Why Optimism Beats Pessimism In The Long Term, Always

Image Source: Unsplash

There was a bit of green on my screen yesterday morning. Nothing spectacular, mind you…but I said I’d take it for as long as it lasts. Why? Because the markets are forward-looking, and no matter how small the buying pressure may start out, it will ultimately blossom,

Many folks think running away is the smarter move. But, in reality, the biggest profits go to those who lean into the fight. And it’s not just me who says so.

Warren Buffett says, “the time to be greedy is when others are fearful.” The late Sir John Templeton, who is widely regarded as one of the greatest stock pickers of all time, said the best time to buy is at “points of maximum pessimism.”

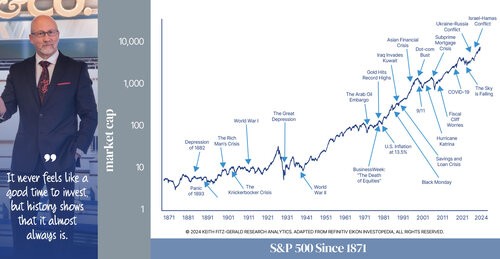

My take? Investing in optimism beats cowering in pessimism. And the numbers bear that out.

One other thing: The super-smart Liz Claman invited me Tuesday to talk tariffs, Apple Inc. (AAPL), and Tesla Inc. (TSLA) as we launched into the last hour of trading.

It's tempting to run for the hills — and I get why you might. But do so at your own risk. Apple has returned 534% over the past decade. And Tesla? Try 1,570%. Meanwhile, the S&P 500 has clocked in at just 139% over the same period.

History shows two things very clearly: A) Great companies occasionally get put on sale, and B) That’s not your cue to run. It’s your signal to lean in and add, using the right tactics, of course.

More By This Author:

Silver: Take Advantage Of The Recent Correction To Buy

Aegon: A High-Yielding, Deep-Discount Play In The Financial Sector

Markets: How Much More Will The Averages, Bank Stocks Sink?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more