When Will Stocks Hit Bottom? Rate Cuts May Be The Best Signal

Image Source: Pexels

As evidence piles up that the stock market is caught in a bear market, the focus inevitably turns to analytics that will signal a high-confidence forecast that the selling has reached exhausted itself and a bottom has arrived. There are many possibilities for crunching the data and all come with caveats. But perhaps the leading first approximation is the start of interest-rate cuts.

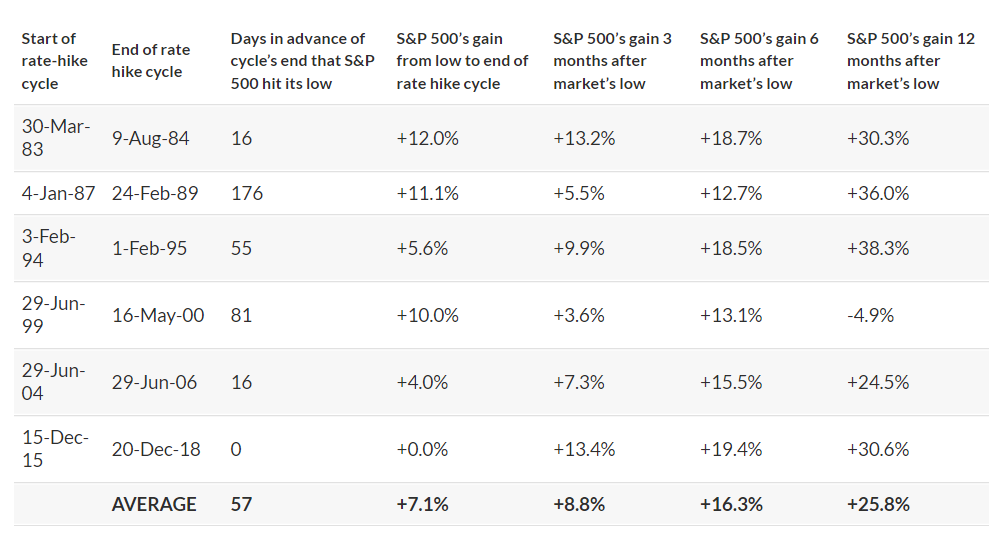

As Bank of America’s research group points out (courtesy of Michael Arouet), Federal Reserve rate cuts tend to precede market bottoms.

Mark Hulbert, the editor of the Hulbert Ratings newsletter, finds similar results. “A lot of money can be made betting on when the Federal Reserve will ‘pivot’ — that is, take its foot at least partially off the rate-hike gas pedal,” he recently explained. “Yet a lot of money can also be lost, as we saw on August 26 when the Dow Jones Industrial Average DJIA, -0.35% lost more than 1,000 points after Fed Chair Jerome Powell dashed hopes that the Fed’s pivot had begun in July.” The future’s always uncertain, but looking to history is still valuable in this analytical niche, he reports.

He finds that the market hit it's low “an average of 57 days prior to the end of the Fed’s rate-hike cycle — about two months.” Good to know, but keep in mind that “there is quite a range, from no lead time at one extreme to almost the entire six-month window on which I focused. Given that it’s hard to know when the Fed will actually begin to pivot, this wide range illustrates the uncertainty and risk associated with trying to reinvest in stocks in anticipation of a pivot.”

In other words, there’s (still) no silver bullet for calling bottoms. But the start of easing policy cycles is an obvious tool for your shortlist. The way I read this analysis: when the Fed starts cutting, the odds appear to shift in favor of correctly anticipating a market bottom, i.e., a calculated risk. Marrying this analysis with other methodologies may provide even better odds of making the right call.

The bad news is: rate cuts are nowhere on the near-term horizon. But a pivot is coming – it always is… eventually.

More By This Author:

When Will Bonds Become A “Buy”?

10-Year Treasury Yield ‘Fair Value’ Estimate - Tuesday, Sept. 20

Clean Sweep Of Losses For Major Asset Classes Last Week

Disclosures: None.