Why Retail "YOLO" Activity Has Collapsed: $346B In Capital Gains Tax Due On Monday

One of the biggest differences in the market between now and a year ago - aside from the elephant in the room of course is that in 2021 the Fed was all-in on easing because "inflation was transitory" and now the Fed is trying to pull off a Volcker, having realized it was dead wrong about inflation - is that in 2021 retail investors dominated marginal price setting, whether it was through forced short squeezes of illiquid stocks, or simply redirecting stimmy checks into high-beta names, while in 2022 they appear to have taken a back seat.

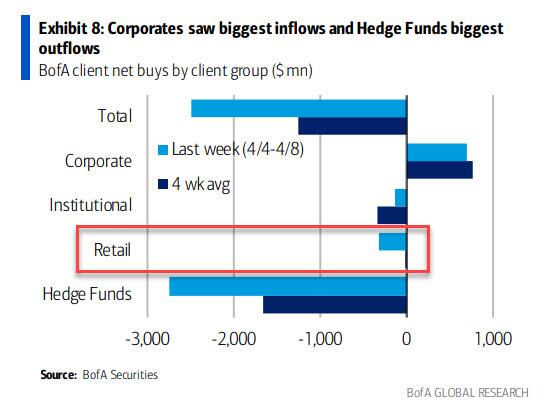

To be sure, retail investors have remain far more bullish - and active - than hedge funds, who have liquidated much of their long exposure in recent months...

(Click on image to enlarge)

... but overall retail activity has been far more muted than in 2021, and as we noted last week, even retail flows finally turned negative as "the last market bull capitulated."

What may have caused this recent reversal in retail sentiment? According to Goldman flow trader Scott Rubner, the answer is simple: taxes.

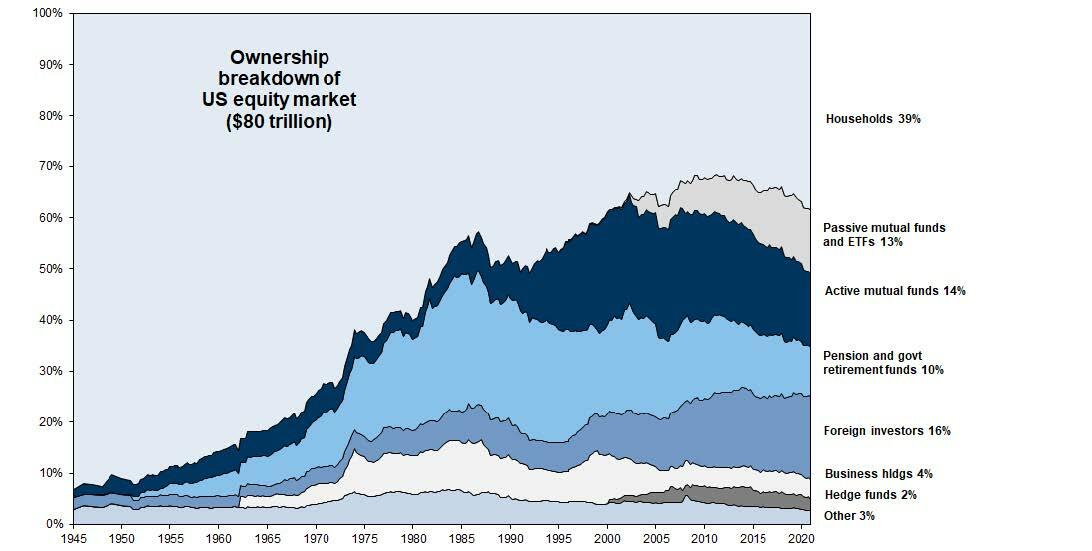

As Rubner writes in the latest edition of Goldman's "Two Minute Views", US Households own 39% of the US equity market and 20x more exposure than hedge funds, and yet this largest owner of equities has slowed their trading activity ahead of April 18th tax deadline.

(Click on image to enlarge)

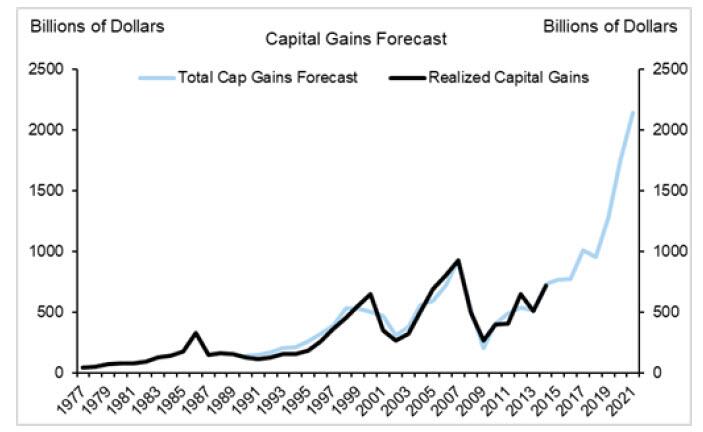

Why? According to Goldman, there is a record $2.14 Trillion worth of realized capital gains in 2021, which means a record capital gains tax bill of $346 Billion due on Monday. Putting it in context, this tax bill exceeds last year’s prior record of $270 Billion by 28%.

According to Goldman, this resembles trading activity from 2021, and because of that the bank is optimistic that we are about to see a resurgence in bullishness: "retail traders saw a resurgence on call option activity during the second half of April after taxes were paid."

Will this time be different?

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more