Why I Own Alibaba Stock

The trade war is generating considerable uncertainty around Alibaba (BABA) stock, but the company is still firing on all cylinders in spite of the challenging environment. Current financial performance is rock-solid, and the company has plenty of room for growth in the long term. Even if the stock carries some very particular risks, the upside potential could more than compensate for those risks in the years ahead.

Alibaba Keeps Growing At Full Speed

The trade war and the economic deceleration in China have generated some concerns around Alibaba stock, but the most recent financial report from the company should dissipate those concerns to a good degree.

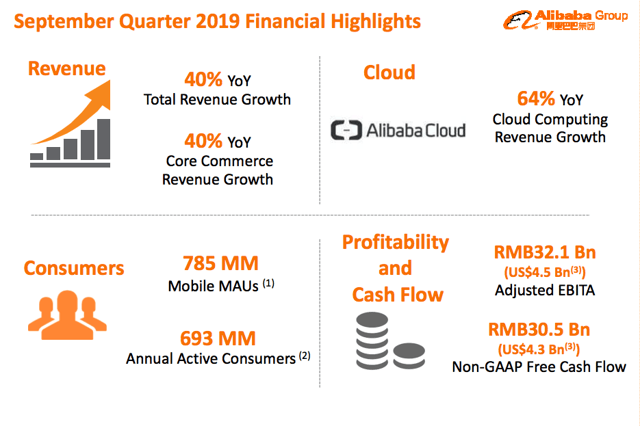

Some key highlights from the report:

- Revenue was RMB119,017 million (US$16,651 million), an increase of 40% year-over-year.

- Annual active consumers on the company's China retail marketplaces reached 693 million, an increase of 19 million from the 12-month period ended June 30, 2019.

- Mobile MAUs reached 785 million in September 2019, an increase of 30 million over June 2019.

- Income from operations was RMB20,364 million (US$2,849 million), an increase of 51% year over year.

(Click on image to enlarge)

Source: Alibaba

Management highlighted two main trends that should provide plenty of opportunities for growth in the years ahead. To begin with, China's economic growth trajectory is shifting, and the country is increasingly focusing on consumption as a major economic growth engine.

China retail sales reached around RMB30 trillion in the first nine months of 2019 growing at 8.2% year over year. This outpaced the overall GDP growth rate of 6.2%. More importantly, online e-commerce is the key driver of China consumption, growing at 17%.

In addition to this, IT spending in China for Internet companies amounts to around $80 billion, while the spend for public sectors and the various industries is over $300 billion according to estimates from Alibaba. This represents a huge opportunity for the company in areas such as cloud computing and big data.

Alibaba Looks Undervalued

Wall Street analysts are on average expecting Alibaba to make $7.35 in earnings per share next year, under this assumption the stock is trading at a forward P/E ratio around 24. Revenue is expected to be $73.51 billion, which puts the price to sales ratio at 6.25. Coming from a high growth business that has just reported a 40% increase in revenue, these metrics look quite attractive.

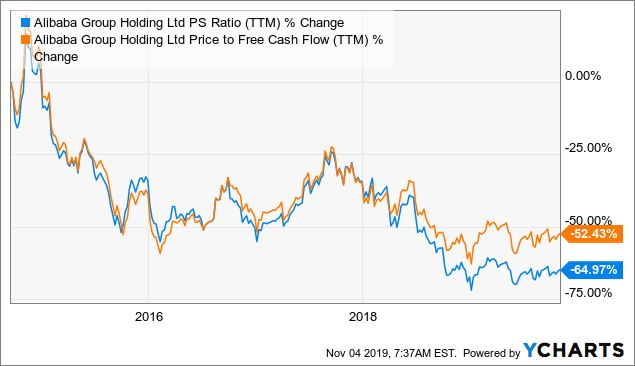

Looking at metrics such as price to sales and price to free cash flow, Alibaba stock is trading at a big discount by historical standards for the company. This is quite interesting since the company has been able to sustain rapid revenue growth over time.

(Click on image to enlarge)

Data by YCharts

You can many times expect a contraction in valuation ratios as a company matures and growth slows down over the years. In the case of Alibaba, it is very reasonable to expect a deceleration in growth going forward, since it's not easy to maintain vigorous growth from such a gargantuan size.

That said, if you are looking for an explanation of why Alibaba is much cheaper than it used to be, you won't find it in the company's current financial performance. Valuation has come down because investors are scared about the trade war and its possible impact on Alibaba stock in the short term, and this could be creating a buying opportunity over the long term.

The following table can be a great tool to put forward-looking valuation in perspective. Data shows the average earnings per share estimate, the expected increase in earnings and the forward P/E ratio implied by those earnings expectations.

It's easy to see that Alibaba looks quite attractively priced in the long term if the company delivers in accordance with those expectations.

(Click on image to enlarge)

Source: Seeking Alpha Essential

Risk And Reward Going Forward

A position in Alibaba carries some very particular risks. To begin with, investors buying Alibaba in the US market are not directly buying shares in the company but in a VIE - Variable Interest Entity - which operates using contractual agreements as opposed to direct ownership.

Some analysts have expressed concern about the possibility that China could decide to rip-off global investors by declaring VIEs illegal or something like that. This does not sound like a very likely scenario, even in the context of the trade war. China is trying to expand its global influence as an economic powerhouse, and it would have a lot to lose by making such an irrational move. In my humble opinion, the chances of something like this happening are quite low.

But we still need to consider the fact that the Chinese government can have a considerable influence on Alibaba, both directly through regulations and indirectly via political pressure and negotiations.

Besides, the accounting rules in China are not as strict as in the US, and Alibaba has a complex balance sheet, with lots of investments and acquisitions over the past several years. None of this means that Alibaba is cooking the books, of course, but the risk of some kind of restatement or something more serious is higher in the case of Alibaba than in the typical US company.

In the middle term, the trade war negotiations and the economic data coming from China can create some volatility around the stock. But it is very encouraging to see Alibaba delivering impressive growth rates under challenging conditions. This speaks well of the company and its ability to continue delivering in all kinds of environments.

Any short-term weakness in the stock price due to macro conditions should be a buying opportunity, but investors still need to acknowledge that Alibaba stock could be affected by headline risk in the short term.

The main point is that those risk factors are already incorporated into valuation levels. Considering the company's growth rates and future opportunities, it's not much of a stretch to say that Alibaba is undervalued by the market.

Risk factors cut both ways, it is not too hard to envision a scenario in which Alibaba's valuation ratios are expanding if the trade war enters some kind of impasse and/or if the company continues sustaining solid growth rates in spite of the economic uncertainty.

In order to focus on the big picture, it can be enlightening to think about the risk and reward trade-off over the long term. Alibaba is growing very rapidly and trading at more than reasonable valuation levels. If you think about what will happen with returns over 3, 5 or even 10 years, chances are that investors in Alibaba will get well rewarded.

Disclosure: I am/we are long BABA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more