Why I Own PayPal Stock

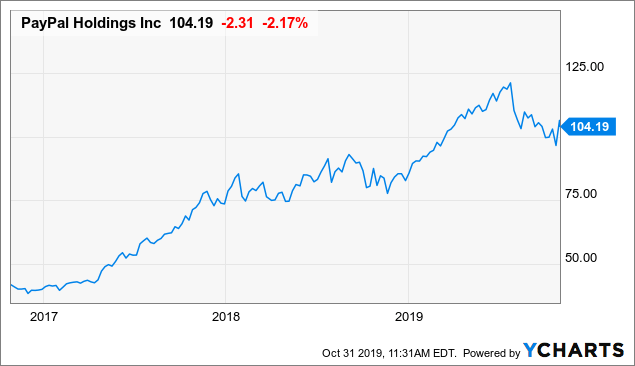

PayPal (PYPL) stock has been quite volatile in the past year. The company is up by more than 25% year to date, but it has also declined by almost 15% from its highs. From that perspective, we could say that PayPal stock is in a long-term uptrend and not too overbought in the short term.

(Click on image to enlarge)

Data by YCharts

Looking at the fundamentals, the company keeps growing at full speed as of the most recent quarters, it continues thriving operationally, and valuation is not excessively high for such a high-quality business.

PayPal Keeps Firing On All Cylinders

PayPal had announced fairly conservative guidance numbers in the second quarter, for this reason, investors have been cautious about the stock leading to the third-quarter results. But the company dissipated those concerns with remarkably strong numbers across the board. Both sales and earnings for the third quarter outperformed expectations, and forward-looking guidance was also quite solid.

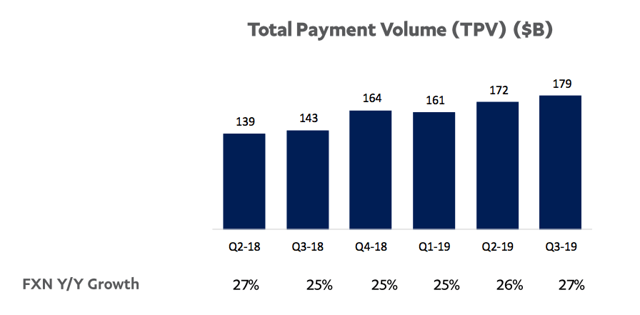

Revenue came in at $4.38 billion during the period, an increase of 19% versus the same quarter in the prior year. For the first time ever, PayPal processed over 1 billion transactions per month in the quarter, up 25% year-over-year to 3.1 billion transactions. Total payment volume (TPV) growth accelerated 80 basis points from last quarter and was up 27% on an FX-neutral basis, to $179 billion.

(Click on image to enlarge)

Source: PayPal

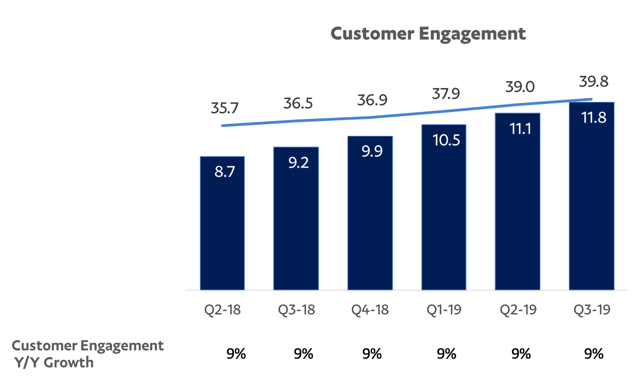

The company added 9.8 million net new active accounts during the quarter, bringing total active accounts to 295 million. PayPal processed 9.8 payment transactions per active account on a trailing twelve months basis, up 9% and showing that engagement levels keep moving in the right direction.

(Click on image to enlarge)

Source: PayPal

Venmo keeps growing at full speed. The company processed more than $27 billion in volume for the quarter, growing by 64% year over year. That's almost $300 million in payments per day and an annual run rate that now exceeds $100 billion for Venmo.

PayPal delivered more than 200 basis points of operating margin expansion on both a GAAP and a non-GAAP basis. On a non-GAAP basis, operating income in the third quarter grew 30% and it exceeded $1 billion for the first time.

All in all, PayPal is delivering rapid revenue growth, gaining new users and increasing engagement levels across those users. Revenues are outgrowing expenses, so profit margins are expanding. Both in terms of operational and financial performance, the numbers look pretty good.

Reasonable Valuation

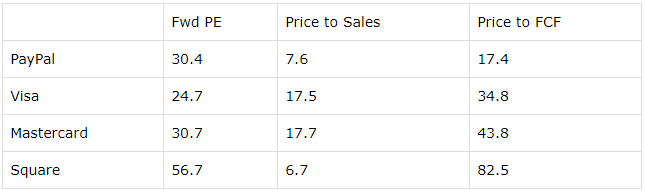

PayPal stock is not particularly cheap, but it is not overvalued either when considering the company's growth potential. Successful players in the payment industry generally trade at above-average valuations because of the remarkably attractive opportunities offered by the payments revolution.

In that context, PayPal stock is reasonably priced in comparison to other companies in the sector. The table below compares forward price to earnings, price to sales, and price to free cash flow for PayPal versus Visa (V), Mastercard (MA), and Square (SQ).

(Click on image to enlarge)

Source: Seeking Alpha Essential

It is important to keep in mind that valuation is always dynamic as opposed to static. Ratios like forward price to earnings are calculated on the basis of earnings expectations in the year ahead. If the company can consistently deliver numbers above expectations and those expectations tend to increase over time, then the stock price needs to rise too in order for the valuation to remain stable.

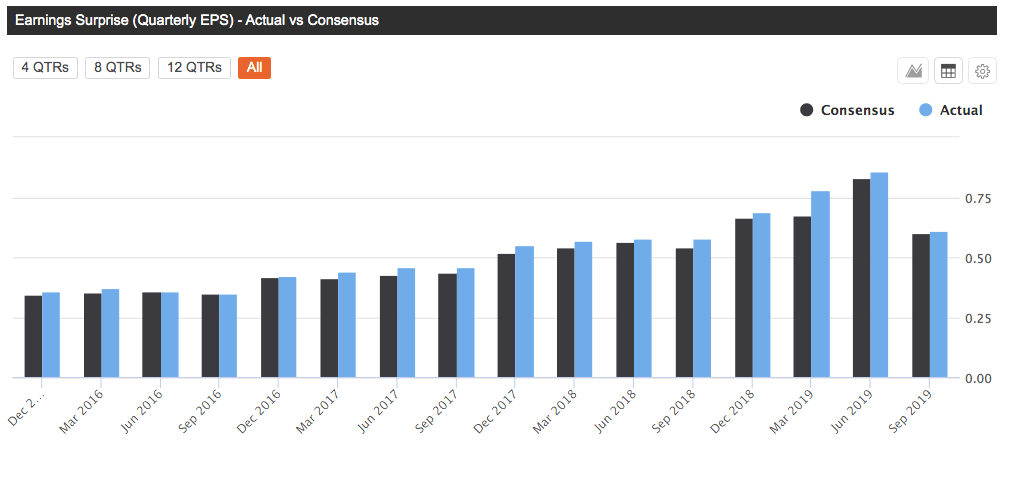

PayPal has an impressive track record in that area, the company has delivered earnings above Wall Street estimates over the past 16 quarters in a row. The chart below shows the consensus earnings estimates and the actual reported numbers for the company over those periods.

(Click on image to enlarge)

Source: Seeking Alpha Essential

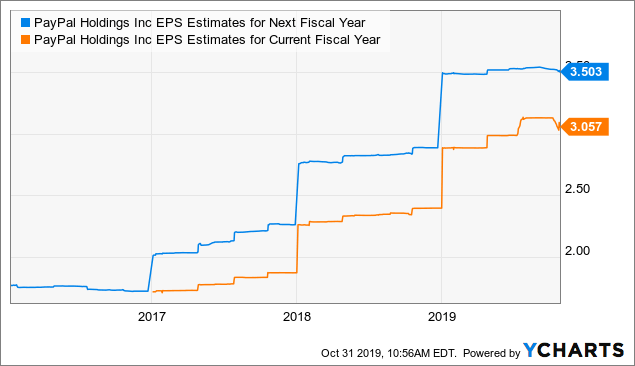

The chart shows how earnings estimates for PayPal in both the current fiscal year and next fiscal year have consistently increased over time. This can be a powerful tailwind for the stock as long as earnings estimates keep moving in the right direction.

(Click on image to enlarge)

Data by YCharts

Valuation needs to be analyzed in the context of other return drivers. A company producing strong growth rates and consistently delivering earnings above expectations deserves a higher valuation than a business producing mediocre financial performance and underperforming expectations.

PayPal is very reasonably priced in comparison to other stocks in the sector, and the company is remarkably solid in terms of both financial performance and its track record of consistently outperforming expectations. With this in mind, current valuation can be considered attractive for such a high-quality business.

Risk And Reward Going Forward

The company operates in a very dynamic industry, and it faces competition from big and powerful players coming from both the financial services and technology industries. In addition to this, all kinds of smaller companies in the fintech space are trying to gain ground in the market.

PayPal is making the right moves by building alliances with several of the top players in the sector, and the company has solid competitive strengths powered by the value of its network. That said, competitive risk is always a factor to keep in mind for a business operating in a high growth market prone to technological disruption.

Now that PayPal is expanding into China, it's worth noting that the government in China tends to benefit local players such as Alipay and WeChat, and regulatory risk all over the world can have a considerable impact on a company operating in such a sensitive industry and dealing with valuable information.

Those risks notwithstanding, PayPal is a high growth business consistently outperforming expectations and trading at valuation levels that are not unreasonable at all for such a high-quality stock. As long as management continues leading the company in the right direction, PayPal stock looks well-positioned for attractive returns going forward.

PayPal is a position in both my own portfolio and The Data-Driven Portfolio since I replicate such a portfolio with my personal money. The stock was purchased at $68.5 per share in July of 2017 and we now have a big gain of more than 78% on the name.

In spite of such a strong appreciation, I think it still makes sense to hold on to PayPal's stock over the long term since the company has enormous potential for growth and valuation is not excessive at all. For those who don't have a position in PayPal, it makes sense to start building one, and any pullback down the road could be considered an opportunity to buy more as long as the fundamentals remain intact.

Disclosure: I am/we are long PYPL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more