What Will Q3 Bank Earnings Show?

The large money-center banks that will kick-off the 2021 Q3 earnings season for the sector this week have enjoyed an impressive run lately, helping these stocks handily outperform the broader market this year.

You can see this in the chart below that plots the year-to-date performance of JPMorgan (JPM - Free Report) and Bank of America (BAC - Free Report), which will report September-quarter results before the market’s open on Wednesday (10/13) and Thursday (10/14), respectively.

Image Source: Zacks Investment Research

We added Microsoft (MSFT - Free Report) to the chart above (orange line) to give you a sense of how the bank stocks have fared relative to one of the strongest performing mega-cap tech stocks. The red line in the chart represents the S&P 500 index, which is up only +18.2% and has clearly lagged these three stocks.

With respect to reserve releases, the bulk of the activity took place in the first half of the year. But we do expect some additional reserve releases in the Q3 reports, given the stable macroeconomic and credit market conditions.

On the core banking side, we don’t expect any notable improvement in performance, with the market looking for evidence that the long-awaited loan growth trend has finally arrived. Net interest margin likely ticked up in Q3 on the back of the September rise in treasury yields.

While we don’t expect much on the core banking side, we do expect strong numbers in the capital markets business, particularly on the investment banking side, while trading revenues are faced with tough comparisons to the year-earlier period. Trading revenues are expected to be below the year-earlier period, with fixed income weakness offsetting equities strength. The advisory side of the business continued to hum, with M&A activities continuing their record volume from the preceding period.

For the Zacks Major Banks industry, which includes these major banks and account for roughly 45% of the Finance sector’s total earnings, Q3 earnings are expected to be up +11.2% on +2.5% higher revenues. This would follow +298.1% earnings growth on -2.1% lower revenues in the preceding period (2021 Q2).

For the Finance sector as a whole, total Q3 earnings are expected to be up +19.9% on +4.9% higher revenues.

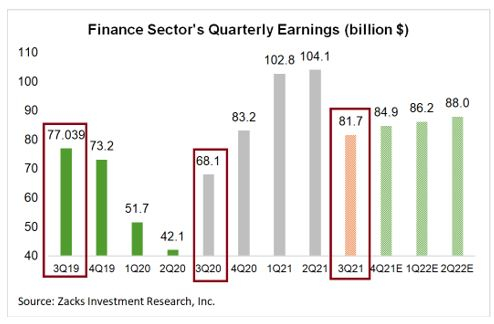

The chart below shows Q3 expectations for the Finance sector’s constituent industries in the context of what these industries reported in 2021 Q2 and what is expected for 2021 Q4 when the comparisons ease off further.

Image Source: Zacks Investment Research

The market knows that the eye-popping earnings growth of the last few quarters was mostly due to easy comparisons. But the sector’s Q2 earnings are expected to be above the pre-Covid 2019 Q2 period by +6%. You can see this in the chart below that shows the sector’s Q3 aggregate earnings expectations in the context of what has been reported in the preceding 8 periods and estimates for the coming 3 quarters.

Image Source: Zacks Investment Research

Please note that Q3 is typically the seasonally weak period for the group.

Expectations for Q3 & Beyond

Total Q3 earnings for the S&P 500 index are expected to be up +26.1% from the same period last year on +14% higher revenues.

The revisions trend for the period showed signs of deceleration after remaining positive for the last few quarters. A combination of the impact of the Delta variant and supply-chain disruptions are likely at play in the unfavorable shift in the revisions trend.

Some of the early Q3 reports from the likes of FedEx (FDX - Free Report), Nike (NKE - Free Report), and others have reconfirmed these unfavorable developments that are weighing on the near-term earnings outlook. It is reasonable to expect this trend to continue into the last quarter of the year as well (2021 Q4), but current consensus estimates don’t reflect this unfavorable trend having any enduring staying power.

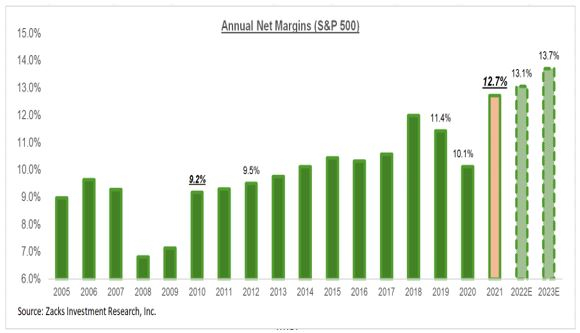

This view is in-line with the Fed’s ‘pricing-pressures-are-transitory’ narrative, which leaves estimates at risk of negative adjustment should the inflation issue turns out to be more troublesome. You can see this view at play in the below net income margins picture.

Image Source: Zacks Investment Research

The chart below presents the earnings and revenue growth picture on a quarterly basis, with expectations for 2021 Q3 contrasted with the actual growth achieved over the preceding four quarters and estimates for the following three.

Image Source: Zacks Investment Research

The chart below shows the comparable picture on an annual basis.

Image Source: Zacks Investment Research

We mentioned earlier how the aggregate 2021 Q2 earnings tally represented a new all-time quarterly record. You can see that in the chart below, with this year’s four quarters highlighted.

Image Source: Zacks Investment Research

We all know that large segments of the economy, particularly in the broader leisure, travel, and hospitality spaces are held down by the pandemic, with companies in these areas still earning significantly less than they did in the pre-Covid period. In fact, many of these companies aren’t expected to get back to pre-Covid profitability levels for almost one more year.

The impressive feature of the record earnings in each of the last two quarters is that they were achieved without help from these key parts of the economy.

Earnings Season Gets Underway

Most companies have fiscal quarters that correspond with the calendar periods. As such, the wide majority of Q3 earnings reports will be from companies that have fiscal quarters ending in September. But there are some companies that have fiscal quarters ending in August and a number of them have been reporting their fiscal August-quarter results in recent days.

The earnings releases in recent days from the likes of FedEx, Oracle (ORCL - Free Report), Adobe (ADBE - Free Report), Nike, and others all fall in this category; they all had fiscal quarters ending in August. We count all of these reports as part of our Q3 earnings tally.

Through Friday, October 8th, we have seen such Q3 results from 21 S&P 500 members. This week will bring results from companies with fiscal quarters ending in September, starting with Fastenal (FAST - Free Report) on Monday, October 12th. In total, we will see Q3 results from 17 index members, including the aforementioned major banks and brokers.

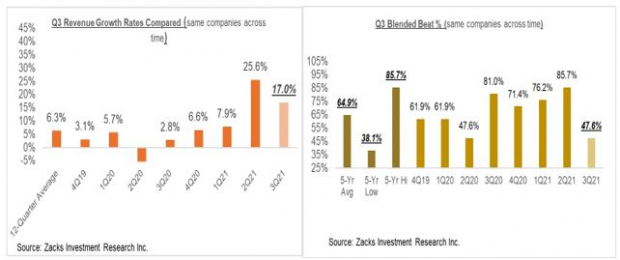

For the 21 index members that have reported Q3 results already, total earnings are up +20.1% from the same period last year on +17% higher revenues, with 76.2% beating EPS estimates and 61.9% beating revenue estimates. The proportion of these 21 index members beating both EPS and revenue estimates is 47.6%.

This is too early and the sample size is too small to offer us any interpretive guidance, but the very strong momentum on the revenue side that was a notable feature of the Q2 earnings season doesn’t appear to be present at this admittedly early stage.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>Q3 Earnings Season Gets Underway

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more