Why Are Top Analysts Obsessed With These 3 Disruptive Stocks?

TipRanks covers the latest market activity on over 5,000 stocks from eight different sectors. Here we focus in on three particularly interesting stocks. These are stocks that have the power to disrupt- and have significant backing from the Street. All these stocks have a ‘Strong Buy’ rating from the best-performing analysts- and big upside potential from the current share price. Indeed, Amazon (Nasdaq:AMZN) recently caused shock-waves with its snap takeover of retail store Whole Foods. Now, according to CNBC, the company is in preliminary talks about entering the lucrative drug purchasing market. But AMZN is just one of the stocks we cover- so let’s take a closer look at all three stocks now:

Amazon

This is arguably the Street’s number 1 stock right now and the ultimate disruptor of various industries. In the last three months the stock has received an incredible 32 buy ratings and just 1 hold rating. The average analyst price target of $1,271 suggests upside potential of 9.4%. Bear in mind that in just three months, AMZN has already spiked from $965 to the current share price of $1,162.

Last week, Amazon held its much-hyped cloud conference AWS re:Invent 2017 in Las Vegas. The company unveiled a whole host of new AI-based products- including Amazon Translate, a service for translating text from one language into another. Andy Jassy, the leader of Amazon Web Services, also highlighted how AWS is crushing its rivals in its breadth and depth of services.

Following the five-day event, analysts quickly ramped up their price targets. Top Wells Fargo analyst Ken Sena boosted his price target from $1,430 to $1,525. The new price target indicates 31% upside and is the stock’s highest price target yet. He highlighted three key reasons to be bullish on AMZN right now: 1) the ‘very successful’ AWS event 2) ‘record breaking’ holiday sales data; and 3) the increasing likelihood that Amazon “ultimately becomes a disruptor” in healthcare via the generic pharmaceutical business.

Meanwhile MKM Partners’ Rob Sanderson reiterated his view that Amazon represents “the best long-term growth story available to large-cap investors today.” He expects continued expansion from Amazon’s AWS cloud business over the coming quarters. Click on the screenshot below for further insights into these ratings.

CymaBay Therapeutics

From consumer giant Amazon, we turn to innovative biopharma CymaBay Therapeutics (Nasdaq:CBAY). CBAY is currently trialing its key product candidate seladelpar. This is a potent orally active PPARδ agonist for patients with the autoimmune liver disease, primary biliary cholangitis (PBC). Seladelpar poses a ‘disruptive threat’ according to top Leerink analyst Joseph Schwartz. He notes that physicians are optimistic despite relatively limited interim clinical data. Based on this analysis he ramped up his price target from $12 to $16 (83% upside potential).

Similarly, top HC Wainwright analyst Ed Arce likes the fact that the drug has shown no serious adverse side effects and has even reduced itchy skin. He continues: “In our view, these beneficial features put seladelpar in a very favorable position over OCA [from rival Intercept Pharmaceutical] because it addresses both the efficacy and tolerability issues… we affirm our Buy rating on increased confidence in the approvability and market potential of seladelpar.”

Check out below how CBAY boasts 100% Street support with six recent back-to-back buy ratings. Over the last three months, share prices have exploded by 43%. Nonetheless, analysts believe that CBAY can spike a further 65% to reach $14.50 within the year.

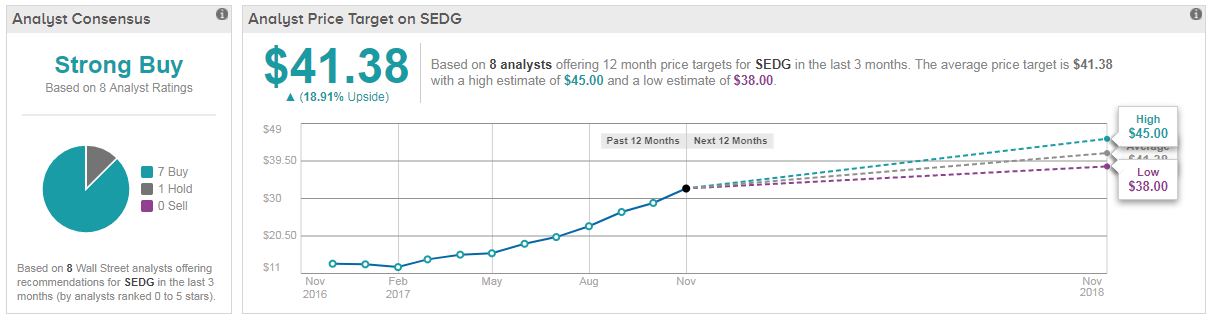

SolarEdge Technologies

SolarEdge Technologies (Nasdaq:SEDG), a leader in solar energy products, has just delivered very impressive third quarter earnings results with ‘near flawless’ execution. For example, SEDG reported record revenue of $166.5M, ahead of guidance of $155M to $165M. Plus the company took share in virtually every market — the US, Europe, Australia, etc.

“We’re staying buyers as this innovator is delivering what growth investors want – big revenue and margin upsides/guides (with the added benefit of solid cash flow)” comments top Canaccord Genuity analyst John Quealy.

He warns that the stock could experience some politics-linked volatility given President Trump’s final import tariff decision on January 12. However, Quealy concludes “we stay constructive given the company’s disruptive technology share gains in solar power, strong cash profitability and move into ancillary power quality/reliability conversion markets more broadly (plus valuation range is on the lower end for an emerging growth name in this tape, in our view).”

His $40 price target suggests 15% upside potential. Note that Quealy has a very strong track record on this stock. TipRanks reveals that across 8 SEDG ratings he scores a whopping 100% success rate and 84% average return.

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more