Which S&P 500 Stocks Are The Most Liquid?

The S&P 500 index and its corresponding ETF — SPX and SPY respectively — are the most liquid underlying that you can trade.

But does that mean that all individual equities that are members of the S&P 500 are liquid?

If you are just buying or selling the stock, then yes any of them would be liquid.

However, if you are trading options, then the option liquidity and the spread between the bid price and the ask price will be a factor.

The TastyWorks platform provides an options liquidity measure that ranks liquidity from one star to four stars with four stars being the most liquid.

Not all stocks in the S&P500 are liquid enough to ideally trade options with.

For example, Transdigm Group (TDG) has only one-star liquidity, which is not liquid enough for options trading.

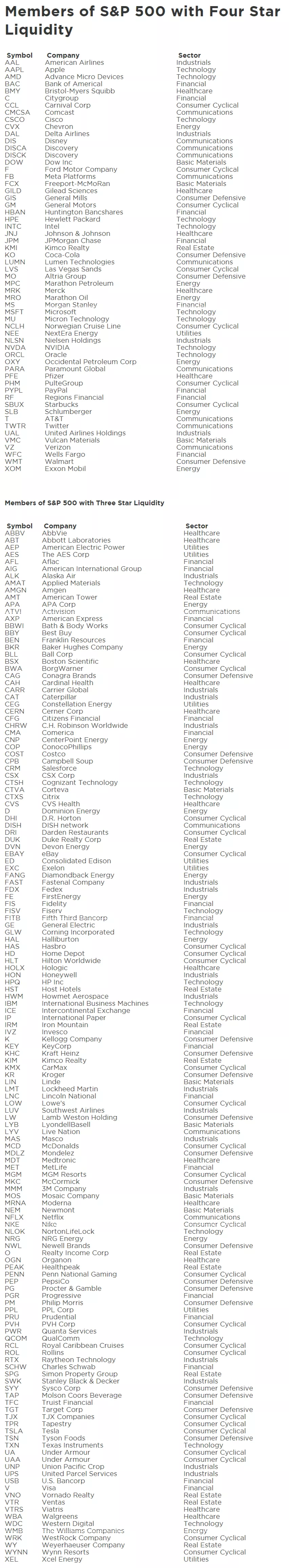

Fortunately, there are 58 symbols that are part of the S&P 500 that has the most liquid rating of four stars. And 145 more that has three star rating.

Where are AMZN and GOOGL

Surprisingly, TastyWorks listed Amazon (AMZN) and Google (GOOGL) as having only two-star liquidity. I’m not sure what metric they used to calculate liquity. Perhaps AMZN and GOOGL are such high-priced stocks which makes their bid-ask spread a bit wide.

At the time of this writing, GOOGL is trading at $2300 and AMZN is at $3300 per share. This is before Amazon’s 20-to-1 stock split.

As far as I’m concerned, Amazon and Google are liquid enough to trade options on them. Just try to negotiate the trade a bit. Put in an order with a good price in your favor. Wait a few minutes, and if not filled, then start moving the price patiently until filled.

Note that the liquidity and composition of the stocks in the S&P 500 can change with time. So this list should not be taken as fixed in stone.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more