Why I Own Mastercard Stock

Mastercard (NYSE: MA) has delivered spectacular returns for investors over the years. The stock has gained over 1,080% in the last decade, far surpassing the S&P 500 index and its cumulative gain of 175.8% in the same period.

MA data by YCharts

Past performance does not guarantee future returns, of course. But high-quality companies with solid competitive strengths tend to keep on winning over time, and Mastercard has what it takes to continue producing outstanding performance in the years ahead.

A High-Quality Business

Second only to Visa (NYSE: V), MasterCard is one of the most powerful and globally recognized brands in the payments industry, a business in which brand recognition and trust are key strategic advantages.

The network effect creates a virtuous cycle of sustained growth and increasing competitive strength for MasterCard. In a nutshell, the network effect means that the value of the service increases as it gains more users over time. The telephone and the internet are textbook examples, and the payments industry works under the same dynamic.

Merchants need to accept the debit and credit cards that can bring more customers to the stores, and customers want to have a card that is accepted everywhere. This means customers and merchants attract each other to the main card networks, and this makes the network more valuable over time.

MasterCard is not only getting bigger when it grows in size but is also getting stronger from a competitive point of view, while also creating more value for customers and merchants. The payments industry still offers massive opportunities for growth in the years ahead. Visa calculates that replacing cash and checks with cards is worth nearly $17 trillion in annual spending around the world.

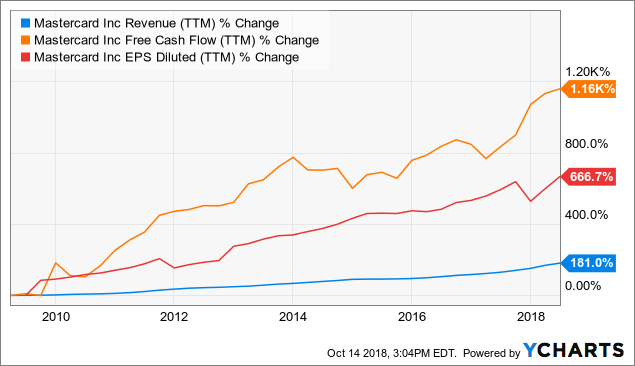

Financial performance over the long term has been truly exceptional. Back in the year 2008, Mastercard was producing $4.99 billion in revenue and $240 million in free cash flow. Fast forward ten years and the business is generating $13.96 billion in sales and $5.52 billion in free cash flow on a trailing twelve-month basis.

The chart below shows how key financial metrics such as revenue, free cash flow, and earnings per share have evolved in the past ten years.

MA Revenue (TTM) data by YCharts

Most of the direct costs of doing business in a particular region are related to the technological infrastructure necessary to process payments, so costs are relatively fixed and profit margins tend to increase with revenue growth. For this reason, Mastercard retains almost 54% of revenue as operating profit, and free cash flow margin is in the neighborhood of 40% of sales.

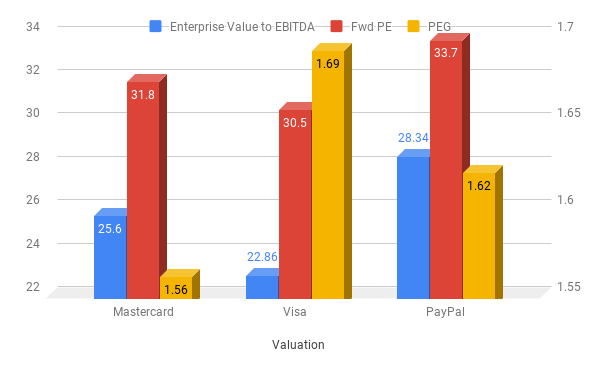

Expensive, But Not Overvalued

It's one thing to say that a stock is expensive, meaning that it is priced at a premium versus the broad market, and a very different thing to say that such stock is overvalued in comparison to its fundamental quality. In other words, superior quality deserves an above-average valuation, and Mastercard is clearly a high-quality stock in a remarkably promising industry.

The chart below compares valuation ratios such as enterprise value-to-EBITDA, forward P/E, and price-to-earnings growth for Mastercard versus other players in the payments industry like Visa and PayPal (Nasdaq: PYPL). The numbers clearly show that Mastercard stock is priced in line with industry standards.

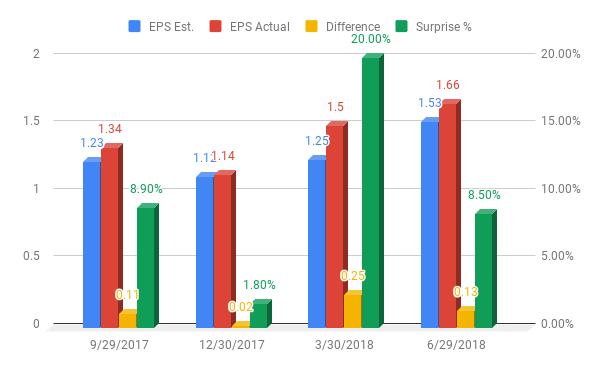

Importantly, the company has an impressive track record in terms of delivering earnings numbers above Wall Street expectations. The chart below shows earnings expectations, the actual reported number, and the difference between the two - both in absolute terms and as a percentage - over the past several quarters.

Stock prices don't reflect a company's fundamentals in isolation. Expectations in comparison to those fundamentals can be even more important. If the company is reporting better-than-expected financial performance, this can be a powerful upside fuel for the stock price.

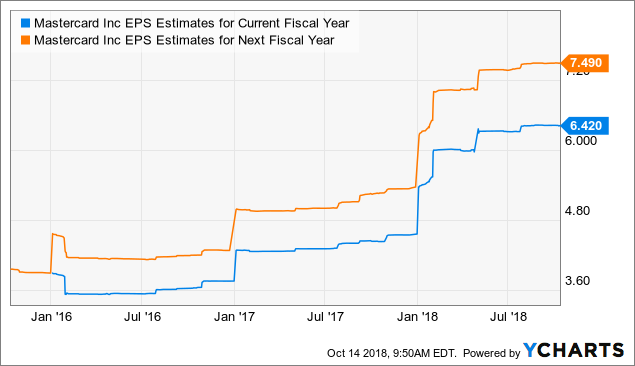

Wall Street analysts have consistently underestimated Mastercard's ability to generate profits over the years. The chart below shows how earnings expectations for the company in both the current year and the next have materially increased over time.

MA EPS Estimates for Current Fiscal Year data by YCharts

If Mastercard continues to beat expectations in the years ahead, this would make its valuation figures more attractive than what current numbers are indicating.

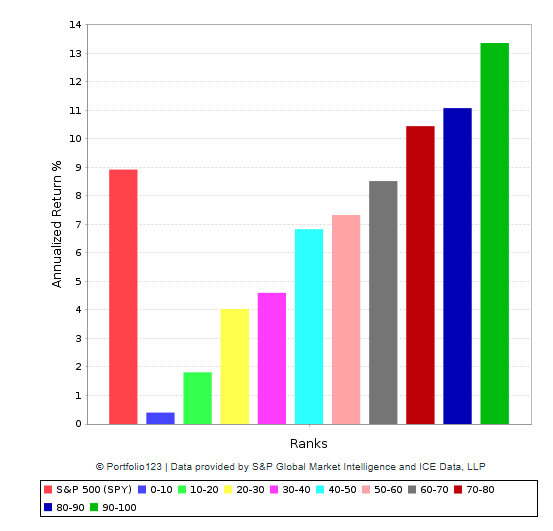

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor". This system basically ranks companies in a particular universe according to quantitative return drivers such as financial quality, valuation, fundamental momentum, and relative strength. The system has produced solid performance over the long term. The chart below shows the annualized returns for companies in 10 different PowerFactors ranking buckets since January of 1999 in comparison to the SPDR S&P 500.

There is a direct relationship between the PowerFactors ranking and annualized returns, meaning that companies with higher rankings tend to produce superior returns, and vice-versa. In addition, stocks with relatively high quantitative rankings tend to materially outperform the market over the years.

Data from S&P Global via Portfolio123

Mastercard is among the best 10% of stocks in the market based on the quantitative algorithm. This means that the stock looks clearly attractive when considering quantitative return drivers such as financial quality, valuation, fundamental momentum, and relative strength in combination.

Historical performance does not guarantee future returns, and performance numbers for quantitative systems should always be interpreted with caution, since the future is always a matter of possibilities and probabilities as opposed to certainties.

Because of its own nature, a quantitative system is always backward-looking. This means a system can tell you that a specific group of companies with certain quantitative attributes has a good chance of delivering market-beating returns over long periods of time, but it does not tell you much about a particular stock.

When it comes to Mastercard, the stock is priced for demanding growth expectations, so it's vulnerable to the downside if the company fails to deliver in accordance with those expectations.

Besides, the industry is particularly dynamic and prone to technological disruption. Big players from the technology sector, such as Apple (AAPL), Google (GOOG) (GOOGL), and Alibaba (BABA), are increasingly venturing into digital payments.

Companies in the sector seem to be inclined to making profitable alliances and playing nice with each other as opposed to savagely competing for customers and earnings. As long as this remains the case, the size of the market opportunity should be big enough for both card operators and tech players to benefit substantially from the death of cash over the years and decades ahead. Nevertheless, it’s important to monitor the industry in case competition becomes more aggressive, which could have a negative impact on margins.

Legal and regulatory risk is perhaps the most important risk factor to watch for in Mastercard. The company operates in a market with few big players and limited competition, and it generates extraordinary profitability. This makes of it an easy target for politicians and lawyers trying to impose limitations and new regulations on the business.

Those risks being acknowledged, Mastercard is a world-class business with rock-solid competitive strength and outstanding profitability. As long as the fundamentals remain strong, chances are that the company will continue to deliver market-beating returns in the years ahead.

Disclosure: I am/we are long MA, PYPL, AAPL, GOOG, GOOGL, BABA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have ...

more

So why Mastercard over Visa?