Where Is The Banking Revolution?

That old expression that what goes up must come down applies to so many things. An umbrella goes up and down, dependent upon the weather. Company executives who are going up will come down, most times. And businesses that appear to be bulletproof can stumble and fall.

I’m thinking Blockbuster, Nokia, Kodak.

Today, we look at companies like Facebook (FB), Google (GOOGL) and Netflix (NFLX) as bulletproof. They’re not. That was demonstrated by Netflix’s latest results:

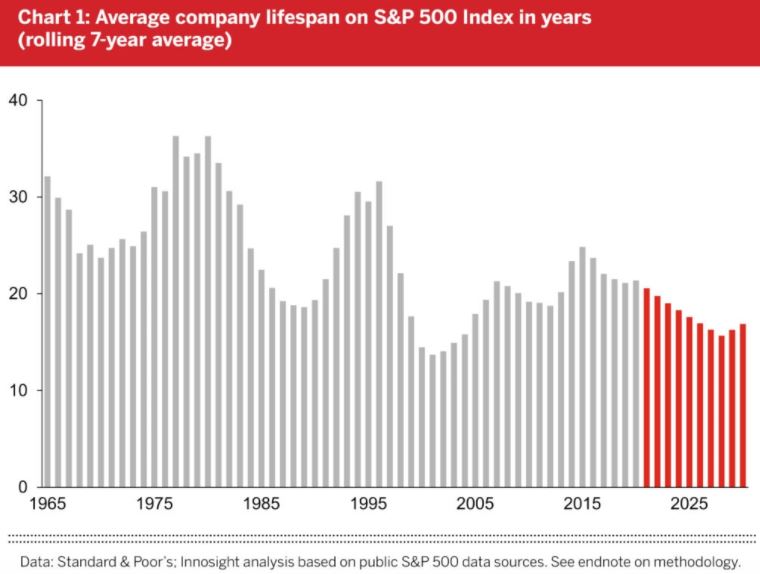

Netflix, Spotify and Twitter are here right now, but they may not be here later. They’ve been around for only a decade or two, which often implies refreshment and renewal. When I say this, the obvious question (for me) is: how come these companies come and go and yet banks have been here forever? McKinsey found that the average life-span of companies listed in Standard & Poor’s 500 was 61 years in 1958. Today, it is less than 18 years. McKinsey believes that, in 2027, 75% of the companies currently quoted on the S&P 500 will have disappeared.

Innosight’s biennial corporate longevity reports that the 30- to 35-year average tenure of S&P 500 companies in the late 1970s is forecast to shrink to 15-20 years this decade.

Interesting. Industries are shaped and re-shaped as we progress. So, why isn’t banking being shaped and re-shaped?

Why?…

Because banks are like countries. You may see companies disappear, but you don’t see countries disappear, unless there is a war or revolution. Banks are like countries.

Think about it. Banks run economies; banks run countries; banks run governments; banks run us. This is why there are so few big banks in each country and why banks can pretty much do what they want.

Sure, some banks fail. They run loans at losses; their risk management is rubbish; they have poor leadership who cannot adapt; they have strategies that go wrong; but most banks are here forever. This is why most banks are the oldest companies in town. Look at your own country. How old are the banks in your country? How come they haven’t been taken over, acquired, replaced?

The reason is obvs, if you think about it. Unlike retail, technology, airlines or other industries, banking is a bedrock. It is the foundation of countries and governments. It doesn’t get replaced and, if large enough, it doesn’t worry.

It can buy, kill or copy any competition. It can tell governments to change the law. It can do pretty much what it wants because banks are the law.

The reason I write this is so many times people talk about banking being disrupted, disintermediated, destroyed and I laugh. It ain’t gonna happen. It’s like saying countries will be disrupted, disintermediated, destroyed. That only happens if there’s a war or a revolution and the real question therefore is: where is the banking revolution?