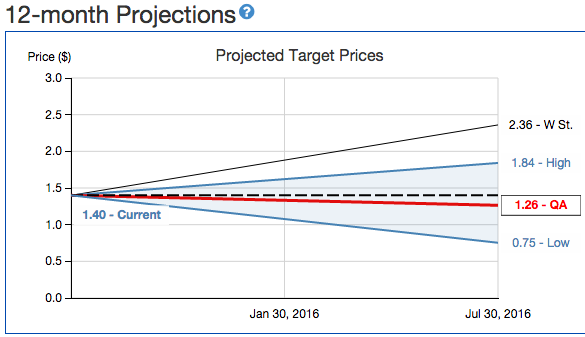

This brings us to our projected 12-month price targets. Our equity pricing model use historical back testing to predict the amount of "excess returns" (i.e alpha) a stock will generate. It combines this with the stock's beta to project a range of 12-month target prices. This range is expected to have a 75% area of accuracy (i.e. the stock price will be within the price range 75% of the time). These projections are shown below:

On our base case, the Quantified Alpha algorithms expect Ballard to decline from its current price of $1.40 to $1.26 over the next twelve months (representing a small decline of 10%). Our algorithms project a 75% probability that Ballard's stock price will be between $0.75 to $1.84 in 12 months.

These are much more sober projections than Wall Street analysts, who currently have an average 12-month price target of $2.36 (representing over 68% upside from current prices). Considering the long history of over optimistic analyst target prices, it would be wise to significantly discount their expectations.

E) Conclusion

At this point, we still think there is significant downside available in Ballard moving forward but wouldn't advise investors to short right now. The stock price is clearly in a downtrend, but it is also extremely oversold at the moment. Potential short sellers should wait till Ballard announces another big contract and gaps up in price off the news to initiate a short position. Those scenarios have historically been the best time to sell Ballard, as the stock tends to have strong, emotionally charged rallies off good news. This will significantly improve the risk-reward nature of the trade, and allow short sellers to get a better price.

We're going to be maintaining our short position (currently have January 15th $4 puts) for the time being, and may supplement the position by writing out-of-the-money naked calls if the stock price does indeed gap up.

Disclosure: The authors wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company ...

more

Some good stuff here, but pretty old. Have anything more current? Where can I read your most recent analysis?

Nice work @[Quantified-Alpha](user:5986), what's your take on the company now? Any updates?

Excellent article. Personally, I was very disapointed with the earnings call. I don't buy that things will be getting better for the company any time soon.