Why A Cautious Market Will Eye Key S&P 500 Support Levels

Image Source: Unsplash

Market Wrap

Despite forecasts seeing anywhere from 200,000 to 300,000 workers dropping off federal government payrolls, markets were focused on technology to start the week. This put pressure on not just the Technology sector but also Utilities, which have increasingly become tied to tech due to the forecasted data center/AI electricity generation supply/demand imbalance. Technology led sectors lower, down 1.43%, followed by Utilities, which gave back 0.50%. The remaining sectors ranged from Healthcare, which gained 0.81% as drug makers remained buoyed by the absence of the FDA’s price-fixing lawsuit, to Industrials which fell 0.45%, led by Uber (UBER) contributing to just under 30% of that sector’s move.

Broad equity indexes followed their expected path, given the various levels of technology exposure. The Nasdaq Composite fell 1.21%, the S&P 500 dropped 0.50% and the Dow ended the day 0.08% higher. Small caps, as they often do, marched to their own drummer but still ended the day down 0.78%.

The Tematica Model Suite saw Market Hedge beat by only one other model, Guilty Pleasure. Shake Shack’s (SHAK) 6.35% gain helped push that strategy ahead as food delivery provider Just Eat Takeaway.com announced it will be acquired by Prosus, potentially expanding Shake Shack’s distribution footprint. Overall, Monday wasn’t as bad a day as Friday, but there are those wondering if Friday was an isolated event or the start of something else. Volatility ended the day higher as the VIX neared a 19 handle which is higher than near-term levels but not in flashing signal territory just yet.

Why a Cautious Market Will Eye Key S&P 500 Support Levels

Futures indicate another weak start to the trading day, but readers will want to revisit those figures once Home Depot (HD), Dillard’s (DDS), and other consumer facing companies have reported their latest quarterly results. Following weaker than market consensus guidance from Walmart (WMT), you’ll want to be mindful of Home Depot’s outlook, including the split between new construction and repair & remodel spending, but also what it says about tariffs. Its comments could be rather timely given comments from President Trump in the last 24 hours that scheduled to hit Canada and Mexico on March 4 were “on time” and “moving along very rapidly.”

Last week’s Flash February PMI data from S&P Global and the University of Michigan year ahead inflation expectations reading for February showed the initial impact of tariffs and related concerns on the US economy. Should we see those proposed tariffs on Mexico and Canada do go into effect, investors will be bracing for an even greater impact when March data is published in April. Recognizing we have a bit of a ways to get there, today we’ll be looking to see if the February Consumer Confidence data echoes the findings in last week’s Michigan inflation data. Those reports will frame the comments from Fed speakers making the rounds this afternoon and tomorrow ahead of Friday’s January PCE Price Index report. Given the developments described above, we continue to think those findings will be viewed more rear-view-mirror-ish than not.

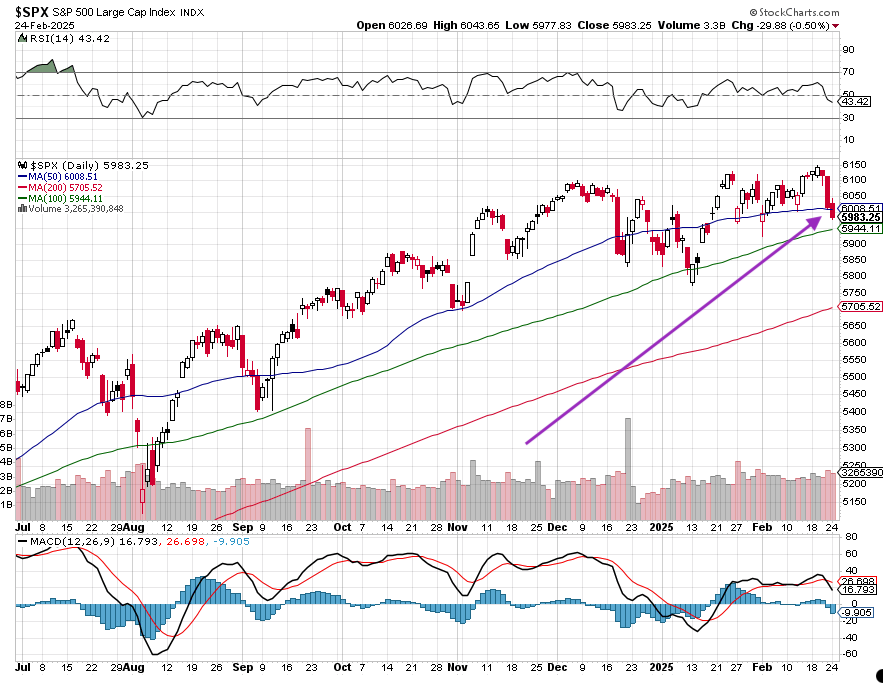

Turning to the market, we can’t help but notice the S&P 500 closed last night below its 50-day moving average. Traders are likely to see that as a signal for caution, and looking to see if the S&P 500 rallies and successfully tests that support line or trend even lower toward the 100-day moving average. Should the February Consumer Confidence figures come in much lower than expected and confirm tariff as well as inflation concerns, traders will be looking to see if the S&P 500 breaches the 100-day support level at 5,955.11.

With that in mind, barring developments out of Washington and the Trump administration, the next focal point for the market will be Nvidia’s (NVDA) latest earnings report and guidance after Wednesday’s market close. Given recent DeepSeek headlines and speculation that Microsoft (MSFT) may be dialing back its data center expansion plans, something Microsoft pushed back on last night, Nvidia will need to deliver results that re-assure the market a robust AI driven ramp remains ahead. Because we are once again in an environment when even a modest weakness in a company’s results or guidance can punish its shares, Nvidia will need other deliver a meaningful beat and raise quarter. If not, because NVDA shares are the second largest holding in the S&P 500 and Nasdaq Composite, a disappointing report could be a catalyst for the market to continue its move lower.

Market Hedging model anyone?

More By This Author:

Is The Market Facing A Flashing Yellow Or Red Light?Reciprocal Trump Tariffs To Trump January PPI Data

What Will Powell Say On Inflation And Tariffs Today?

Disclosure: None.