Which Mag-7 Stock, Apple Or Nvidia, Should You Buy For Tariff Relief?

Image Source: Unsplash

With new tariffs being imposed by President Donald Trump on Chinese goods at the beginning of April, Apple Inc (AAPL - Free Report) and NVIDIA Corporation (NVDA - Free Report) saw their stocks decline. However, the latest tariff relief has been a blessing in disguise for these tech behemoths, helping them prevent higher import costs and product price rises. This has prompted speculation on which stock to invest in. Let’s explore –

Apple Stock Remains Risky Bet, Even With Tariff Exemptions

President Trump’s steep tariffs on goods produced and imported from China could have disrupted Apple’s supply chains as severely as during the COVID-19 pandemic. However, Apple breathed a sigh of relief after the Trump administration exempted electronic devices like smartphones and computers from reciprocal tariffs.

Before the tariff exemption, Apple planned to increase iPhone production in India, which is subject to lower levies, while also securing its supply chain. Apple intends to produce over 30 million iPhones in India, satisfying a significant portion of American demand, which constitutes a third of global demand.

However, Apple is manufacturing its upcoming iPhone 17 in China, which will be launched soon. Shifting the production base to India or another location in a short time will require a herculean effort. It may also lead to retaliation from China, which has set up inquiries into U.S. companies and may create difficulties for Apple through its customs processes.

A complete breakup from China would be improbable as Apple produces the bulk of its iPhones in China, and there is a dearth of required skills to manufacture iPhones in the United States at the moment. Instead, Apple argued that the United States should boost semiconductor production and revive high-value job opportunities.

However, the tariff relief is temporary, and if no breakthrough occurs soon, it may impact Apple’s near-term profitability. President Trump said that relying on China for vital tech goods like smartphones and semiconductors isn’t acceptable. If tariffs are imposed, iPhone prices will rise, impacting American consumers and Apple’s sales volume. Anyhow, some tariffs still apply to goods imported from China and there may be sectoral tariffs on goods that have semiconductors, which can further affect Apple’s stagnating revenues.

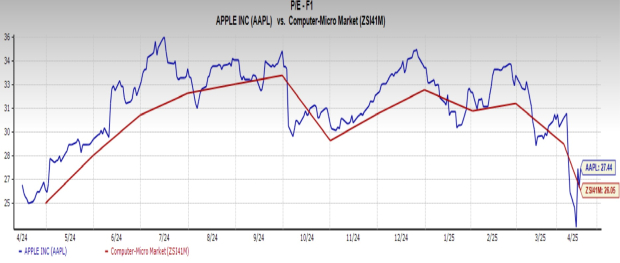

Given the supply-chain risks, stagnant revenues and tariff uncertainties, Apple isn’t a favorable stock choice currently. Moreover, according to the price/earnings (P/E) ratio, Apple stock trades at 27.4X forward earnings. In comparison, the Computer - Micro Computers industry’s forward earnings multiple is 26.05. The Apple stock, therefore, is overvalued and may plummet if tariff issues remain unresolved.

Image Source: Zacks Investment Research

Here’s Why NVIDIA Is the Better Stock to Buy Now

Like Apple, NVIDIA too got a momentary relief from Trump’s tariffs. This is because certain critical chips used by NVIDIA and produced in China were exempted. Now, there is a 90-day pause in tariffs, but the outcome depends on how the negotiations between the United States and its trade partners unfold. So, an element of ambiguity persists.

However, NVIDIA remains the preferred stock to buy during these times of distress. With graphic processing units (GPUs) continuing to gain popularity at a breakneck speed and artificial intelligence (AI) infrastructure spending increasing, NVIDIA’s long-term future looks brighter. Lest we forget, Apple faces tough competition across all segments, economic challenges, and regulatory hazards, affecting its long-term outlook.

Coming back to NVIDIA, the company is experiencing high demand for new Blackwell and older Hopper chips because of their superior AI interfaces compared to competitors. The company’s CUDA software platform is in more demand among developers than Advanced Micro Devices, Inc.’s (AMD - Free Report) ROCm software platform. Major cloud computing companies like Amazon.com, Inc. (AMZN - Free Report) and Alphabet Inc. (GOOGL - Free Report) are also spending billions of dollars on AI data center infrastructure, which could benefit NVIDIA.

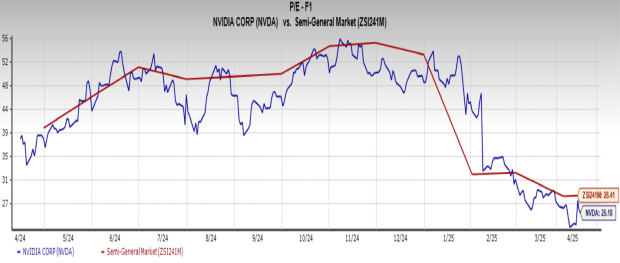

NVIDIA stock is currently more affordable than its competitors, with a forward P/E ratio of 25.18 compared to the Semiconductor - General industry’s 28.4X forward earnings multiple. This leads to NVIDIA having a Zacks Rank #2 (Buy) at present, whereas Apple has a Zacks Rank #4 (Sell).

Image Source: Zacks Investment Research

More By This Author:

3 Healthcare Funds To Buy Amid Tariff Turmoil

4 Manufacturing Tools Stocks To Watch Despite Industry Headwinds

4 Energy Stocks To Gain Despite Oilfield Service Industry Woes

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more