What To Watch As The Market Nears Being Overbought

Market Recap

Yesterday saw markets close mixed, but it was only a few names that did a lot of heavy lifting to pull the S&P 500 into barely positive territory with a 0.10% gain. The advance decline line for holdings of the SPDR S&P 500 ETF Trust(SPY) was 150/353, and the top ten contributors to fund return included 5 of the Mag 7 names as well as tech and AI adjacent names like Palantir (PLTR) and Advanced Micro Devices (AMD). Apple (AAPL) and Amazon (AMZN) showed up in the top ten detractors from performance with Berkshire Hathaway (BRK.B). The remaining seven slots were filled with Pharmaceutical names as the Healthcare sector reacted to the Secretary of Health and Human Services’ testimony on Capitol Hill.

Once again, Mag 7 and Technology names were additive to broad equity indexes as evidenced by the Dow falling 0.21%, the S&P 500 rising 0.10% as mentioned, and the Nasdaq Composite adding 0.72%. Small caps reflected what some would say was the prevailing tone in yesterday’s markets, as they fell 0.88%. Sectors were mixed, with Healthcare being the clear standout as it fell 2.35%. The remaining sectors saw returns ranging from 0.65% (Technology) to -0.92%(Materials).

The Tematica Select Model suite also saw mixed results yesterday, with leadership coming from Nuclear Energy & Uranium, Space Economy, and Artificial Intelligence. Laggards included Luxury Buying Boom, EV Transition, and Homebuilding and Materials.

What to Watch as the Market Nears Being Overbought

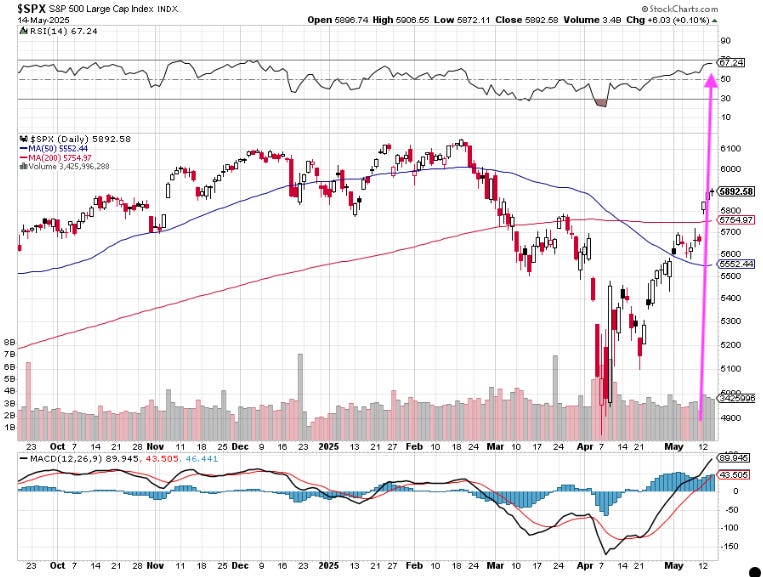

We have witnessed quite a move in the stock market since its recent bottom in early April. All told, the S&P 500 has climbed almost 22% and the Nasdaq Composite almost a staggering 30% in what some would call a rather compressed period. We all know the headline drama around tariffs and the economy that hit the market in late March and early April. And as those fears and concerns have been dialed back, the stock market made quick work of rocketing higher back toward late February-early March levels. However, that move also has the S&P 500 careening toward once again being overbought.

The Nasdaq Composite?

Already there based on its relative strength index (RSI) level of 70.70 with last night’s market close.

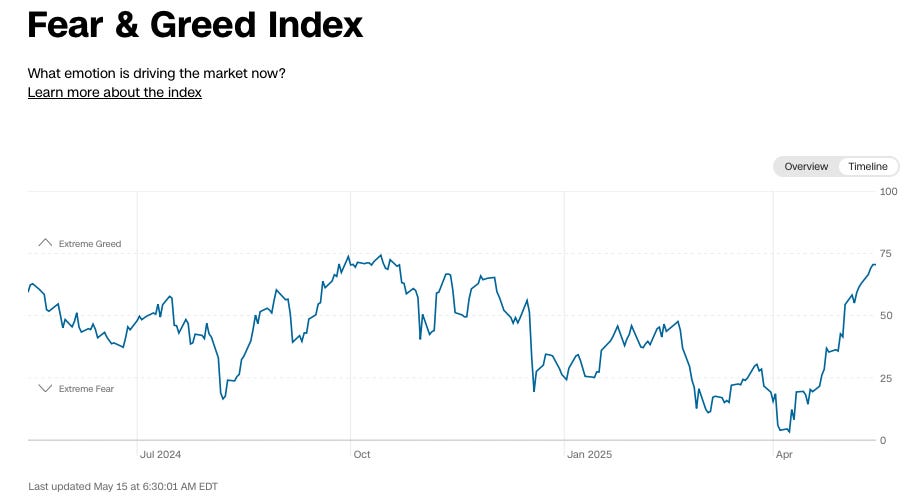

And with those conditions, it should come as little surprise that the Fear & Greed Index is back deep in “Greed” territory.

With President Trump saying the US is close to deals with Iran and India, we could see the market continue to march higher, but if that comes to pass, more than likely, it is going to raise some questions as the market moves into quarterly results from retailers and the next wave of investor conferences. The picture those companies paint about recent tariff developments, current quarter color and hints about 2H 2025 will influence the market direction. It could also lead to revisiting our Market Hedge model. Just saying.

We at Tematica will stick to following the data, both hard and soft, as well as the signals we collect each week. So while last night’s results and comments from Cisco (CSCO) and Coreweave (CRWV) were supportive for several of our models, including Artificial Intelligence and Digital Infrastructure, this morning we’ll be digging into quarterly results from Walmart (WMT) and from Applied Materials (AMAT) after the close. We’ll harness what they say and what it means for our Cash-Strapped Consumer and CHIPs Act models. Oh yeah, isn’t Fed Chair Powell speaking today as well?

If you missed you missed what Cisco and Coreweave had to say, here’s a preview of what we’ll be sharing in this weekend’s Signals post:

CoreWeave posted a fivefold jump in revenue in its first earnings report as a public company, fueled by what Chief Executive Mike Intrator called accelerating customer demand. The cloud provider plans to pull forward certain investments in order to continue meeting this demand, Intrator added, warning that these higher costs are expected to have a near-term effect on margins.

Cisco Systems Inc. experienced another quarter of growing demand for its networking products amid the artificial-intelligence boom… Cisco said its AI-infrastructure orders from webscale customers topped $600 million during the quarter, “surpassing our $1 billion target one quarter early.” The company’s product orders were up 20% from the previous year — or up 9% when excluding Splunk — and Cisco said it saw growth across all of its markets. Product revenue was up 15% year over year, while services revenue climbed 3%.

More By This Author:

April Inflation & Retail Sales Data Ahead, But Why Earnings Will Matter MoreTariffs Continue To Take Their Toll As We Wait For The Fed

Tariffs And Uncertainty Take Their Toll On Corporate Guidance

Disclosure: None.