Why ConocoPhillips Stands Out As A High-Resilience Upstream Player

Image: Bigstock

Key Takeaways

- ConocoPhillips holds a global portfolio across 14 countries with key U.S. shale basin assets.

- ConocoPhillips can sustain operations at break-even costs as low as $40 per barrel WTI.

- The company's debt-to-capitalization ratio of 26.4% reflects stronger resilience than peers.

ConocoPhillips (COP - Free Report), a leading player in the upstream sector, boasts a diversified asset base spread across 14 countries. Notably, the company holds a strong portfolio of assets in the shale basins of the United States, including the Delaware Basin, Midland Basin, Eagle Ford, and Bakken shale.

The company stands out among leading exploration and production players due to its diversified asset portfolio that supports low-cost production. The company's advantaged inventory position in the U.S. enables it to sustain operations at a break-even cost as low as $40 per barrel WTI.

Furthermore, ConocoPhillips' balance sheet strength enables it to weather unfavorable pricing environments. ConocoPhillips has a debt-to-capitalization ratio of 26.4%, which is significantly lower than the sub-industry average of 49.1%. By the end of the second quarter, ConocoPhillips had $5.7 billion in cash and short-term investments, which demonstrates its strong liquidity position.

The company’s low-cost asset portfolio, which includes the advantaged U.S. shale basin assets, enables it to sustain profitability even during unfavorable commodity price environments. Furthermore, its strong balance sheet with low leverage positions it to navigate commodity price volatility more effectively than many of its peers.

Leveraging Low Debt and Quality Assets: EOG Resources and Exxon Mobil

Like ConocoPhillips, EOG Resources (EOG - Free Report) and Exxon Mobil Corporation (XOM - Free Report) can withstand commodity price volatility better than many of their peers.

EOG Resources is a leading independent exploration and production company with operations focused on the prolific acres in the United States, as well as several resource-rich international basins. The company has a debt-to-capitalization ratio of 12.66%, which is significantly lower compared to the composite stocks belonging to the industry.

Exxon Mobil Corporation is a global integrated energy firm with a strong presence in the Permian Basin of the United States and the Starbroek Block offshore Guyana. These resources are crucial to Exxon Mobil's upstream production and profits. The company has a debt-to-capitalization ratio of 11.06%, which is significantly lower compared to the composite stocks belonging to the industry.

ConocoPhillips Stock's Price Performance, Valuation & Estimates

Shares of ConocoPhillips have plunged 15% over the past year compared with the 17.1% decline of the industry.

Image Source: Zacks Investment Research

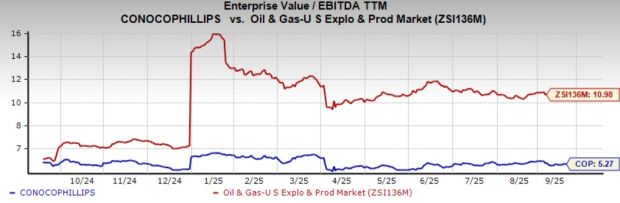

From a valuation standpoint, ConocoPhillips trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 5.27x. This is below the broader industry's average of 10.98x.

Image Source: Zacks Investment Research

It should be noted that the Zacks Consensus Estimate for the company’s 2025 earnings has been revised downward over the past 30 days.

Image Source: Zacks Investment Research

As a final note, ConocoPhillips, Exxon Mobil, and EOG Resources all carry a Zacks Rank #3 (Hold) rating at the moment.

More By This Author:

5 Stocks To Buy From The Prospering Life Insurance Industry3 Electronics Stocks To Buy From A Prospering Industry

Nuclear ETFs Soar YTD Under Trump Regime, Top 2024 Performance

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more