When The Winds Change

“Change is the investor’s only certainty.” - Thomas Rowe Price, Jr.

2022 marked several major changes in market trends amid a substantial shift in global macroeconomic regimes. After historic levels of stimulus, multi-decade highs in inflation across several major economies led to monetary tightening. This shift weighed on asset classes in many regions, and traditional routes of diversification proved problematic as bonds and equities fell in tandem. In U.S. equities, growth, mega-cap and “big tech”, dominance gave way to a resurgence in value, as well as outperformance from smaller companies and Energy. Exhibit 1 summarizes the changing trends observed in 2022 in sharp contrast to 2020 and since the start of the 2010s, by showing the excess returns of various indices versus the S&P 500®.

(Click on image to enlarge)

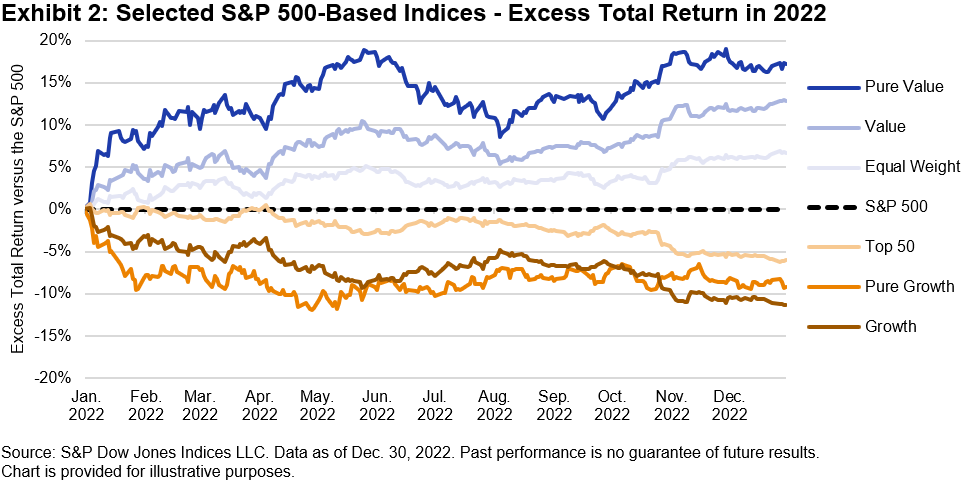

The S&P 500 Pure Value was one of the few indices to remain near flat in 2022, falling 1% compared to the S&P 500’s 18% decline. The S&P 500 Value and S&P 500 Equal Weight Index also outperformed by 13% and 7%, respectively. Exhibit 2 shows the consistent outperformance of these indices throughout 2022. All three indices benefited from their greater exposure to value-oriented companies last year, as growth-oriented companies came under particular pressure amid interest rate hikes.

(Click on image to enlarge)

Growth has had a symbiotic relationship with the Communication Services, Consumer Discretionary, and Information Technology sectors. Unsurprisingly, growth’s underperformance had a particularly large impact on these sectors, as they declined 40%, 37%, and 28%, respectively. On the opposite side of the sector spectrum, the S&P 500 Energy led the way as it gained 66% on the back of higher oil prices. Energy’s momentum contributed to the widest spread (best minus worst) in calendar year sector returns on record (see Exhibit 3).

(Click on image to enlarge)

2022 reminds us that change is a constant in life. Being equipped with a full range of index-based tools can help market participants manage within different market regimes.

More By This Author:

Style, Size, And Skewness

Contextualizing Style Shifts

Style Chicken Or Sectoral Egg?

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.