When Will Disney Pay A Dividend?

Companies that have the discipline to pay and raise dividends over long periods of time tend to have wide moats around their business. This makes the products, goods, or services that they sell in demand regardless of economic conditions.

Strength even in recessionary environments allows these companies to be able to reward shareholders with dividend payments. It is why we believe that the Dividend Aristocrats are an excellent starting place for those seeking high-quality businesses to invest in.

Companies that don’t pay a dividend are often high-growth names, such as Alphabet (GOOG)(GOOGL) or Amazon.com Inc. (AMZN), that favor reinvesting profits back into the business as opposed to distributing them to investors. This can often lead to growth in the business and the share price alike. We can understand the appeal of these stocks to investors.

Unlike many of the names we profile in this series, The Walt Disney Company (DIS) has paid a dividend before. Prior to suspending its dividend in 2020, Disney had established a dividend growth streak of 10 years.

This article will examine Disney’s business model, growth prospects, and when investors might expect the company’s dividend to be reinstated.

Business Overview

Disney is one of the largest entertainment conglomerates in the world. The company’s assets are very diversified, ranging from media networks, including ABC and ESPN, parks and resorts, such as Disneyland and Disneyworld, studio entertainment, including Marvel and Lucasfilm, and merchandise.

Disney was founded in 1923 by Walt Disney and his brother. Today the company has a market capitalization of more than $180 billion.

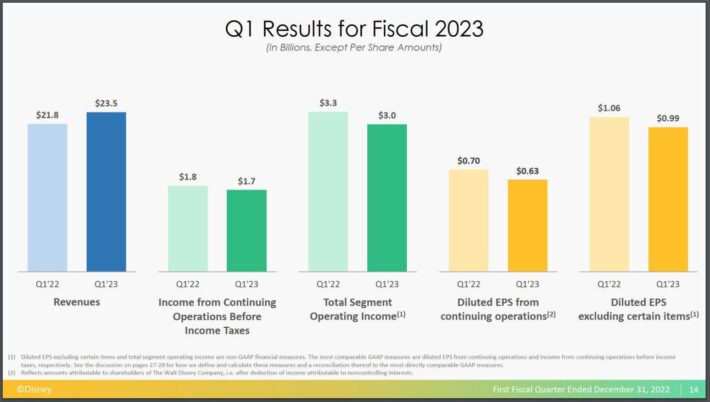

The company reported earnings results for the first quarter of fiscal year 2023 on February 8th, 2023 that easily beat the market’s expectations.

Source: Investor Presentation

Revenue grew 8% to nearly $23.5 billion, which was $232 million ahead of estimates. Adjusted earnings-per-share of $0.99 did decline $0.07, or 6.6%, from the comparable period of fiscal year 2022, but was $0.20 more than anticipated.

Revenue for Media & Entertainment Distribution grew 1% to $14.8 billion, driven mostly by gains in direct-to-consumer. ESPN+, which had been a headwind in recent years as viewers cut the cable cord, has seen improvement, with average revenue per user growing 14% in the quarter.

Revenue for Disney Parks, Experiences, and Products grew 21% to $8.7 billion due to higher demand for parks. The company reported higher volumes in both domestic and international channels.

Disney is projected to earn $4.15 per share in fiscal year 2023, which would be an 18% improvement from the prior fiscal year.

Growth Prospects

Disney has a multitude of ways that it can grow its business. First, its media empire is vast. This includes wildly popular content from Marvel and Lucasfilm. For example, Black Panther: Wakanda Forever grossed more than $800 million worldwide while season 3 of the Mandalorian has been one of the most-watched properties in all of streaming.

But Disney’s success goes beyond these two contents. Avatar: The Way of the Water, distributed by subsidiary 20th Century Studios, generated $2.3 billion worldwide, making the film the fourth best grossing film of all time.

Disney Parks, Experiences, and Products was the best performer during the most recent reportable period as this segment has benefited from the pent-up travel demand following the worst of the Covid-19 pandemic. The company also reported that customers were spending more than they typically do at parks. Operating income growth for this segment was 25%, which ran ahead of revenue growth.

Another area that could prove lucrative for Disney is the direct-to-consumer business, especially the company’s Disney+ platform. Disney+ is not yet profitable as seen by the $1 billion loss in the first-quarter. This loss was due to higher programming, production, and technology costs. However, the loss was a $400 million improvement on a sequential basis. The company has undertaken steps to reduce marketing expenses.

Disney+ Core finished the quarter with 104.3 million subscribers, which was a 1% increase from the fourth quarter of fiscal year 2022.

Where growth could come from is in how much revenue per subscriber Disney could generate from its streaming service platform. In the last quarter, average revenue per paid subscriber fell 3% to $5.77 due to unfavorable currency exchange. This is lower than the majority of peers. Raising monthly subscription prices even slightly and spreading that increase out over the customer base would greatly assist in the reduction of the loss the streaming platform currently has.

While price increases could cause some customers to drop their service, Disney’s experience with Hulu shows that this might not be the case. Hulu has passed through several price increases over the past few years, but the streaming service saw total subscribers grow 2% to 48 million. This growth occurred even as average revenue per subscriber inched higher to $87.90.

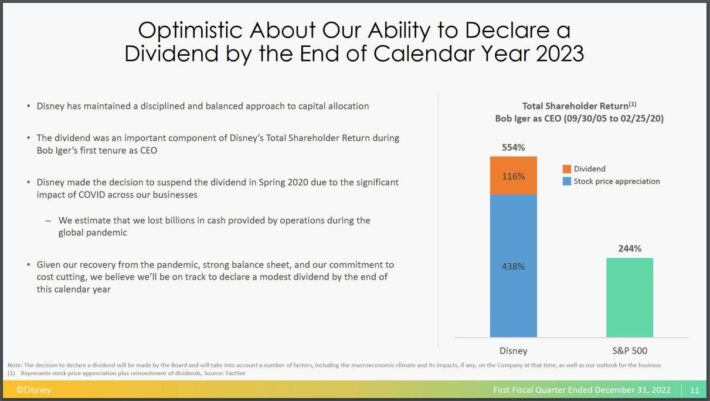

One last factor to consider is that longtime Disney CEO Bob Iger ended his retirement and returned to the company in late 2022. Iger oversaw many of the acquisitions that have helped make Disney the company that it is today. While not a long-term solution, Iger’s return can be seen as a positive for the company due to the success he had the first time as head of the company.

When Will Disney Pay A Dividend Again?

Disney suspended its dividend during the calendar year 2020 as the company, and world dealt with the great unknowns of the Covid-19 pandemic. In hindsight, this was a prudent move as social distancing restrictions cut deeply into the company’s revenue and earnings-per-share.

But growth has begun to return, with the company forecasted to show high teens earnings growth for the current fiscal year.

As a result, management has indicated that a change in the dividend policy is likely to come later this calendar year.

Source: Investor Presentation

On the recent conference call, leadership targeted late 2023 for the dividend to be reinstated.

Investors might be asking what the dividend might look like. Even meeting expectations for earnings-per-share this fiscal year would still place Disney at half of its pre-pandemic high of $8.36 per share that was achieved in fiscal year 2018. Free cash flow is also an issue as this metric declined 81% to a loss of $2.2 billion in the first quarter compared to a loss of $1.2 billion in the prior year.

In short, the company still has a way to go before it reaches its previous level of success.

In the decade before the pandemic, Disney had an average dividend payout ratio of 23%. Given the weight of the loss of Disney+, the new dividend is unlikely to occupy even such a low percentage of profits. Therefore, we believe a dividend payout ratio of 10% is a more likely starting place for Disney. Assuming Disney reaches estimates for the fiscal year, this equates to an annualized dividend of $0.42.

Using the current share price of $100, the stock would have a yield of just 0.4%. This is much lower than Disney’s average yield of 1.3% for the 2010 to 2019 period.

However, the lower starting point for the dividend would provide some level of income to investors and provide evidence that the company has turned a corner from the depths of the pandemic. It would also provide the possibility for future dividend increases if results continued to improve. At the same time, it likely wouldn’t be as much of a burden on the company to cause another dividend suspension, which would hurt Disney’s credibility with investors.

Final Thoughts

Unlike the other names in the series, Disney has paid a dividend before. The company cut it during 2020 as its business grinded to a halt under the weight of the pandemic. While not yet back to where it was, overall business has improved.

The opportunity for a dividend has returned due to this. Disney has declared that it aims to distribute a dividend by the end of calendar year 2023. While investors shouldn’t expect a dividend on par with previous years, the reinstatement of the dividend, even a small one, can be taken as a positive sign for Disney after several years of turmoil due to the pandemic.

More By This Author:

3 High-Dividend Stocks Under $10

3 Cheap Monthly Dividend Stocks

Top 3 ‘Hold Forever’ Monthly Dividend Stocks

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more