Wheel Trade Example: How To Handle A Trade Gone Bad

Today, we’re going to look at a wheel trade example, but not a winning trade. This time we will be looking at a trade that is under pressure. When trading the wheel, it’s important to understand what happens when a stock drops in step 1. There's no doubt this may be eye-opening for some of you.

Introduction

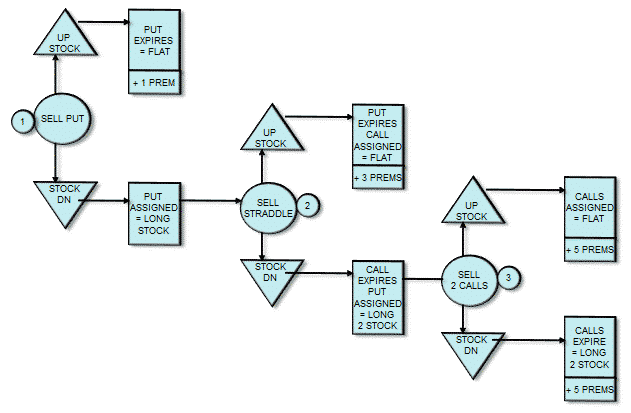

The wheel strategy is one of our favorite trades, and we like to refer to it as “covered calls on steroids.” Here is a reminder of the process.

We like to trade this on low beta, high dividend, and/or blue-chip companies. We start by selling a put. If the stock drops and we are assigned, we then sell a call at or above the strike price we were assigned at, and also sell an out-of-the-money put.

If the stock keep dropping and we are assigned on the second put, we then start selling covered calls, provided the call strike is above our cost basis or assignment price. Let’s go to our example.

BHP Wheel Trade Example

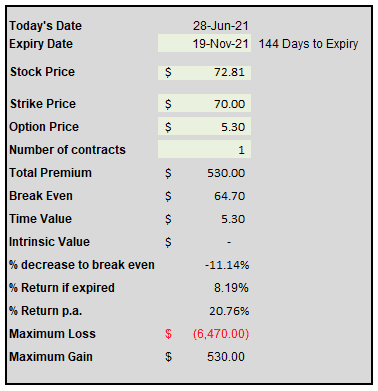

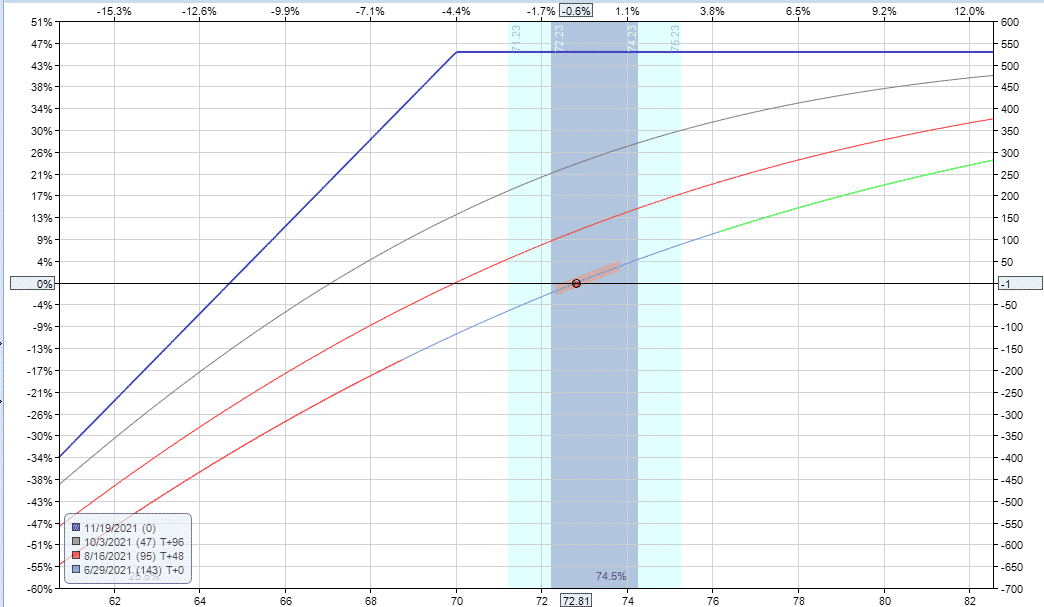

On July 28, BHP Group (BHP) was trading at 72.81 and I sold the November 70 strike put for 5.30. Here’s how the initial trade looked:

The initial trade had a 20.76% annual return percentage and a margin for error of 11.14% on the downside. The breakeven price was 64.70.

- Delta: 38.61.

- Gamma: -2.25.

- Vega: -17.49.

- Theta: 2.24.

BHP is a blue-chip Australian mining company with a dividend yield that typically ranges from 3-5%.

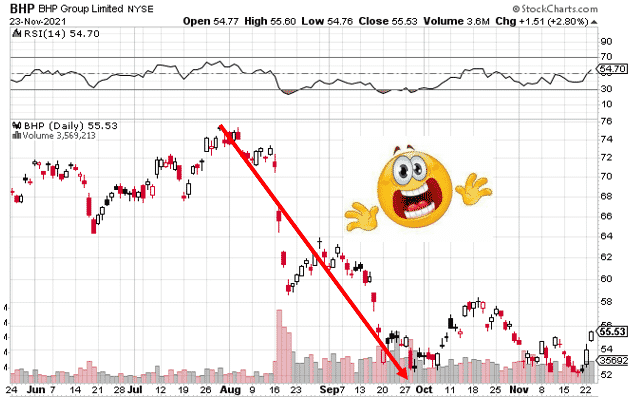

The plan for the trade was to either let the initial put expire worthless or take ownership of the shares, hold them forever, and collect the dividend. And, of course, to continue with the wheel by selling another put if assignment occurred. BHP rallied briefly to hit a high around 80 in late July, but then dropped severely from that point on.

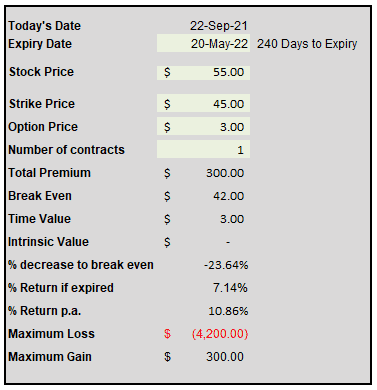

Nov. 19 has passed, and I was assigned 100 shares at 70, with the stock trading well below the breakeven price. On Sept. 22, I went slightly away from the plan and preemptively sold the second put. I sold the May 2022, 45 strike put for 3.00.

Looking at that position in isolation, we see the following:

Implied volatility was high at the time, so I was able to place the second put quite far out-of-the-money, giving the trade a 23.64% margin for error. This piece of the wheel strategy had a slightly lower annual return potential at 10.86%.

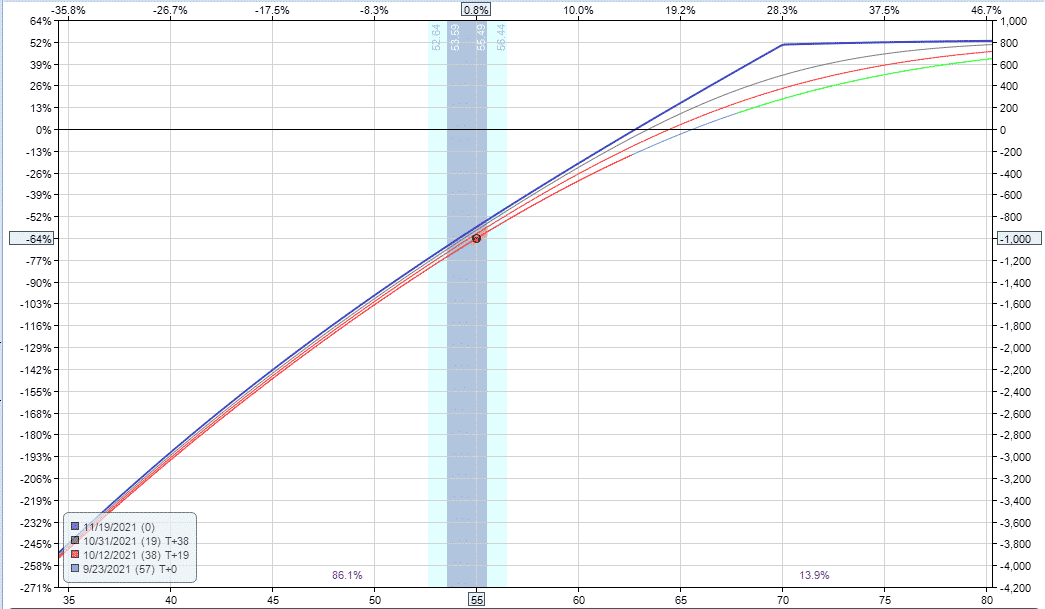

Here’s how the combined wheel trade looked at that point in time:

- Delta: 114.06.

- Gamma: -3.27.

- Vega: -16.75.

- Theta: 2.35.

Dollar Cost Averaging

Let’s assume BHP keeps dropping and the 45 strike puts get assigned as well. The combined cost basis would be (70 + 45 / 200) = 57.50. The net cost basis is actually a bit lower because we have received 8.20 in total option premium.

- 57.50 – (8.20 / 2) = 53.35.

I would prefer if BHP rallied back up to 70, but I’m also alright with owning 200 shares with a cost basis of 53.35 and continuing to collect the dividend.

Getting Assigned on the Wheel Trade

As mentioned above, the 70 strike put was assigned recently. Sometimes, when the stock is a long way below the assignment price, I will wait for the stock to recover before selling the covered call. However, in this case, I wanted to generate some premium to compensate for having to hold the stock for potentially quite a while.

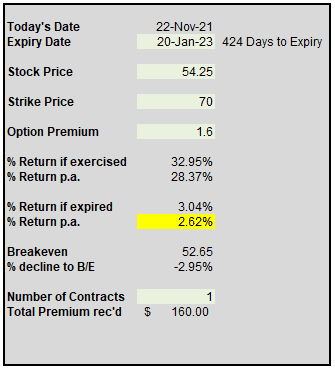

I went out to January 2023 and sold the 70 strike call for 1.60. That provides for an annualized return of only 2.62%, but when combined with the annual dividend, the total annual yield for holding the 100 shares and the covered call would be around 5.5% to 7.5%. A bit lower than I would like, but still better than money in the bank.

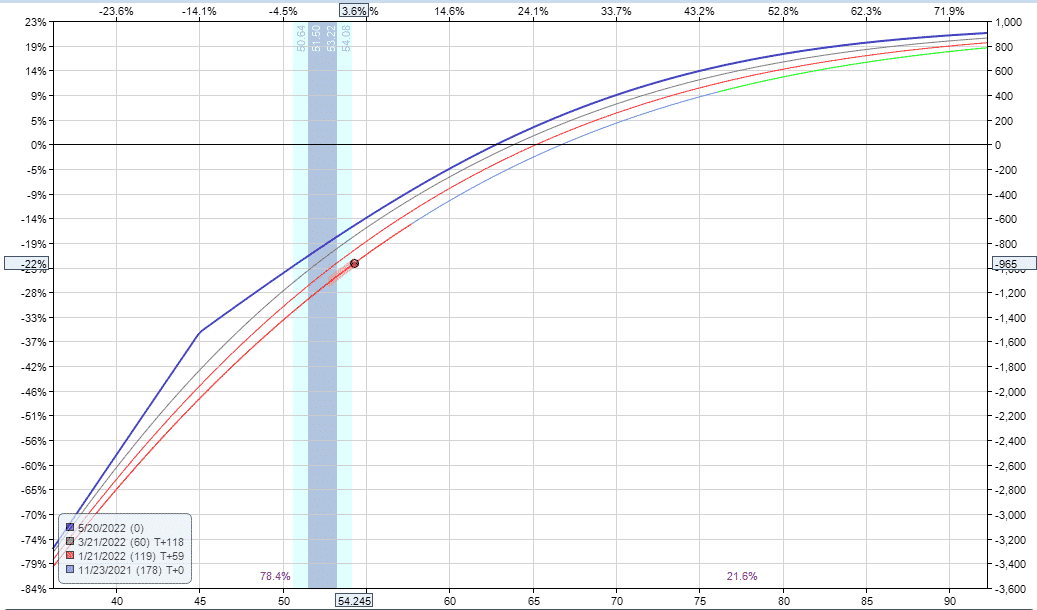

Here is where the trade sits as of Nov. 26, 2021. Quite a bit of work to do to get this one back into profitability, but I’m in it for the long haul.

- Delta: 99.55.

- Gamma: -3.85.

- Vega: -28.08.

- Theta: 1.75.

Also, remember that 70 is my gross cost basis on the first 100 shares, but my net cost basis is actually 64.74. So, assuming BHP does get back above 70 by January 2023, the shares will be bought and sold at the same price ($70) and the total profit on the trade will be equal to the premium received ($990):

- $530 from the November 2021, 70 strike put.

- $300 from the May 2022, 45 strike put.

- $160 from the January 2023, 70 strike call.

A $990 profit over a cost basis of $6,470 is a 15.30% total return. Total time in the trade would be 571 days, which makes the annualized return 9.78%. This is assuming BHP gets back above 70, of course.

Again, this is slightly lower than what I usually aim for, but I’m alright with accepting a lower profit potential in return for trying to salvage a losing trade.

Conclusion

This wheel trade example, shows what can happen when a stock drops severely from your initial entry point. The key is not to panic and to instead stick to your plan.

My plan in this case was always to take ownership of the stock and hold the shares indefinitely in the dividend investing portion of my account. I may have to wait a year or two for this one to come back to profitability, but I’ll just sit back and collect the fat dividends while I wait.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with ...

more