When Do You Sell A Winner? – January Dividend Income Report

Image Source: Pixabay

I sold a winner

Selling is like saying goodbye; it’s hard to let go, especially when you were in a good relationship!

I sold one of my winners in February. Let’s use this as an example of how to apply these selling rules.

Performance in Review

Let’s start with the numbers as of February 12th, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $298,402.23

- Dividends paid: $5,152.47 (TTM)

- Average yield: 1.73%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017 – January 2025): 174.36%

Annualized return (since September 2017 – 88 months): 14.94%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 17.02% (total return 212.60%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 11.30% (total return 117.30%)

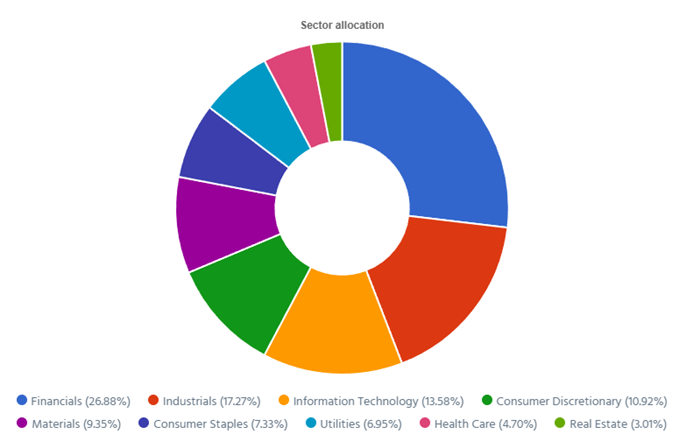

Dynamic sector allocation calculated by DSR PRO as of February 12th, 2025.

When Do You Sell When You Have Made Money?

Selling is like saying goodbye; it’s hard to let go, especially when you were in a good relationship!

If you’ve followed my portfolio for a while, you probably know I’m about to tell you that I sold my BlackRock (BLK) shares in February.

I keep saying that my #1 sell rule is when a company I hold doesn’t match my investment thesis and financial metrics, I must let it go.

I’ve reinforced this rule since I got burned by Algonquin (AQN) a few years ago. I let the investment thesis take up too much room in my thinking and didn’t focus enough on the financial metrics. It’s important to learn from your mistakes.

Back to BlackRock – Why did I sell a performing asset that was up 165%?

In 2017, I added BlackRock to my portfolio as the company showed a perfect dividend triangle and a robust investment thesis.

BlackRock’s investment thesis in 2017

The company was the world’s largest asset manager and also the world’s largest ETF manufacturer. This was enough to secure its present and its future. BLK built strong relationships with institutional investors. Banks, pension plan managers, and other investment firms tend to stick with large asset managers for a long time. BlackRock offers a wide range of investment products using the same playbook: it charges a recurring fee on the assets under management. Regardless of where people invest, as long as it was with BlackRock, the company made money. With such a strong investment narrative, you could expect a strong dividend triangle.

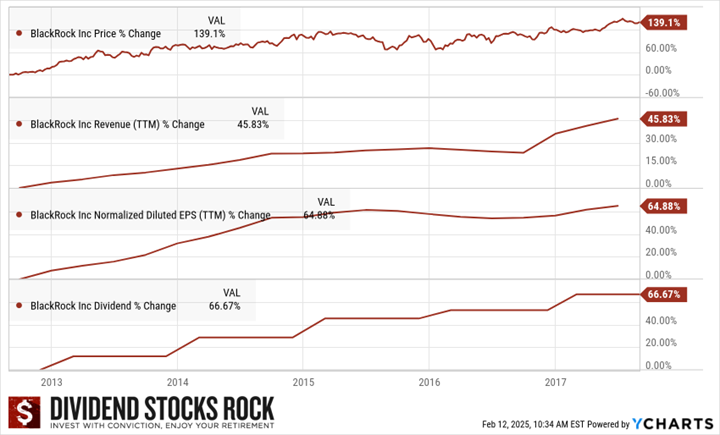

2017 BLK Dividend Triangle

BlackRock (BLK) Dividend Triangle in 2017.

When you look at the numbers from 2012 to 2017, the company reported steady revenue and EPS growth. Even better, the dividend grew at the same pace the EPS did during that period (64.88% and 66.67%, respectively).

So, I pulled the trigger toward the end of 2017 with conviction. I had found a great company with a great story and great numbers. Everything was there for a successful investment story.

For fun, please note that I bought BLK close to its 5-year all-time high (around $420). This highlights that a stock’s all-time high is highly relative and doesn’t give you much indication as to when it’s a good time to buy.

Fast-forward to today. The only time I could have bought BLK at a cheaper price was during a few days in March 2020, when the world was convinced it would be in lockdown for years.

BlackRock is an interesting case study as I sold it for a nice profit even though the company’s investment thesis is still intact. However, some metrics aren’t as strong as before.

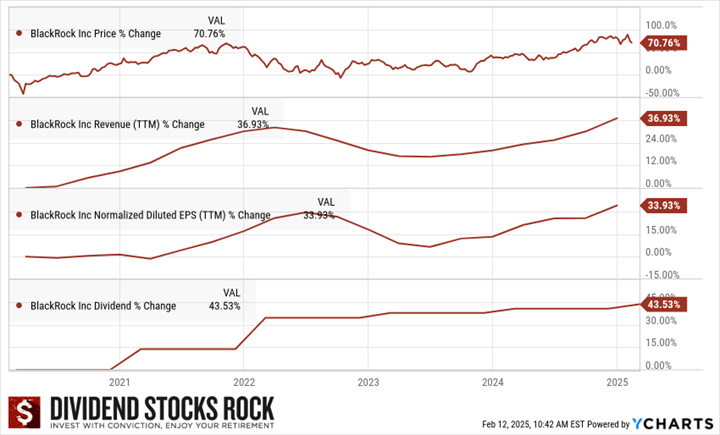

2025 BLK Dividend Triangle

BlackRock (BLK) Dividend Triangle in 2025.

When you look at today’s dividend triangle, the company still shows robust numbers, even weaker than in 2017. Revenue and EPS are back in growth mode after a difficult period in 2022. This is totally normal, as you can’t expect companies to thrive each quarter for the next 50 years.

When you look at the 5-year dividend growth, it’s still very solid at 43.53% (or a 7.5% annualized growth rate!).

However, since I monitor my holdings closely, I have noticed that BLK slowed down its dividend growth policy in 2023 when management offered a 2.6% increase (from $4.88 to $5.00). That was a small red flag back then. After all, 2022 was a bad year and management could have been being simply prudent.

Then, management offered a 2% increase in 2024 (from $5.00 to $5.10). I wasn’t pleased and I started talking about watching BLK closely.

2025 was the final nail in the coffin, with another weak increase of 2.17% (from $5.10 to $5.21). I sold my shares because BLK was no longer a strong dividend grower. My strategy is to invest in companies offering continuing generous dividend increases.

More By This Author:

Bull And Bear Cases For Troubled Stocks - Do You Own Them?

Where To Find The Best Stocks: Sectors That Deliver For 2025 And Beyond

Crafting a Dividend Income for Life: Why Low-Yield, High-Growth Stocks Win the Retirement Race