What's Going On With Tesla Shares?

Image Source: Unsplash

The market enjoyed a solid bounce in today’s session, with yields in retreat. It’s undoubtedly a welcomed day of price action following a few weeks of volatility.

And today, there were several high-flyers on the move, including Tesla (TSLA), PPG Industries (PPG), and American Airlines (AAL). For those interested in momentum, let’s take a closer look at what’s moving each.

Tesla

Tesla saw negative coverage following the release of its Q3 EV production and deliveries results despite warning investors of a planned factory shutdown in the prior earnings call. The market has seemed to shrug off the news, with bulls re-taking control of shares.

Regardless, the EV leader produced over 430,000 vehicles and delivered roughly 435,000 throughout Q3, reflecting a sequential decline. Still, the company’s 2023 volume target of 1.8 million vehicles remained unchanged, undoubtedly to the likes of investors.

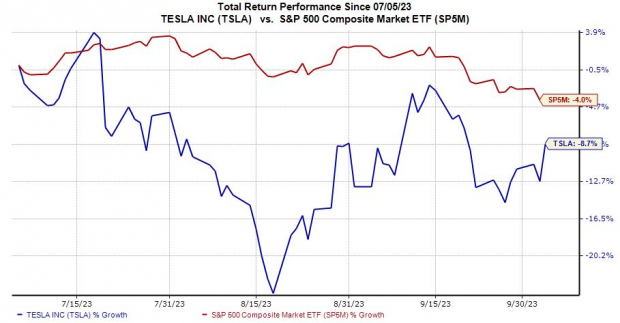

Despite the recent bounce, Tesla shares are down roughly 9% over the last three months, providing market participants an opportunity to buy shares at discounted levels.

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming quarterly release expected on October 18th, as the Zacks Consensus EPS Estimate of $0.74 suggests a 30% pullback from the year-ago period. Analysts have taken their expectations lower following the previously announced factory shutdown, with the estimate down 14% since July.

Image Source: Zacks Investment Research

PPG Industries

Citigroup maintained its buy rating of PPG shares but lowered its price target to $154 per share. Regardless, the updated PT reflects a 16% upside from current levels, and investors shrugged off the cut, with PPG shares seeing positive price action.

Still, it’s worth noting that PPG shares have recently broken through the 200-day moving average, a level that shares previously found support.

Investors will likely be better off waiting until PPG shares can clear and hold the 200-day moving average, which would reflect a meaningful change in the current trend.

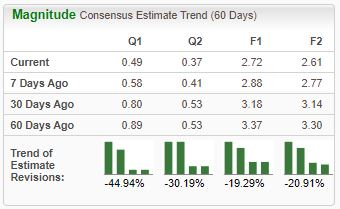

Image Source: Zacks Investment Research

In addition, the company is expected to see solid growth in its current fiscal year (FY23), with Zacks Consensus Estimates suggesting 24% earnings growth on 3% higher sales. Peeking a bit ahead, estimates allude to an additional 12% earnings growth in FY24 paired with a 3% revenue increase.

Image Source: Zacks Investment Research

American Airlines

American Airlines shares have faced notable selling pressure over the last several months following a hot start to 2023, now flat on a year-to-date basis. The company benefitted from a boom in travel demand, but worries of impending consumer weakness have recently taken hold of shares.

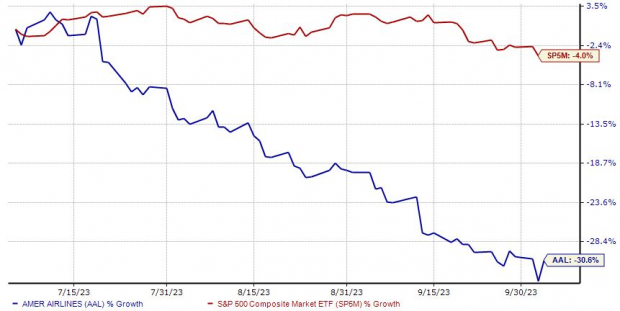

Image Source: Zacks Investment Research

In fact, analysts have taken their earnings expectations lower across all timeframes, further reflecting the current negative sentiment.

Image Source: Zacks Investment Research

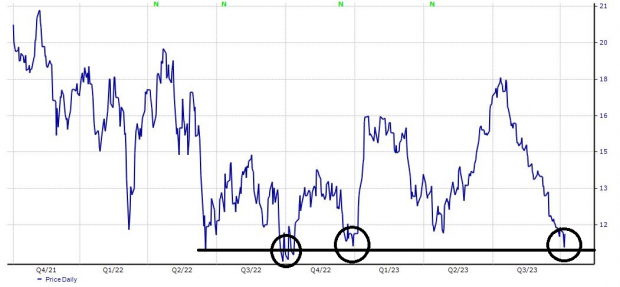

The favorable price action in today’s session likely looks to be due to a technical bounce at previous support, as we can see illustrated below. Still, the negative earnings estimate revisions the company has seen remain a critical piece of the story, likely to continue weighing on near-term share performance.

Image Source: Zacks Investment Research

Bottom Line

The market delivered a strong performance today, with green spread across many areas following a tough stretch over last the few weeks.

Throughout the session, several stocks helped lead the general market higher, including Tesla, PPG Industries, and American Airlines.

More By This Author:

3 Pax World Funds To Buy for Steady Returns3 Top-Ranked Stocks To Buy For High-Yield

Time To Buy These 2 Energy Stocks Poised For A Rebound

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more