What's Going On With Earnings In Q4 And Beyond?

Image: Bigstock

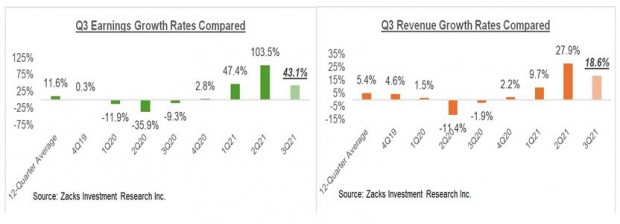

Earnings and revenue growth have come down in the ongoing Q3 earnings season from the first-half’s breakneck speed, but it is still very high.

You can see this in the comparison charts below that shows the Q3 earnings and revenue growth for the 460 S&P 500 members that have reported results through Friday, November 12th.

Image Source: Zacks Investment Research

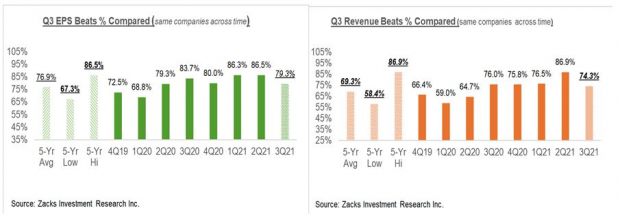

The unfavorable comparison to the first half of the year isn’t only with respect to the growth rates, as the proportion of these companies beating EPS and revenue estimates is also tracking below what we had seen from this same group of companies earlier in the year, as you can see in the charts below.

Image Source: Zacks Investment Research

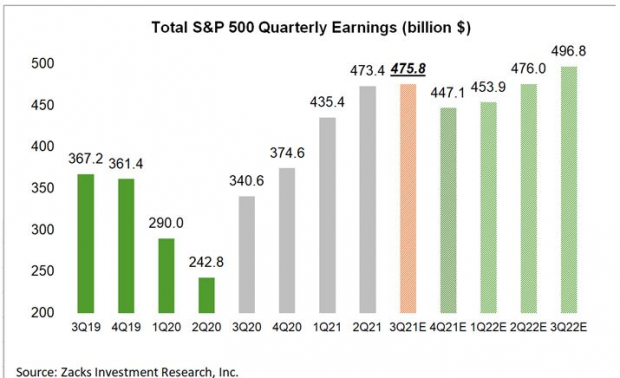

The decelerated growth pace notwithstanding, aggregate Q3 earnings for the S&P 500 index are on track to reach a new all-time quarterly record, surpassing the record set in the preceding quarter. You can see this in the chart below that shows the 2021 Q3 aggregate total at $475.8 billion, unchanged from last week.

Image Source: Zacks Investment Research

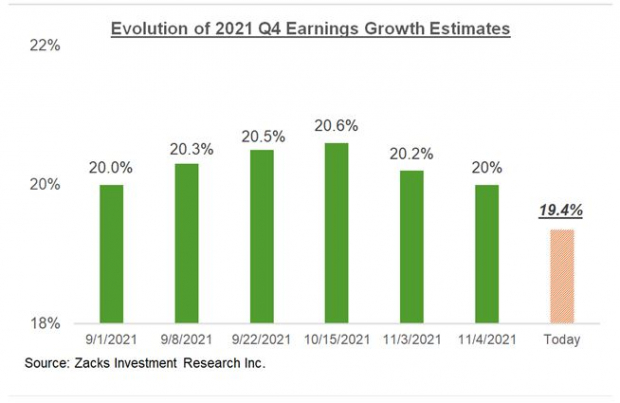

The one notable disconcerting development this earnings season is on the revisions front, with estimates for the current period (2021 Q4) modestly turning down in recent days after inching up at the start of the reporting cycle.

Image Source: Zacks Investment Research

This is in contrast to the persistent positive revisions trend that we have been seeing since the Summer of 2020. While the magnitude of negative revisions to Q4 estimates is fairly modest in the aggregate, it is relatively more pronounced for the Retail and Transportation sectors.

Partly offsetting these estimates cuts are rising estimates for the Energy sector that have been steadily going up lately.

Even as estimates for 2021 Q4 have modestly come down, they continue to move up for next year, though the pace of revisions has moderated and a number of sectors are starting to see estimates come down.

Earnings estimates for full-year 2022 have gone up +14% since January 2020, +4% since June 2021 and +0.5% since the start of October.

The +0.5% increase in aggregate 2022 earnings estimates for the S&P 500 since the start of October hides opposing cross currents ‘under the hood’, with positive revisions for the Energy and Auto sectors offsetting negative estimate revisions of varying magnitudes for most of the other sectors.

It will be interesting to see how these revisions trends evolve as we move into the Q3 reporting cycle for the Retail sector whose members will start coming out with results this week.

Macro trends related to supply chain problems and input cost inflation, including labor, have become notable headwinds for some of these industries. The Retail space is particularly vulnerable to these negative trends.

Q3 Earnings Season Scorecard

Including all the results that came out through Friday, November 12th, we now have Q3 results from 460 S&P 500 members or 92% of the index’s total membership. Total earnings (or aggregate net income) for these companies are up +43.1% from the same period last year on +18.6% higher revenues, with 79.3% beating EPS estimates and 74.3% beating revenue estimates.

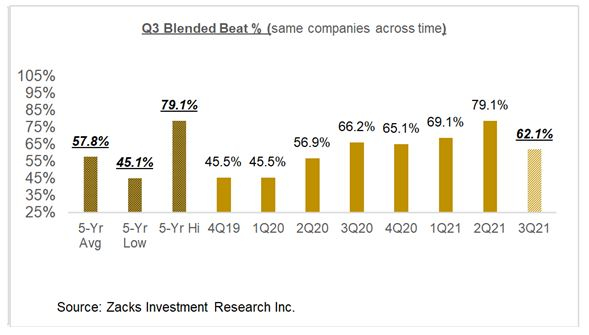

The proportion of these companies beating both EPS and revenue estimates is 62.1%. The comparison chart below shows how the Q3 blended beats percentage compares to other recent periods for this same group of 460 index members.

Image Source: Zacks Investment Research

This Week’s Key Earnings Reports

This week brings Q3 results from more than 300 companies, including 14 S&P 500 members. The notable index members reporting results this week include Walmart (WMT - Free Report), Target (TGT - Free Report), Nvidia (NVDA - Free Report), and others.

Walmart will report Q3 results before the market’s open on Tuesday, November 16th. Walmart is expected to earn $1.39 per share on $135.3 billion in revenues, which represent year-over-year growth rates of +3.7% and +0.4%, respectively.

Walmart shares have lagged the broader market and Target in the year-to-date period, with the stock up only +3% vs. the S&P 500 index’s +25% gain and Target’s +47.9% rise.

While both big-box operators are negatively exposed to macro trends related to supply chain bottlenecks and labor shortages, the market appears to be giving a lot more credit to Target for its digital efforts.

Target reports Q3 results before the market’s open on Wednesday, November 17th, while Nvidia will come out with quarterly results after the market’s close on Wednesday, November 17th.

Nvidia shares are literally on fire, with the stock up +133.7% in the year-to-date period, handily outperforming the Zacks Tech sector’s +25.9% gain and the Zacks Semiconductor industry’s +45.3% rise.

Nvidia is expected to bring in $1.11 per share in earnings on $6.83 billion in revenues, up +52.1% and +44.5% from the year-earlier level, respectively. The stock was up following the last quarterly release on August 18th, which followed two back-to-back quarterly releases that had weighed on the stock price immediately after the release.

With Nvidia shares up more than +60% since the last quarterly report on August 18th, it may be very hard to please the market with this earnings report.

Expectations for Q3 & Beyond

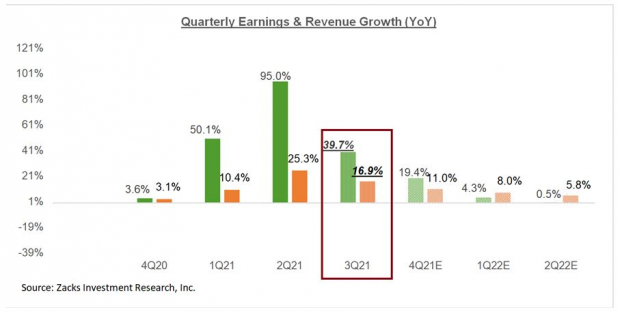

Looking at the quarter as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total Q3 earnings for the S&P 500 index are expected to be up +39.7% from the same period last year on +16.9% higher revenues.

The chart below presents the earnings and revenue growth picture on a quarterly basis, with expectations for 2021 Q3 contrasted with the actual growth achieved over the preceding four quarters and estimates for the following three.

Image Source: Zacks Investment Research

The chart below shows the comparable picture on an annual basis.

Image Source: Zacks Investment Research

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more

So we have predictions about profits and profitabilities relative to may companies and segments, all for the near future. And some folks believe these predictions and act upon them as though they re true. My question is about the basis of these predictions, and are they any better than numbers plucked out of open air? Or pulled from some un-named body orfice?

Just what data is examined to make predictions about profitability and share prices? And how reliable are the predictions likely to be? And what is the track record as far as accuracy?