Why Wall Street's "Most Accurate Analyst" Expects Another Market Correction Before Year-End

Two weeks ago we dubbed Morgan Stanley's Michael Wilson, the bank's chief US equity strategist, Wall Street's most accurate forecaster. Here's why:

Over the past year, Morgan Stanley's Michael Wilson has done something virtually none of his colleagues have been able to do: he called market moves correctly before they happened and also timed the market's inflection points with uncanny precision: turning bullish at the depths of the March crisis, when most of his peers were apocalyptic, then remaining bullish until just over a month ago.

This is when he warned "brace for a very difficult trading environment over the next five weeks" - which followed with the early September tech dump - and then two weeks after he again correctly predicted that US stocks were due for their second 10% correction in as many months, as 'investors were a bit too complacent on the uncertainty surrounding the election outcome, unlikely passage of a fiscal stimulus before the election, and second wave of COVID-19." The S&P 500 has indeed fallen 9% while the Nasdaq and Russell 2000 have fallen 10% and 7%, respectively.

He was, again, right. Then, at the start of November, he reversed his bearish bias, when, as we reported, he predicted that 'the correction we expected is now mostly finished and adding to equities on further weakness this week is recommended.'

Since then, the S&P is up +13.5% to a new all time high, the Nasdaq is up +10.8% also to a record high, and after today's Pfizer news, the Russell has exploded 16% higher. In short, he was right again.

As we also pointed out, just ahead of the Pfizer (PFE) vaccine news, Wilson said he remained a "committed bull" even though the S&P had broken above his price range of 3,150 to 3,550. Although with the index having faded much of its record gains in the past two weeks, it now appears that most of the positive news associated with a COVID-19 vaccine has been priced in.

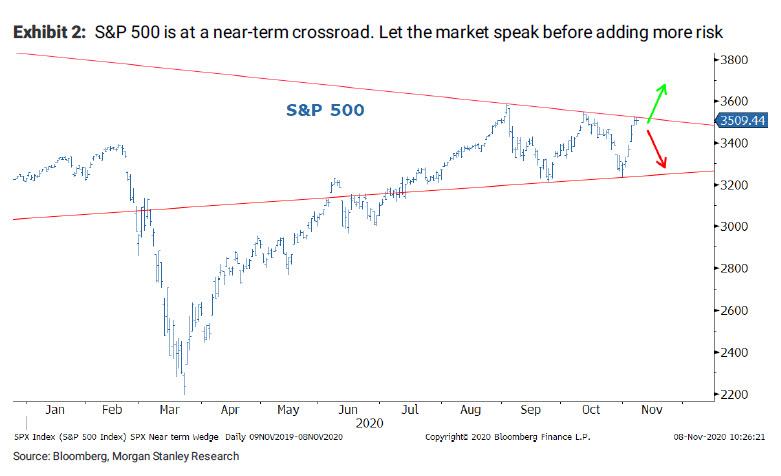

The biggest question, however, is whether now that the resistance trendline has been broken, does Wilson think it's time to take profit or go even longer? The answer is two-fold.

As Wilson writes in Morgan Stanley (MS)'s latest "Sunday Start" note, his target over the next 12 months is another 10% upside in the S&P, "as earnings continue to surprise on the upside, thanks to better top-line growth next year combined with extraordinary operating leverage – a typical feature of the first year coming out of a recession."

However, at the same time, he also cautions that in the near-term he sees the risk of yet another drawdown in stocks, which would be the third 10% correction since September. This will be catalyzed by the market's realization of the news that "the vaccine won’t be ready for mass distribution for another three-four months as case counts and deaths increase."

Still, once this small correction is in the rear view mirror, which perhaps may even trigger additional Fed easing during the December FOMC meeting when the Fed is expected to extend the maturity of its TSY purchases, Wilson remains "a steadfast bull on a 12-month view in terms of both the earnings outlook and the market."

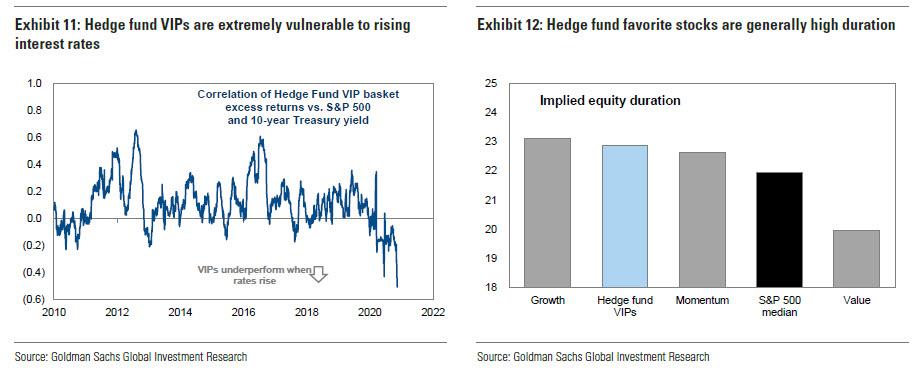

But perhaps Wilson's most important point is not that stocks may or many not dip before grinding higher, but his conviction that rising 10-year yields will hit tech stocks and other equities with record-high duration, while propping up cyclical and value names.

To wit:

With our economists forecasting 7.5% nominal US GDP growth next year, a 1% 10-year Treasury bond looks awfully mis-priced on a 12-month view. This has implications for equity valuations, especially longer-duration ones like the Nasdaq and S&P 500.

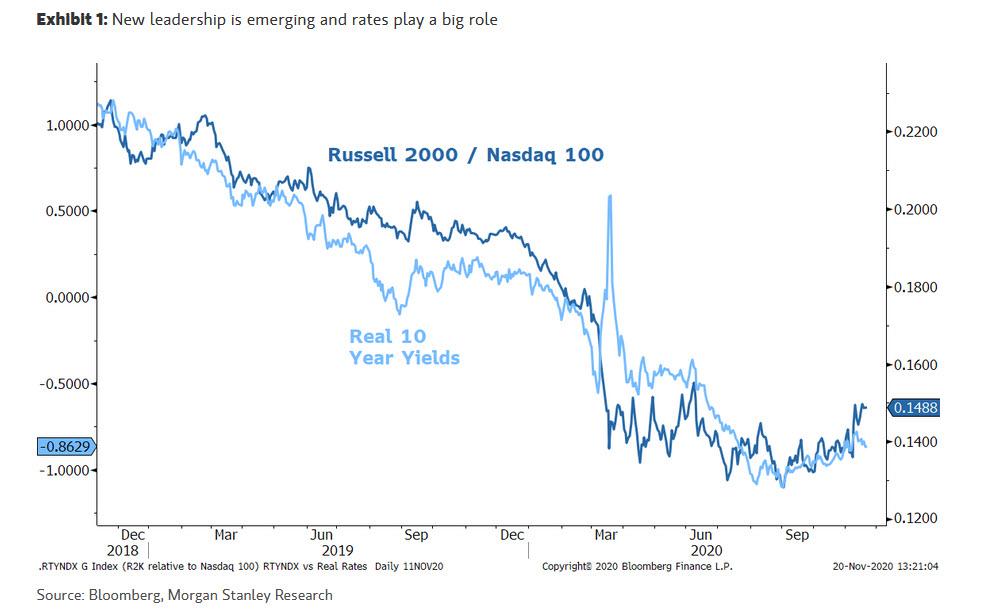

Conversely, shorter-duration cyclical stocks should get a boost from better growth and higher interest rates – hence the rotation we have been witnessing in the equity markets from the Nasdaq to the small-cap Russell 2000 over the past few months as markets contemplate a full reopening of the economy. We think this rotation has further to go if we are right about the economy and rates.

This means that "the real opportunity next year for investors is likely to take place below the surface in smaller-cap stocks that have greater sensitivity to what is likely to be a very strong economic recovery. Along these same lines, financials, consumer services, materials, industrials, and cyclical technology stocks should do best."

The bottom line is to look for 10% upside to stocks from here, or what is roughly in line with expectations from Goldman and JPM. However, the upside will take place not under the leadership of the mega tech names which benefited from plunging real rates, but on the back of cyclical names.

And while we appreciate Wilson's insight, it is very difficult to envision how the broader stock market can rise if the handful of "hedge fund VIP" names, which just happen to be the largest companies in the world in which everyone is invested, are aggressively sold off in the coming quarters after leading the market to all time highs for the past decade.

Below we repost the full note from Michael Wilson, which is titled "Trusting the Cycle."

November is the month when our macro team gets together to discuss its year-ahead outlooks across all asset classes. It’s a rigorous two-week process that allows us to collaborate and think about the next 12 months rather than the next 12 hours.

As a strategist, I’m always torn between trying to forecast the next year versus the next week, and quite frankly I look forward to thinking about the longer term. However, with a US election this month and an ongoing global pandemic, this year’s process presented some unique challenges.

The 12-month view is often easier to map out than the very short-term outlook because it comes down to things that can be analyzed and forecast – namely, earnings and interest rates. While flows, sentiment or positioning may dominate stock prices in the short term, the value of a stock is ultimately determined by earnings and valuation, which is heavily dependent on interest rates.

On both counts, our calls this year have been highly consistent. We’ve been well ahead of the consensus on the recovery story and specifically on earnings. We have also been more bearish than consensus on bonds, especially long-dated ones, where we think rates are likely to head meaningfully higher next year.

Last week, we got more good news that supports these views. Moderna announced that its COVID-19 vaccine was 94.5% effective in trials, and the final analysis showed Pfizer’s vaccine to be 95% effective. The initial reaction in equity markets to Moderna’s release was bullish, but more muted than after the initial Pfizer announcement of 90% efficacy. Interestingly, none of the major large-cap US averages are currently trading above their levels immediately after Pfizer’s first announcement on November 9. Yet, the small-cap Russell 2000 is higher.

Effective vaccines are exactly what the doctor ordered to get the economy fully reopened next year. Furthermore, they’re also what’s needed for greater participation in the economy from citizens who remain wary of contracting the disease. That’s the good news. The bad news is that the vaccine won’t be ready for mass distribution for another 3-4 months as case counts and deaths increase. This juxtaposition feeds directly into our short- versus long-term dilemma when thinking about our 2021 outlook.

With US equity markets a bit exhausted at the moment, I see the risk of one more drawdown before year-end. Nevertheless, I remain a steadfast bull on a 12-month view in terms of both the earnings outlook and the market. New bull markets that coincide with a new economic cycle last for years, and the business cycle trumps the political one.

In S&P 500 terms, we forecast 10% upside over the next 12 months as earnings continue to surprise on the upside, thanks to better top-line growth next year combined with extraordinary operating leverage – a typical feature of the first year coming out of a recession. While 10% upside is attractive, the real opportunity is in small-caps and stocks that can deliver the operating leverage we expect.

With our economists forecasting 7.5% nominal US GDP growth next year, a 1% 10-year Treasury bond looks awfully mispriced on a 12-month view. This has implications for equity valuations, especially longer-duration ones like the Nasdaq and S&P 500.

Conversely, shorter-duration cyclical stocks should get a boost from better growth and higher interest rates – hence the rotation we have been witnessing in the equity markets from the Nasdaq to the small-cap Russell 2000 over the past few months as markets contemplate a full reopening of the economy. We think this rotation has further to go if we are right about the economy and rates (Exhibit 1).

Bottom line, as we look forward to a more normal year in 2021, we expect US equities to remain firmly in a bull market. In the near term, stocks are elevated and may have to contemplate a second wave in the absence of a fiscal deal and before the vaccines can be widely distributed.

The real opportunity next year for investors is likely to take place below the surface in smaller-cap stocks that have greater sensitivity to what is likely to be a very strong economic recovery. Along these same lines, financials, consumer services, materials, industrials and cyclical technology stocks should do best.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Many thanks Tyler. Stay safe

Many Christmas to you and family too