Why I Own Splunk Stock

Splunk (SPLK) reported better than expected earnings on Thursday, and the stock was rising after hours. The most recent earnings report from Splunk could be a game-changer in terms of dissipating investor concerns about the company, potentially providing a key catalyst for the stock price to keep moving higher.

A Major Catalyst For Splunk

Splunk is a top player in software for data analytics, an industry offering tremendous opportunities for growth over the long term. But the company is changing its business model, moving away from perpetual licenses and focusing on recurrent cloud-based revenue.

This new business model will provide more visibility to investors going forward, but it can also have a negative impact on cash flows in a particular quarter. Even if the fundamentals have remained solid, cash flows have been under pressure over recent months, and this has been weighting on the stock price.

On June 14, I published an article entitled Buying Opportunity In Splunk Stock. The main thesis in such an article was that the uncertainty due to the business model transition was creating an attractive entry price in Splunk, as the market was being too shortsighted.

From such an article:

Splunk stock is under selling pressure lately, mostly due to a negative reaction from investors to the company's most recent earnings report. The company is growing at full speed but cash flows are disappointing because Splunk is transitioning towards a business model more focused on recurring revenue, which has negative implications on cash flow generation in the short term.

Over the long term, however, management is leading the company in the right direction, and temporary weakness seems to be presenting a buying opportunity for investors in Splunk.

Importantly, the data from the most recent quarter confirms that the business keeps firing on all cylinders, with both earnings and sales numbers exceeding Wall Street expectations and management raising guidance for the full year.

If the most recent earnings report from Splunk can finally dissipate the concerns surrounding the company, it could provide a major catalyst for the stock price to move higher over the coming months.

Splunk Keeps Firing On All Cylinders

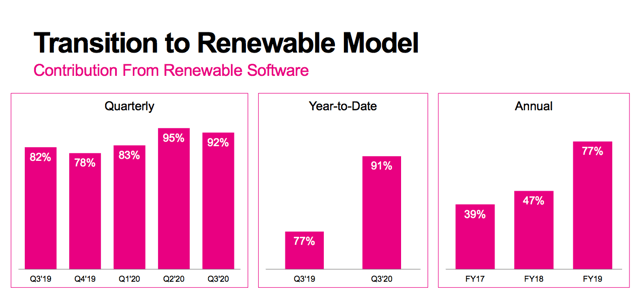

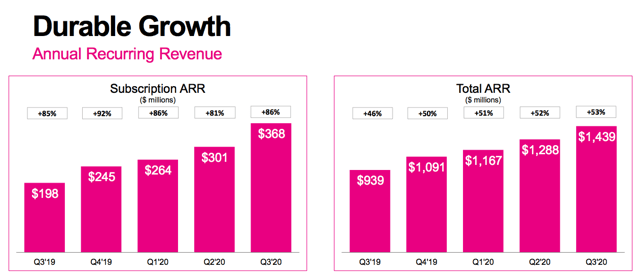

The transition towards a renewable revenue model is practically complete, and annual recurring revenue - ARR - increased by a vigorous 53% last quarter. By all accounts, it looks like the company is moving in the right direction.

(Click on image to enlarge)

Source: Splunk

Some notable highlights from the report:

- Total revenue reached $626 million, up 30% year-over-year.

- Software revenue reached $454 million, an increase of 40% year-over-year.

- Cloud revenue increased by 78%.

- Non-GAAP earnings reached 58 cents per share, up by 52%

- The company raised its guidance for revenue in the current year by $50 million.

- Splunk expects Non-GAAP operating margin to be around 23% of revenue in the coming quarter.

- Splunk signed 440 new enterprise customers during the quarter.

- As of the end of the quarter, Splunk has over 450 issued patents and over 650 pending patent applications.

- In the past 2 years, the company has more than doubled the size of its R&D team.

- Splunk has closed the acquisition of 8 new companies since September 2017 and it has committed a $150 million venture arm to invest in the wider data ecosystem.

(Click on image to enlarge)

Source: Splunk

CEO Douglas Merit explained in the conference call how data is becoming an enormously valuable resource across all kinds of industries and organizations:

We believe data is the answer to many of the world's most pressing problems and its greatest opportunities. It also represents a necessary strategy for all organizations to thrive, let alone survive, in this new paradigm. From improving corporate performance, to optimizing government responsiveness, to fighting crime, to medical research, to firefighting or to the rollout of Porsche's new electric car, we believe every problem is a data problem, and our customers think so, too.

According to estimates from IDC, digital transformation investments are projected to reach over $1 trillion in 2019, and they're expected to reach $6 trillion in 4 years. Splunk is already a provider to over 90 of the Fortune 100 companies, and it has over 19,000 customers across all kinds of sectors.

In other words, the company is in the right position to benefit from massive growth opportunities in the years ahead.

The Stock Is Reasonably Priced

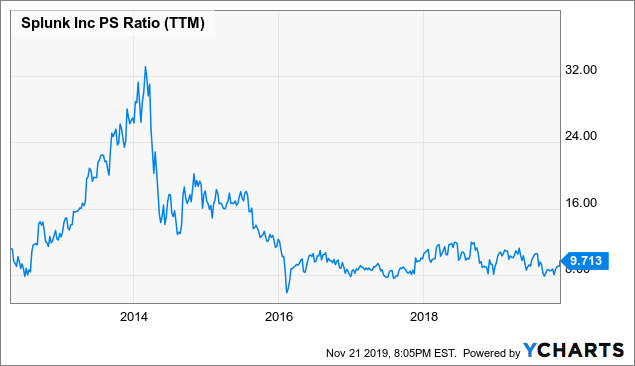

High growth stocks in the software as a service sector generally trade at elevated valuation levels. In the case of Splunk, the price to sales ratio has been much higher in the past, and the stock is still trading at valuation levels that are not too far away from the low end of the valuation range.

(Click on image to enlarge)

Data by YCharts

The table below shows the average revenue estimates and the forward price to sales ratios for Splunk in the coming five years based on these estimates. Even when expecting a material deceleration in revenue growth rates, the stock is not too expensive at all if the company manages to meet those estimates.

(Click on image to enlarge)

Source: Seeking Alpha Essential

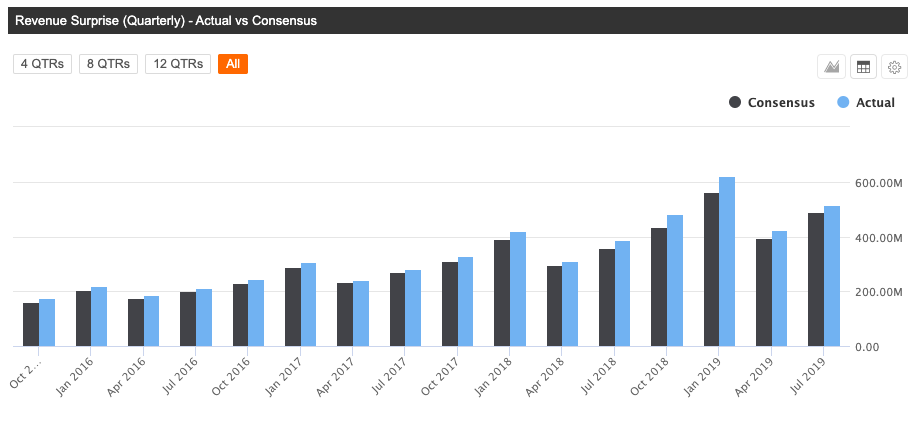

Speaking of which, Splunk has an outstanding track record of not only beating but also surpassing Wall Street expectations. The chart shows the expected revenue figures and the actual reported numbers in the past 16 quarters, and Splunk has delivered above expectations in each of those quarters.

(Click on image to enlarge)

Source: Seeking Alpha Essential

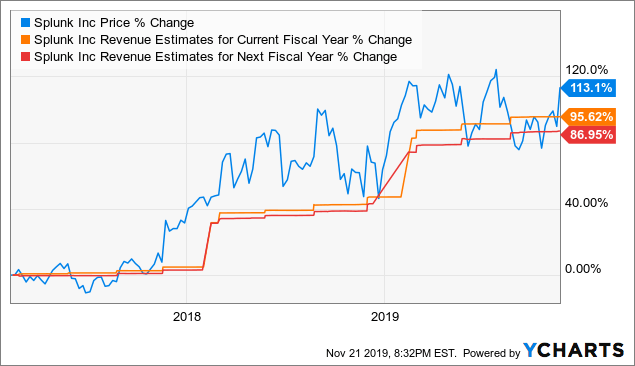

With the company typically outperforming expectations, Wall Street analysts keep running from behind and increasing their earnings forecasts for Splunk. If the price to sales ratio is going to remain constant, rising earnings expectations should push the stock price higher too.

(Click on image to enlarge)

Data by YCharts

Past performance does not guarantee future returns, but winning companies tend to keep on winning over time, and Splunk management seems to have the healthy habit of providing conservative guidance numbers and then outperforming expectations. As long as this trend remains in place, it could be a strong tailwind for Splunk stock.

Risk And Reward Going Forward

Splunk operates in a very dynamic industry prone to technological disruption. Success attracts the competition, and it makes sense to expect the company to face growing competitive pressure from multiple fronts in the years ahead. With this in mind, investors in Splunk stock should keep an eye on the competitive landscape in order to make sure that the company is still at the forefront of the data revolution.

Since the company is aggressively investing for growth, profit margins, and cash flows tend to be hard to predict in the short term. This can be a source of volatility on the stock price on a quarterly basis.

Those risk factors being acknowledged, Splunk is a top-quality growth stock with plenty of potential for expansion in the years ahead. Companies in the sector generally trade at expensive valuation levels, but Splunk is not overvalued at all for such an outstanding business.

Splunk is a position in my own portfolio. With the stock rising strongly after earnings, it makes sense to be patient when building a position. However, the long-term investment thesis in Splunk is stronger than ever, and any pullback or price consolidation down the road should be considered a buying opportunity.

Disclosure: I am/we are long SPLK.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more